Updated 23 December

XRP Holds Critical $2.20 Support Amid Market Corrections

XRP has been declining recently, mirroring trends in the broader cryptocurrency market. Despite this, XRP maintains critical support levels and is poised for potential recovery.

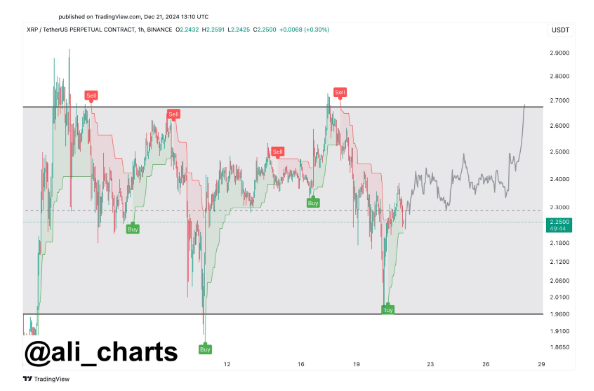

Technical analysis indicates that the $2.20 mark is crucial for XRP's future movements. Analyst Ali Martinez noted that XRP's next significant move depends on its performance around this threshold.

Key Levels To Watch: $2.20 Support And $2.70 Resistance

The cryptocurrency market has experienced substantial selling pressure since December 17 due to Bitcoin dropping below support levels, resulting in notable price corrections across cryptocurrencies. XRP fell from $2.708 on December 17 to a low of $1.98 by December 20, marking a 27% decrease within three days.

Following this drop, XRP rebounded, regaining the $2 price level, and is currently trading around $2.2, down 7% weekly.

Ali Martinez highlighted two potential paths for XRP based on its movement around the $2.2 level. Holding above this support is essential for a bullish outlook. If sustained, XRP may consolidate before attempting to reach the $2.70 resistance. A strong upward momentum past $2.70 could propel the token above $3. Conversely, falling below $2.20 may lead to a rapid decline towards $1.96 before attracting new buying interest.

Image From X: ali_charts

Whale Accumulation Up Amid Crypto Market Correction

On-chain data from Santiment indicates increased interest from whales during the current downturn. Wallets holding between 1 million and 10 million XRP have accumulated an additional 80 million XRP since December 17, reflecting strong confidence in the token’s long-term potential. This accumulation may help stabilize prices above the $2 mark and facilitate recovery.

Furthermore, technical analysis using Elliot impulse waves suggests that the recent dip below $2 could signify the end of a corrective wave, with bullish impulse wave 3 anticipated to commence soon.

Currently, XRP is trading at $2.27.

Featured image from Tech Xplore, chart from TradingView