13 4

XRP Faces Intense Selling Pressure as Exchange Inflows Surge

XRP is experiencing significant downward pressure, trading below critical technical levels after dropping under the $2 mark. This decline has shifted market sentiment towards fear, with bulls struggling to find support.

- XRP has declined by approximately 50% from its cycle peak of $3.66, now hovering around the $1.85 region.

- Analysis indicates this is part of a deeper corrective phase, not a minor pullback.

- Selling pressure intensified due to profit-taking and capitulation from recent buyers.

- Confidence has deteriorated as prices moved away from prior highs.

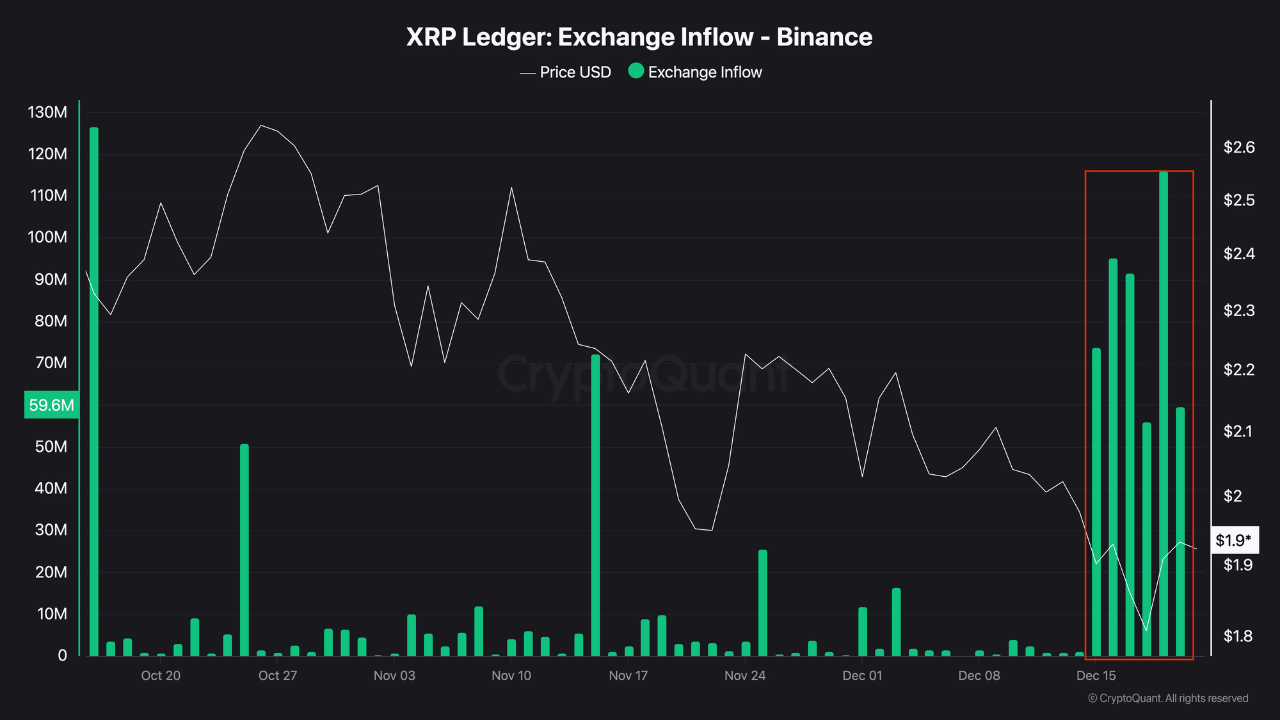

Exchange Inflows and Sell-Side Pressure

- Rising XRP inflows to exchanges, particularly Binance, indicate increased sell-side pressure.

- Daily inflows have ranged between 35 million XRP and a spike of 116 million XRP on December 19.

- This pattern suggests a shift in investor psychology with longer-term holders taking profits and new entrants selling at a loss.

- Continued high inflows suggest unfavorable conditions for accumulation.

XRP Price Action Details

- XRP is trading near the $1.87–$1.90 zone, reflecting a prolonged downtrend.

- The price structure shows a bearish trend with consistent lower highs and lows.

- XRP is below all major moving averages, reinforcing the bearish outlook.

- The $1.80–$1.85 region is critical support, but weak buying suggests further downside risk.

- A break below this level could lead to a deeper retracement toward $1.50.

Without reclaiming the $2.10–$2.20 range, XRP's path remains downward, with risks of further consolidation or correction continuation.