4 0

BEARISH 📉 : XRP Faces Selling Pressure Amid Downtrend and Market Uncertainty

XRP Faces Selling Pressure Amid Market Fragility

- XRP faces persistent selling pressure with limited momentum, reflecting cautious investor sentiment.

- Volatility has decreased, but lack of strong buying suggests market consolidation rather than a rebound.

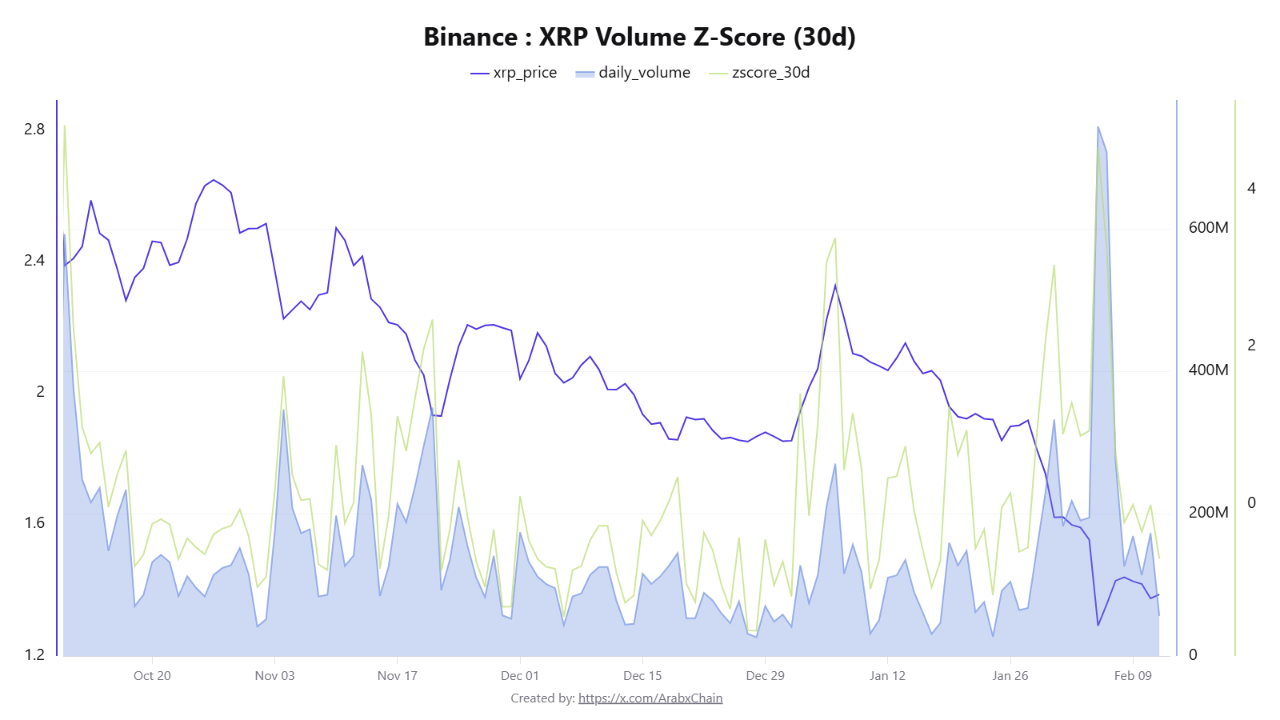

XRP Trading Volume Insights

- CryptoQuant analysis shows XRP trading near $1.37 with a daily volume of 173 million XRP on Binance.

- The Z-Score is close to zero, indicating trading activity aligns with its historical average.

- This balance between buyers and sellers suggests market stabilization rather than immediate bullish or bearish trends.

XRP Volume Equilibrium Indicates Potential Consolidation

- Stable Z-Score suggests a consolidation phase before a significant market move.

- An increase in trading volume could signal new trends, with Z-Score above +2 indicating potential bullish momentum.

XRP Tests Key Support as Downtrend Persists

- XRP trades under sustained selling pressure, with a notable decline from the $2.00–$2.20 region to $1.30–$1.40.

- Trading below major moving averages indicates a bearish medium-term structure with resistance likely at rallies.

- Recent declines accompanied by increased volume suggest active participation in the selloff.

- A recovery above $1.80–$2.00 needed to stabilize sentiment; otherwise, further downside remains possible.