0 0

Glassnode Warns XRP Faces Sell Pressure as Price Nears Critical $2 Level

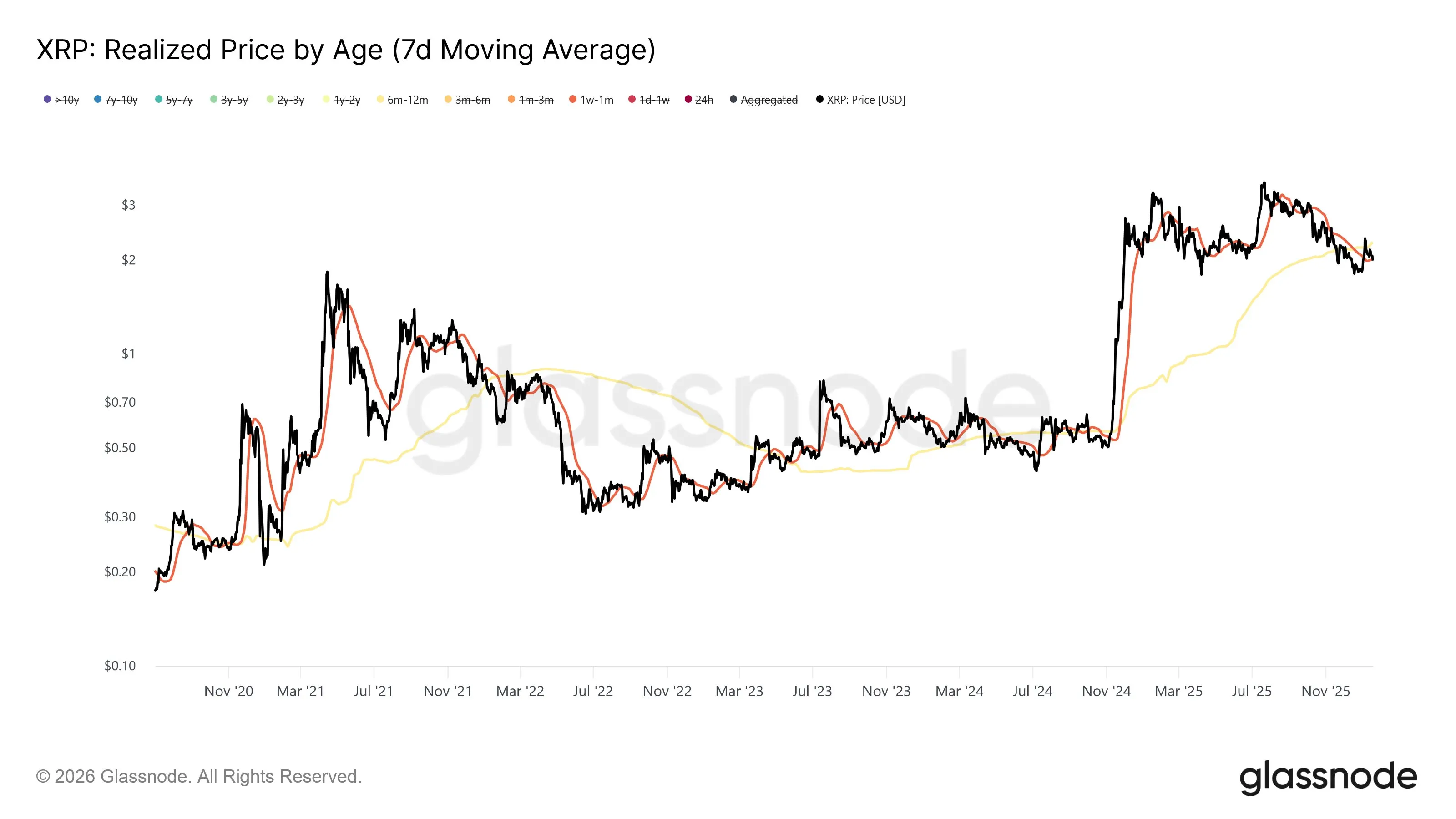

Glassnode reports that XRP is returning to a cost-basis configuration similar to February 2022, with newer buyers accumulating at levels causing previous investors to be underwater. This on-chain setup could influence sell pressure around key price zones.

- Current market structure for XRP resembles February 2022, with psychological pressure building on top buyers.

- Short-term wallets (1-week to 1-month) accumulate below the cost basis of 6-month to 12-month holders, indicating newer demand at lower prices.

- Cohorts tend to behave differently when price revisits their cost basis, potentially creating overhead liquidity that caps upside.

- Glassnode’s “Realized Price by Age” chart highlights the gap between shorter-term and 6–12 month cost bases during recent consolidation.

XRP trades slightly below $2, a significant psychological level. Retests of $2 have seen $0.5B–$1.2B in losses weekly, indicating many holders exit at a loss when price revisits this level.

- $2 level acts as both a chart and behavior level, affecting spending decisions and clustering capitulation or forced de-risking.

In February 2022, XRP experienced a sharp round-trip in price due to macroeconomic risks, notably the Russia-Ukraine escalation, impacting risk assets broadly.

Currently, XRP is trading at $1.9294.