0 0

XRP Exchange Reserves Drop to Seven-Year Low Amid ETF Demand

The XRP market is showing potential signs of future price changes despite its current bearish trend. Key points include:

- Exchange reserves have decreased to a seven-year low of 1.7 billion XRP, suggesting tightening liquidity.

- Three factors likely to influence XRP's price by 2026 are regulatory clarity, investor demand through spot ETFs, and real-world adoption of the XRPL network.

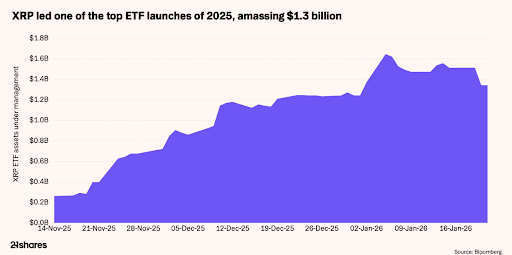

- XRP ETF products in the US attracted significant inflows initially, indicating a shift from speculative to structural investment strategies.

- As per 21Shares, XRP's smaller market cap compared to Bitcoin could mean a larger impact on price due to proportionally higher capital inflows.

XRP Price Projections for 2026

- The report outlines possible scenarios for 2026: a base case peak of $2.45, a bull case of $2.69, and a bear case of $1.60.

- The base scenario expects steady ETF inflows and gradual utility improvement.

- The bull scenario anticipates institutional tokenization and reduced liquid supply enhancing pricing.

- The bear scenario considers stagnant adoption and capital moving away from XRP.

Currently, XRP's price is hovering around the bear case, with challenges in maintaining levels above $1.6.