0 0

XRP Stabilizes Above $2 Amid Balanced Market Activity

XRP Market Overview

- XRP is attempting to stabilize above the $2 mark after recent selling pressure.

- Trading data indicates a balanced market without signs of panic or speculative excess.

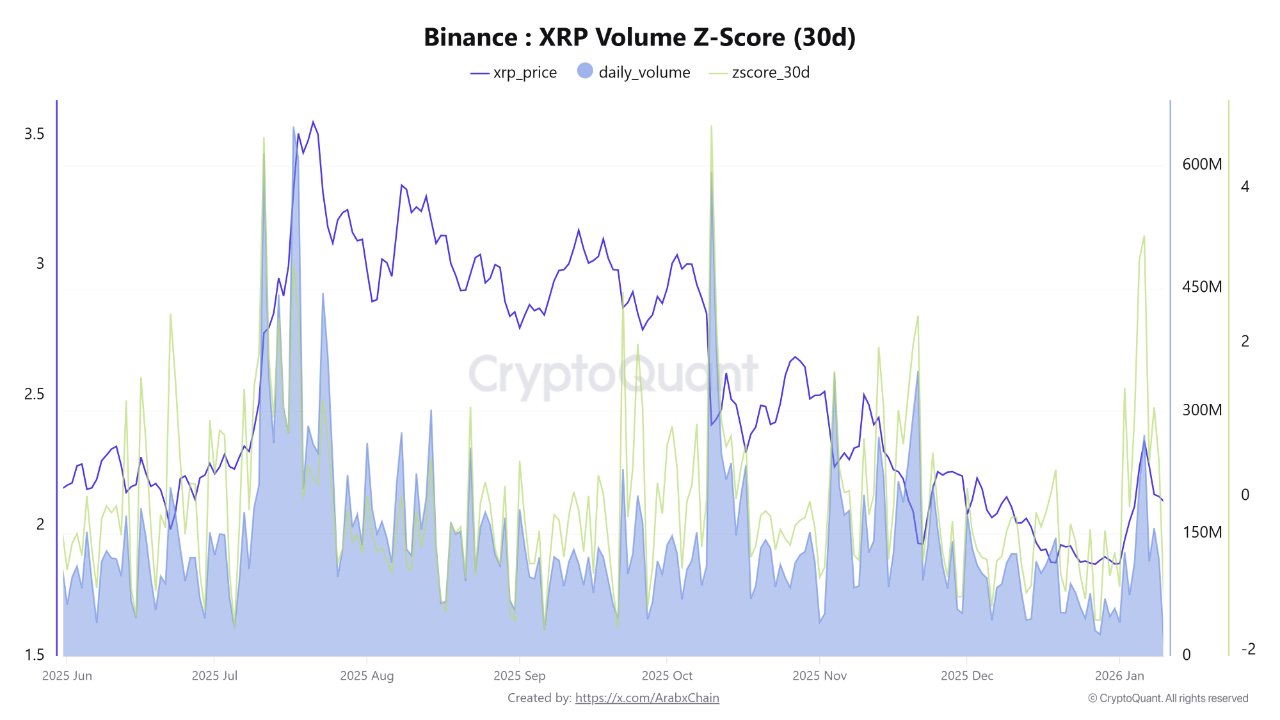

- The 30-day Z-Score for XRP trading volume is around 0.44, suggesting normal activity levels.

- This Z-Score implies neither aggressive inflows nor market apathy, indicating potential consolidation.

- If XRP's price rises with a Z-Score above 1.5–2.0, it may signal new capital and momentum-driven growth.

- A declining Z-Score near zero or negative suggests fading interest and potential downside risks.

- Current conditions indicate stability, awaiting volume confirmation for significant moves.

XRP Price Analysis

- XRP is trading near $2.05 but remains below key moving averages, indicating structural weakness.

- The 200-day moving average around $2.55–$2.60 acts as critical resistance.

- Despite short-term recovery efforts, XRP has not surpassed major resistance levels, signaling continued distribution.

- Lower highs and lows persist, with muted volume suggesting limited conviction in the rebound.

- For bullish momentum, XRP needs to hold above $2.30–$2.40 and break past the 200-day moving average.