Updated 17 December

XRP Price Targets $3.34 Following Corrective Downtrend in Descending Channel

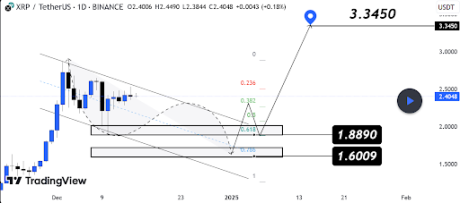

The XRP price is currently on a consolidation path after reaching a six-year high of $2.9 on December 3. It has struggled to maintain upward momentum, with analysis indicating a corrective downtrend within a descending channel. However, there are indications that XRP may rebound towards its all-time high.

Corrective Downtrend and Key Support Levels

XRP has been experiencing a corrective downtrend since December 3 when it peaked at $2.9 on Binance but dropped to $2.25 before closing at $2.5. This initiated a bearish phase marked by consecutive daily bearish candles.

Attempts at upward movement faced rejections, leading to lower highs and lower lows characteristic of a descending channel. This channel represents a temporary correction rather than a long-term bearish trend. Key support levels identified are $1.8890 and $1.6, aligning with the 0.618 and 0.786 Fibonacci retracement levels from the $2.9 high.

These support zones could stabilize XRP if downward pressure continues. Successfully maintaining these supports might enable a bullish reversal, while failure could lead to increased bearish pressure and a potential drop to a notable support level at $1.5.

Potential Rebound and Target Levels for XRP Price

If XRP rebounds from the identified support zones, it may challenge resistance at $2.8, marking the first milestone on its upward trajectory. A break above $2.8 could lead to a target of $3.3450.

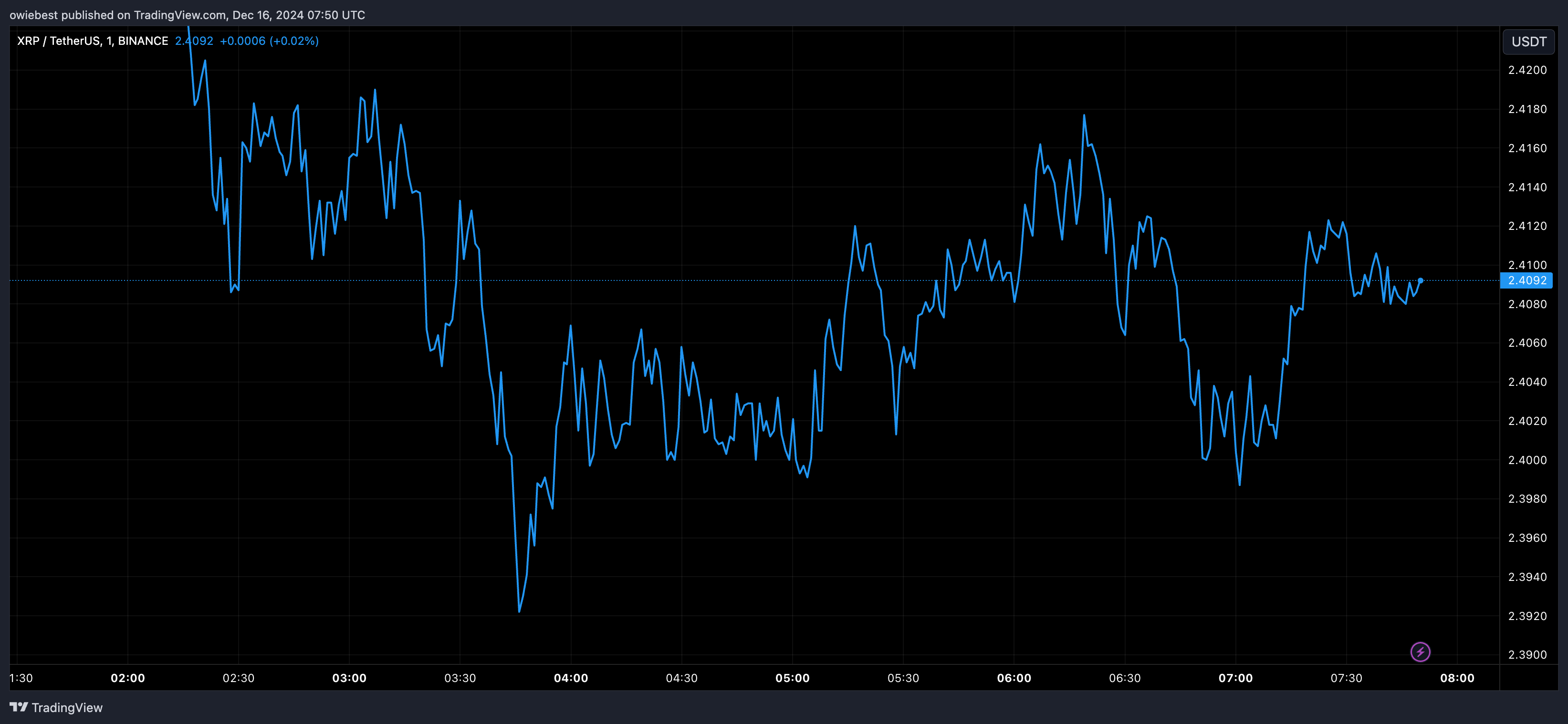

Currently, XRP is trading at $2.41, down 0.9% in the past 24 hours and 2% over the last seven days. Achieving the $3.345 target would represent a 39% increase from current levels, positioning XRP close to its all-time high of $3.4. The necessary bullish momentum could also facilitate new all-time highs beyond this point.