26 0

XRP Supply Squeeze Expected as DeFi Demand Tightens Liquidity

A potential XRP supply squeeze is emerging, fueled by increased locking, tokenization, and deployment within Decentralized Finance (DeFi) ecosystems. Analyst Zach Rector suggests that the long-dismissed "XRP supply shock" could become a market reality.

Key Developments

- XRP's circulating supply is being tightened as more assets are locked in the Flare ecosystem.

- Zach Rector minted FXRP tokens to explore yield generation through the Flare ecosystem without leaving the XRP Ledger.

- 4 million XRP, worth over $11.21 million, were locked in escrow within a Flare core vault, reducing active circulation.

- Flare aims to tokenize up to 5% of the total XRP supply, potentially impacting liquidity and price if demand increases.

- The Flare community views the network's development positively, seeing new yield opportunities for XRP holders.

Flare’s Growing DeFi Role

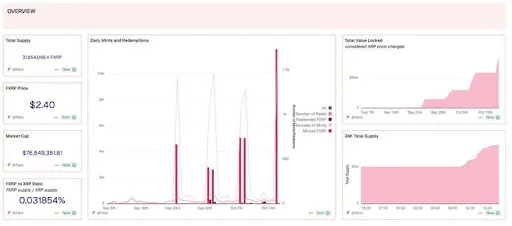

- FXRP activity and Total Value Locked (TVL) have risen sharply since early September 2025, indicating growing DeFi participation.

- Increases in FXRP cap trigger financial activity on-chain, positioning Flare as a significant force in XRP's DeFi adoption.

- MessariCrypto reports FXRP minting has surpassed 30 million tokens, with a TVL increase of over 25% recently.

- Key features like FAssets incentives and liquidity enhancements are transforming XRP into a productive asset.

This trend points toward an evolving role for XRP within DeFi, potentially impacting its market dynamics significantly.