7 1

41.5% of XRP Supply in Loss, Raising Selling Pressure

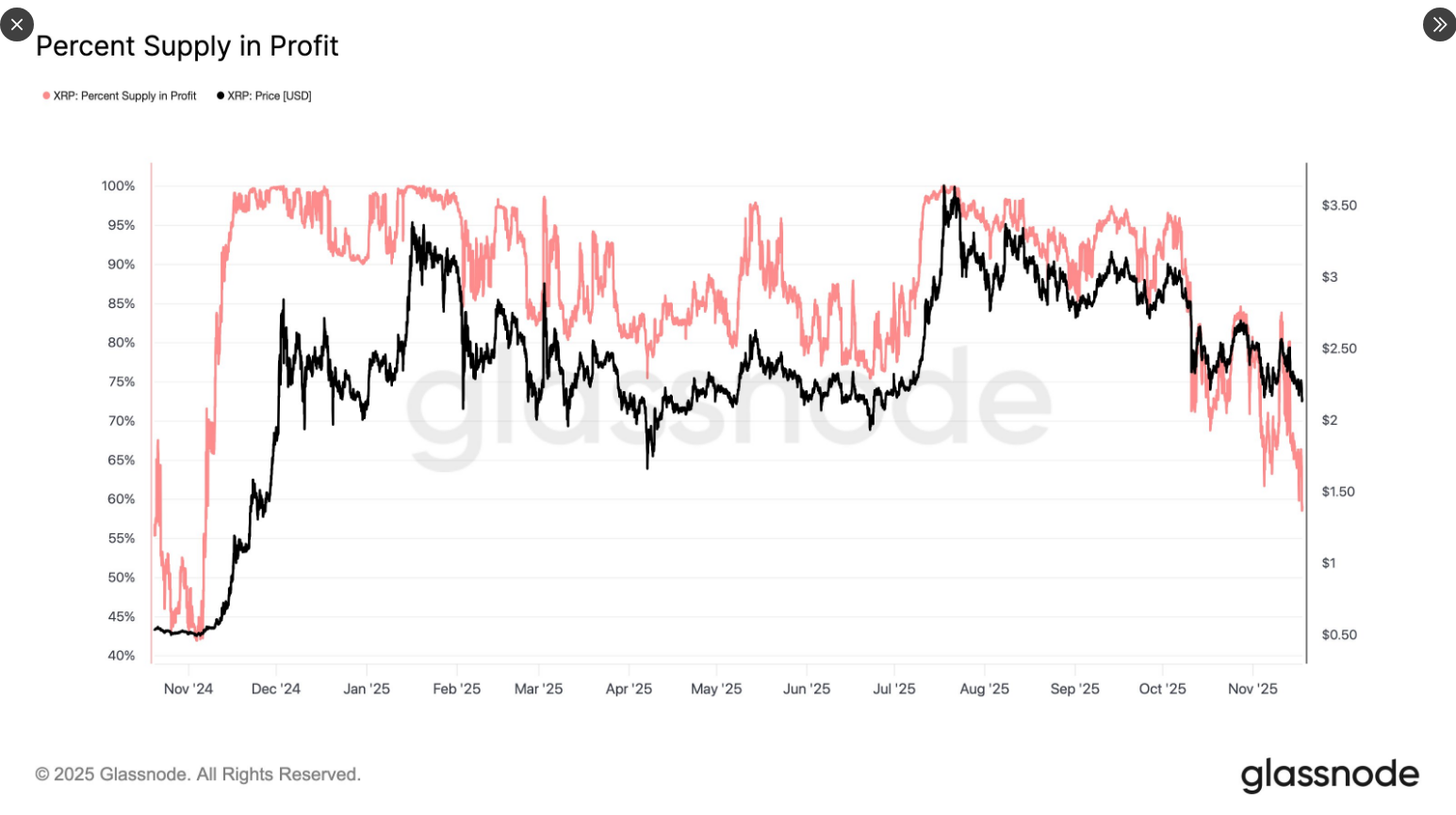

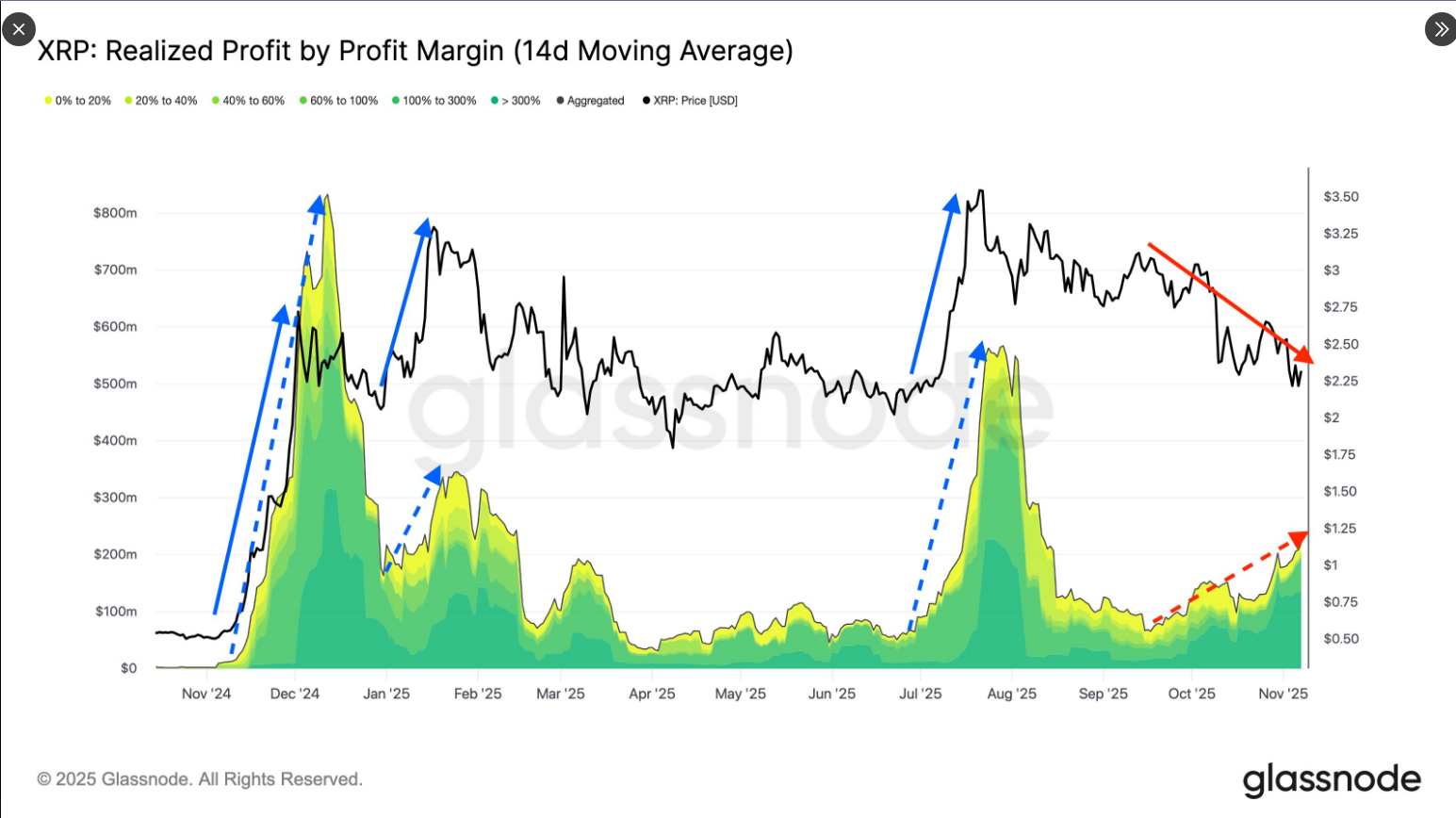

Current on-chain data indicates that XRP is experiencing selling pressure, with 41.5% of its supply, approximately 27 billion tokens, in loss. This is the lowest profitability level since November 2024 when XRP was around $0.53.

Holder Concentration and Selling Risk

- A significant portion of holders purchased XRP above current prices, now facing potential losses after a 40%+ decline from July's peak of $3.65.

- This situation increases the risk of selling pressure as investors may exit to prevent further losses.

Potential Impact of ETFs

- The launch of spot-XRP ETFs by Canary Capital and upcoming offerings from Franklin Templeton and others could influence market flows.

- Initial demand for these ETFs will depend on broader market liquidity and investor risk appetite.

Price Levels and Market Outlook

- XRP currently trades at approximately $2.19, down over 10% in the past week.

- The $2.16 level is crucial; defending it could lead to a bounce towards the $2.35–$2.60 range.

- A break below support could trigger more selling, especially from holders aiming to minimize losses.

Overall, XRP faces a challenging environment with a top-heavy market structure due to high entry prices for many holders. Future price action will largely depend on ETF inflows and market participants' ability to defend key support levels.