13 0

XRP Exchange Reserves Drop to Lowest Since July 2024 Amid Weak Price

XRP is experiencing a critical phase, testing a significant demand zone below the $1.90 mark amidst deteriorating market conditions in the altcoin sector. The price action is fragile, with bulls struggling to maintain key support levels, indicating a potential shift towards a bearish trend.

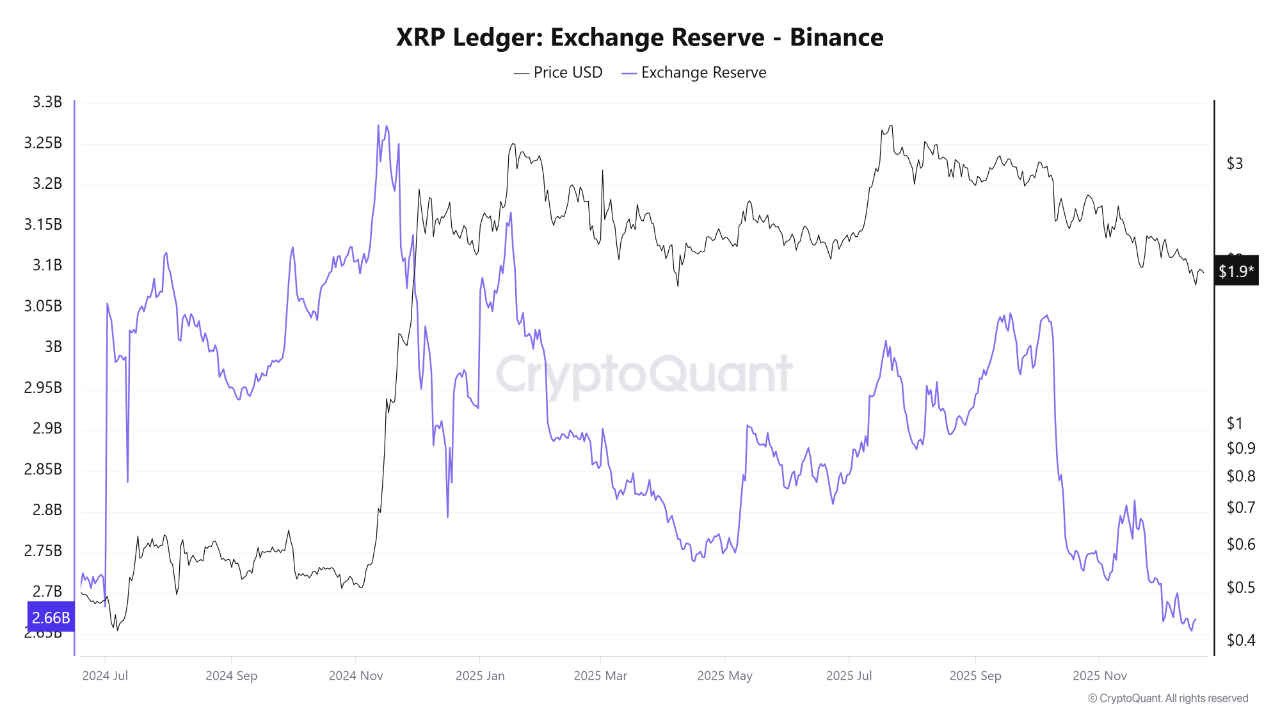

- On-chain data reveals a notable decrease in XRP reserves on Binance, despite ongoing price corrections.

- This decline suggests reduced sell-side pressure, as fewer tokens are available for sale on exchanges.

- The divergence between price behavior and on-chain supply dynamics could indicate stabilization or relief rallies when sentiment turns pessimistic.

Exchange Reserves Hit Multi-Month Low

Current data shows XRP balances on Binance have dropped to approximately 2.66 billion XRP, the lowest since July 2024. This contraction in exchange reserves points to a reduction in sell-side liquidity, potentially setting the stage for a supply-driven price move.

- XRP trades at a crucial support zone ($1.80–$1.90), previously a foundation for bullish trends.

- Momentum indicators suggest fading bearish pressure, but no confirmed reversal yet.

- A defense of the $1.80 level could spark recovery, while a breakdown may increase downside risk.

Long-Term Demand and Weekly Structure

XRP's weekly chart shows it trading near $1.87, continuing a corrective move that has weakened previous bullish momentum. Key observations include:

- Consistent lower highs and lows confirm a shift toward a bearish medium- to long-term structure.

- Selling pressure remains strong, with weak dip-buying interest.

- XRP has lost key weekly moving averages, now acting as resistance around $2.40–$2.60.

- The $1.80–$1.90 area is crucial; a close below $1.80 could lead to further declines toward $1.50.

- For recovery, XRP must reclaim the $2.20–$2.40 range and overcome former resistance levels.