XRP Surges 380% to Overtake Tether in Market Capitalization

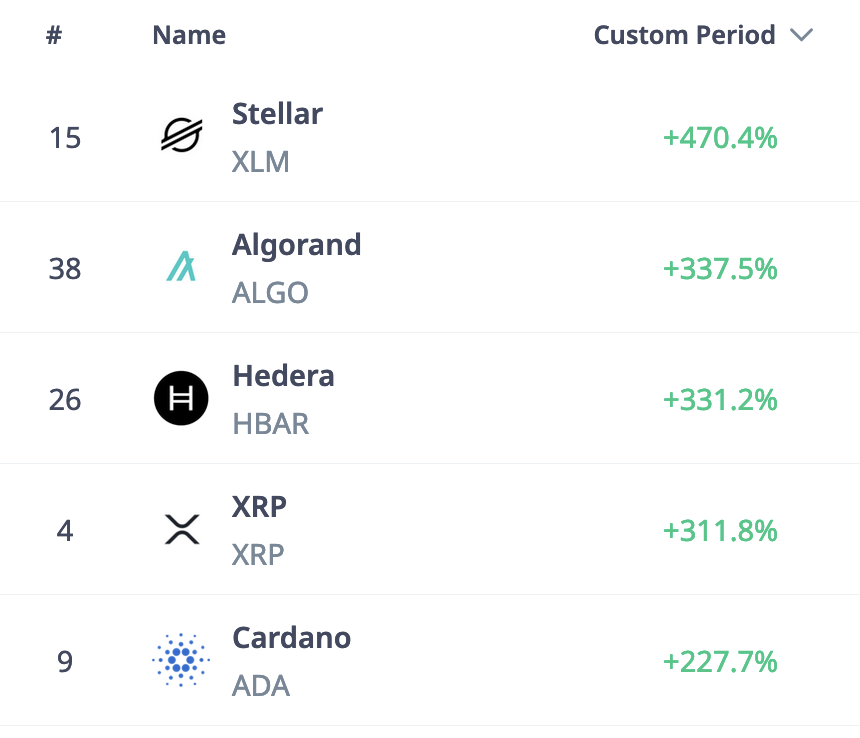

XRP's significant 380% rally over the past month has propelled it into the forefront of the cryptocurrency market. It has surpassed both Solana (SOL) and Tether (USDT) in market capitalization. With its market cap reaching all-time highs and a fully diluted valuation (FDV) double that of SOL, XRP's rise is attributed to regulatory clarity, network adoption, and speculative interest.

Political Winds and Market Sentiment

The resolution of Ripple Labs' prolonged legal battle with the US SEC has significantly contributed to XRP's growth. The $125 million penalty imposed was substantially lower than the SEC's initial $2 billion demand, alleviating a major concern for investors. This shift has reinstated confidence among institutional and retail investors.

Attorney John E. Deaton, an advocate for XRP holders, highlighted that the SEC's claim regarding the illegality of all XRP tokens represented a “gross overreach.”

The recent US election results have further influenced XRP's trajectory. Trump's victory is seen as a potential catalyst for more favorable cryptocurrency regulations, particularly benefiting domestic networks initiated by US companies.

Market sentiment is also shaped by nostalgia, as many retail traders are revisiting cryptocurrencies they initially engaged with during previous market cycles.

The Rise of XRP Memecoins

Another factor driving XRP's growth is the emergence of memecoins on the XRP Ledger, including DROP, SIGMA, and RPLS, which have attracted interest from speculators. While transaction costs are low and throughput is high across ecosystems, the trading volume of these memecoins on XRPL remains modest at $78 million over the past 24 hours.

ETF Speculation

Speculation surrounding the approval of XRP-focused ETFs represents another key driver of XRP's price increase. Analysts suggest that ETF introductions could significantly attract institutional capital. Recent regulatory clarity has positioned XRP as a viable alternative to Solana and Ethereum for institutional adoption.

Ripple CEO Brad Garlinghouse has stated that the introduction of an ETF is “inevitable.” Interest from firms like Bitwise and 21Shares in filing for ETFs could further enhance XRP's appeal to institutional investors. The SEC's deadlines for decisions on these filings are set for May and June next year.

XRP, now the third-largest cryptocurrency, remains a focal point in the market. Its ability to maintain this momentum will depend on converting current hype into sustainable adoption.