11 0

XRP Whale Accumulation Increases Amid Market Weakness, Signals Potential Bottom

XRP's price is nearing its yearly low amid broader market selling pressure. Despite this, CryptoQuant reports increased activity among XRP whales, indicating a complex underlying scenario.

- Whales are actively trading and accumulating XRP, even as retail participation declines.

- This behavior diverges from market sentiment, suggesting potential strategic positioning by large holders.

- Historical patterns show significant recoveries often begin during pessimistic phases when whales accumulate quietly.

Whale Accumulation as a Potential Indicator

- Recent whale activity aligns with market bottoming phases, suggesting a possible pre-rally signal for XRP.

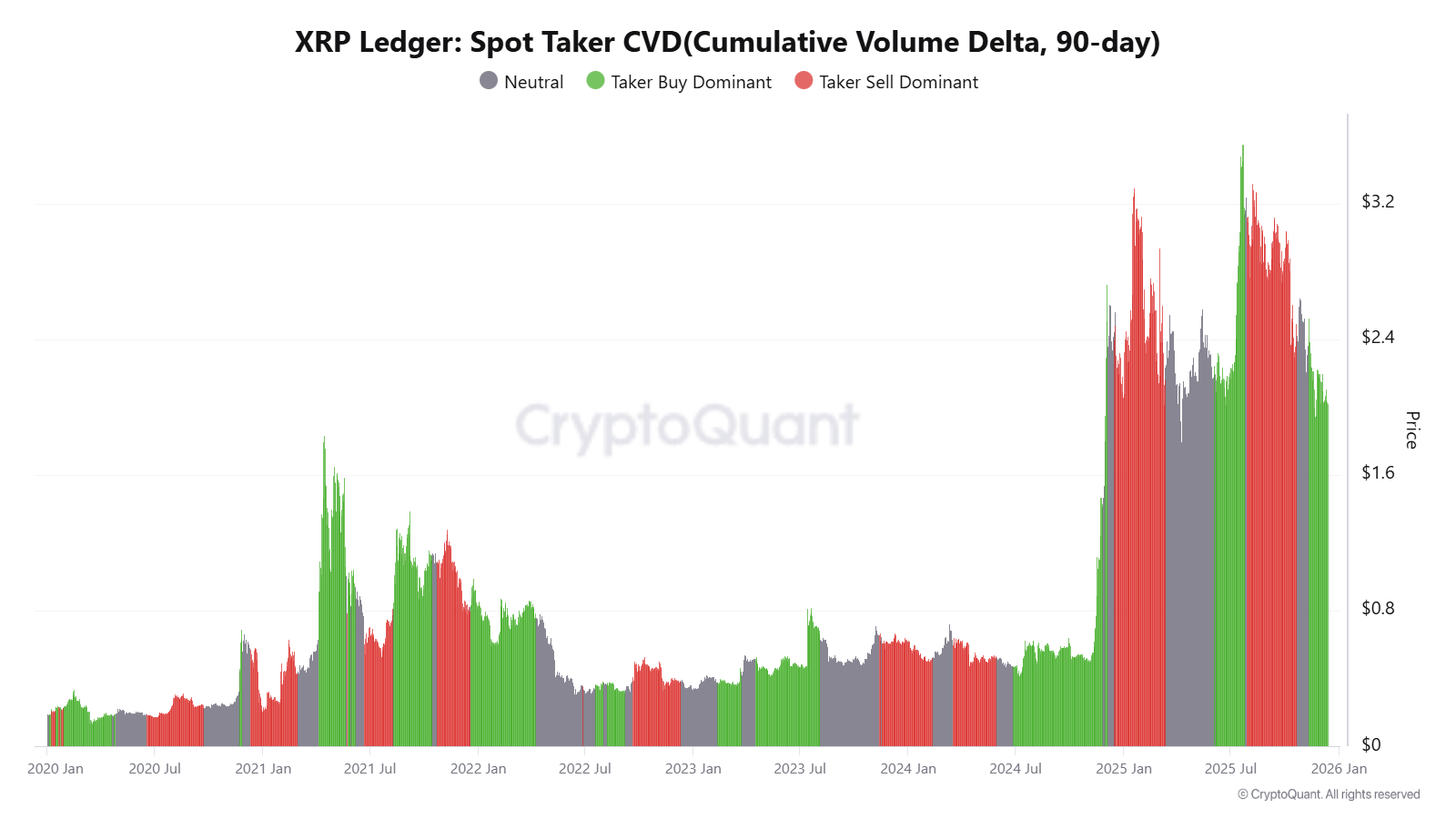

- The XRP Spot Taker CVD has turned taker-buy dominant, indicating strengthening real-time demand.

- The combination of whale accumulation and bullish CVD trend suggests a constructive medium-term outlook for XRP.

Price Analysis: Testing Yearly Lows

- XRP remains under the 50-day, 100-day, and 200-day moving averages, showing weakened trend structure.

- $2.00 region acts as a key support, repeatedly tested with reduced volatility but lacking strong rebound momentum.

- Volume analysis shows more pronounced selling spikes, while buy-side volume is subdued, reinforcing a bearish trend.

For an uptrend to materialize, reclaiming the 50-day moving average and establishing higher lows are crucial, alongside converting whale accumulation into visible spot demand.