XRP Reaches Two-Year High with Over 90% Weekly Growth

XRP reached a peak of $1.26, marking a new two-year high amidst anticipated regulatory changes in the US following recent elections. The coin's value surged by over 90% within a week, reigniting investor interest in Ripple.

Last Friday, XRP closed at $1.05, reflecting a 116% monthly increase from $0.50 a week prior. This rally coincided with Bitcoin's spike above $93,000, contributing to an improved overall market sentiment.

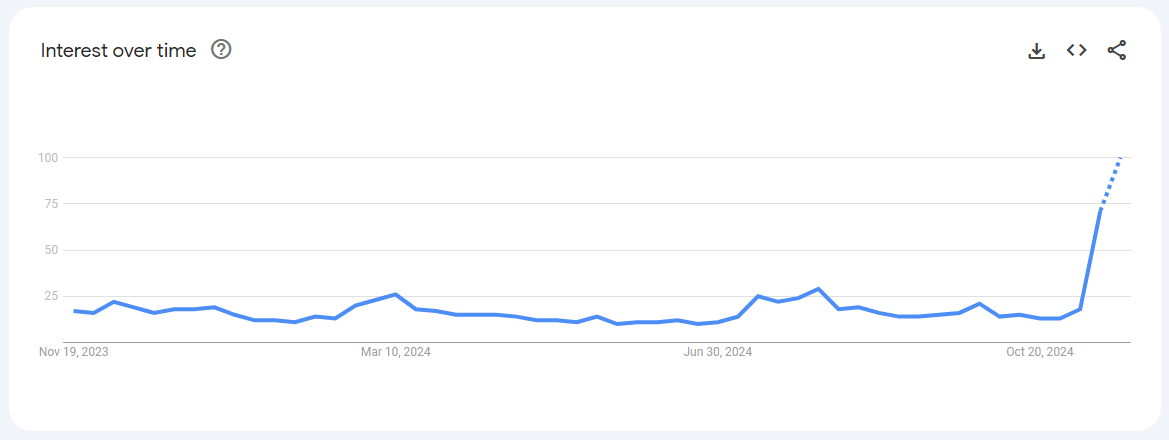

Google Trends Data Indicates Increasing Interest

As XRP's price rose, search interest also increased significantly. Google Trends showed a peak popularity score of 100 on Monday, up from 8 eight days earlier, indicating heightened public interest likely driven by XRP's price movement and its return to top market capitalization rankings.

XRP has regained its position above Dogecoin, achieving a market valuation of nearly $65 billion. While some traders note the historical significance of XRP's recent weekly closure, concerns arise over potential overbought conditions as the relative strength index (RSI) exceeded 93.

#XRP Highest weekly close in 2 years | How high will it go?

pic.twitter.com/BcoOWyt2Q1

— Cryptoes (@cryptoes_ta) November 18, 2024

Overcoming Resistance and Forecasts

XRP's price rise has broken through long-standing resistance levels that kept it below $1. Analysts suggest this could pave the way for long-term growth. If market sentiment and trading volume remain strong, projections indicate a potential upswing.

Analysts predict a 14.35% price increase over the next month, with one-year forecasts suggesting a 99% rise. Sustaining crucial support levels will be essential to avoid significant declines.

What's Next for XRP?

XRP is currently trading at $1.14, supported by renewed enthusiasm and favorable macroeconomic conditions for digital assets. However, caution is advised as XRP's RSI reaches levels not seen since 2017, indicating a potential consolidation phase before further gains.

Long-term prospects appear promising, but future movements depend on market developments and Ripple's ability to maintain recent momentum. Investors are closely monitoring these factors.

Featured image from MoneyCheck, chart from TradingView