4 0

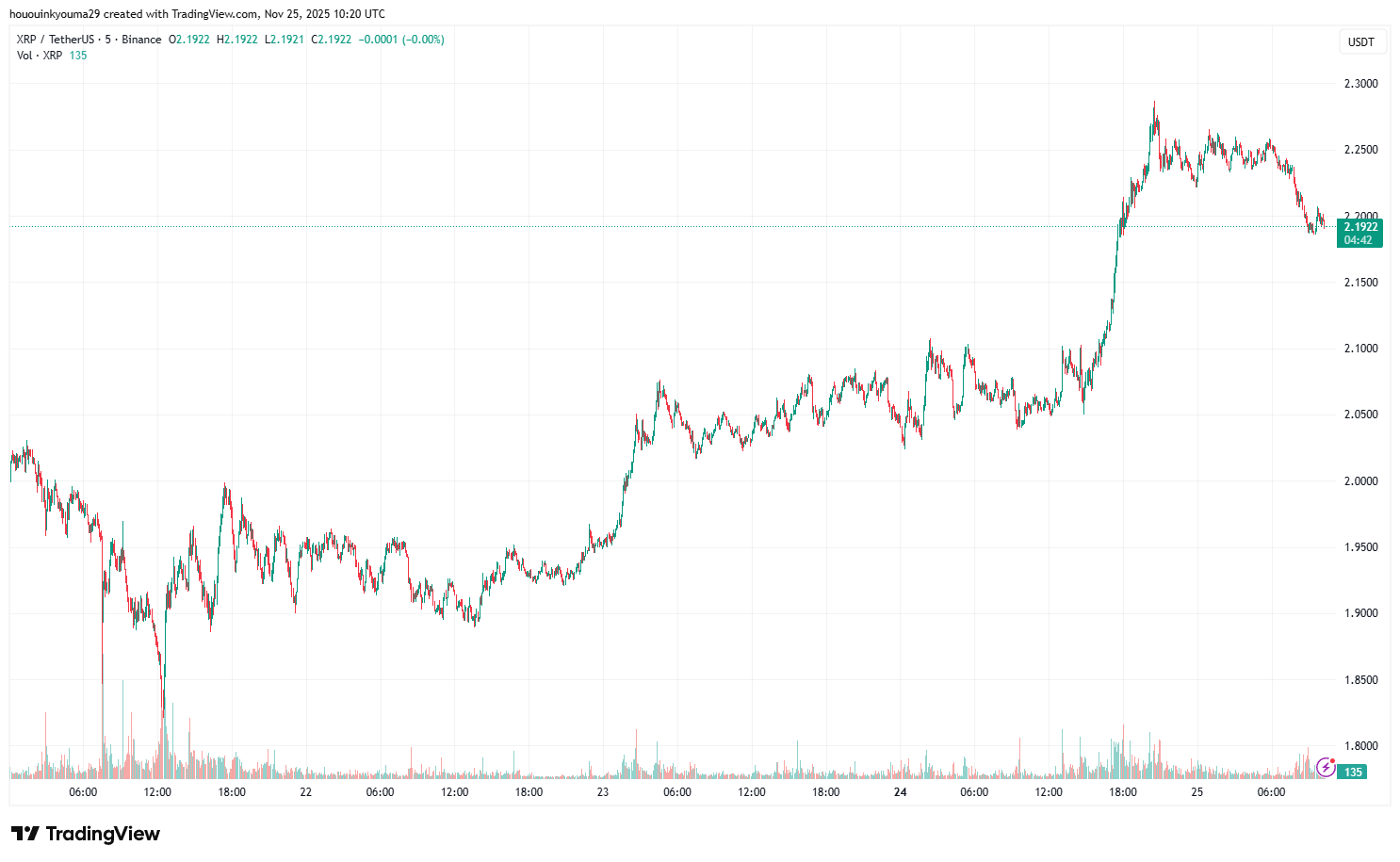

– XRP surges 7%, reaching $2.19 after recent market recovery – Franklin Templeton, Grayscale launch XRP ETFs on NYSE Arca – Open Interest RSI enters sell zone, signaling speculative leverage – Previous patterns suggest potential local tops after similar surges – Glassnode notes realized losses spike when XRP retraces to $2

XRP Surge and Speculative Leverage

- XRP experienced a 7% increase, returning to $2.19, while the broader cryptocurrency market showed signs of recovery.

- The growth coincides with the launch of exchange-traded funds (ETFs) by Franklin Templeton and Grayscale on NYSE Arca, under tickers XRPZ and GXRP.

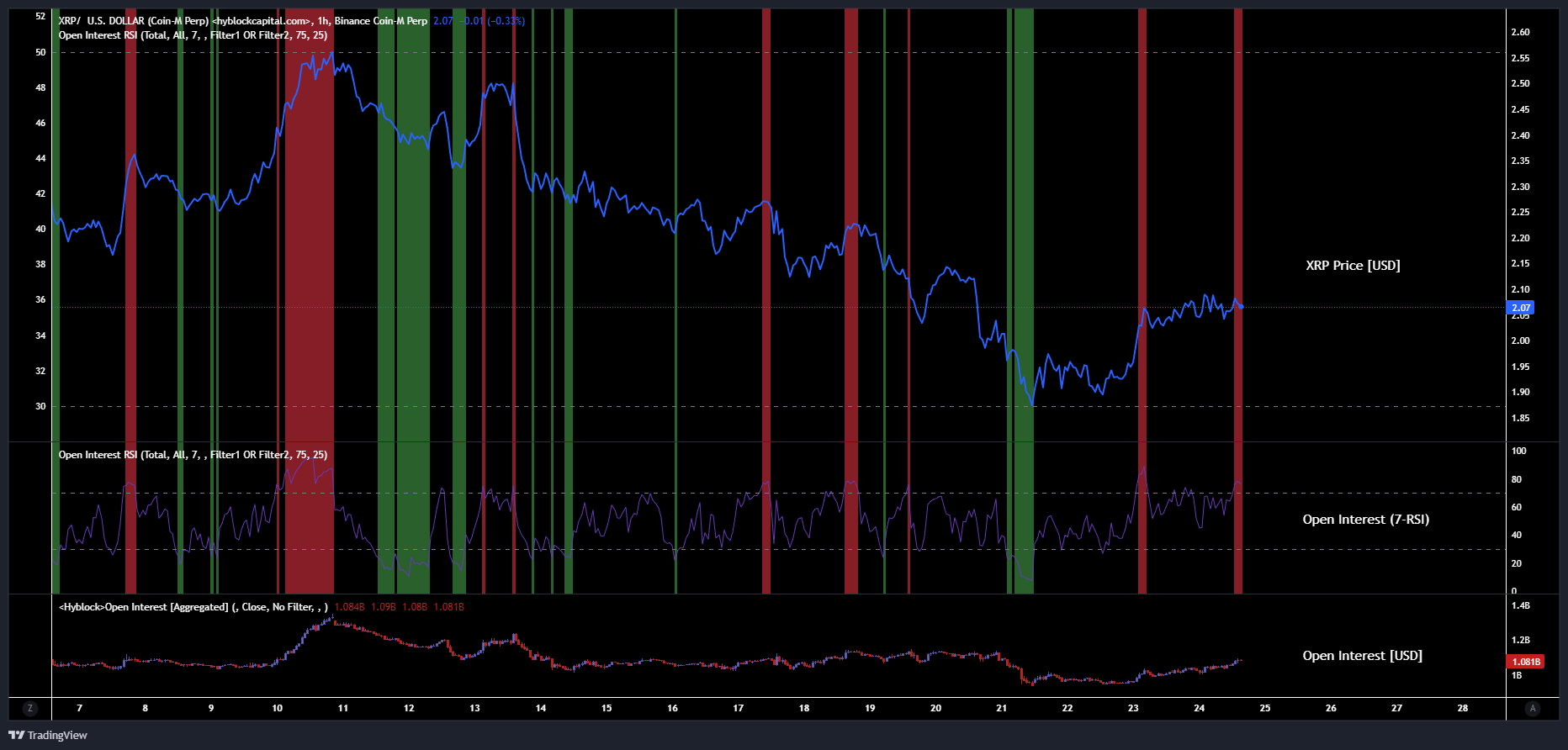

Open Interest RSI in Sell Zone

- CryptoQuant analyst Maartunn highlights that the XRP Open Interest Delta RSI has surged above 70, indicating aggressive derivatives positions.

- This pattern often aligns with local tops, suggesting potential speculative leverage risks.

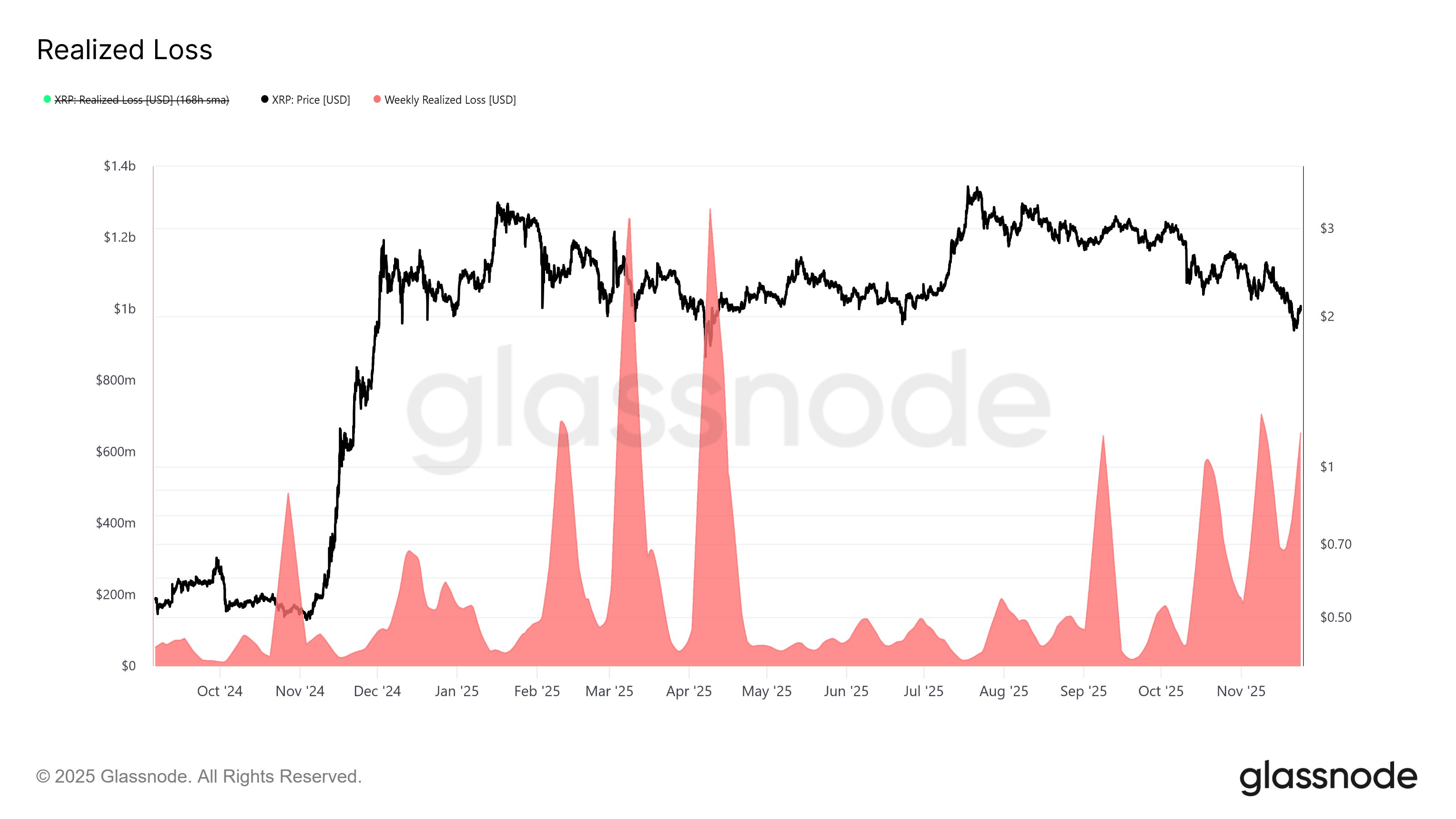

Realized Loss Spike

- Recent XRP price drop below $2 led to significant realized losses, as noted by Glassnode.

- Historically, each test of the $2 level has resulted in $0.5B–$1.2B in weekly investor losses since early 2025.