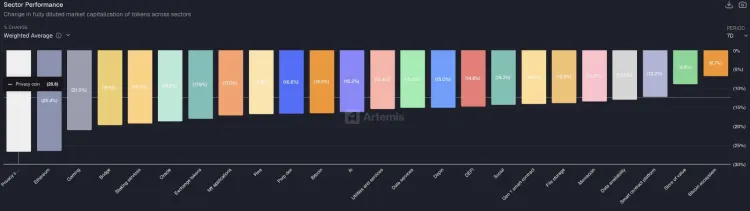

BEARISH 📉 : ZCash and Monero Lead 25% Privacy Sector Decline

- The privacy coin sector, including [Monero](https://holder.io/coins/xmr/) and [ZCash](https://holder.io/coins/zec/), is experiencing a 25% decline due to regulatory pressure and delistings from exchanges.

- Traders are moving away from privacy-focused assets towards transparent, high-volatility tokens with strong community narratives.

- [Maxi Doge](https://holder.io/coins/maxi/) has raised over $4.57M, capturing liquidity from exiting sectors, with significant whale accumulation.

- $MAXI offers gamified trading experiences with competitions and high-yield staking, contrasting the passive nature of traditional privacy coins.

Privacy coins are facing challenges due to tightening regulations and liquidity fragmentation, causing a significant price drop. The narrative shift from 'hiding wealth' to 'multiplying wealth' leads traders to seek alternative, more transparent assets.

Major exchanges in the EU have delisted privacy tokens, prompting institutional capital to exit these assets. This move has resulted in sustained selling pressure on $XMR, indicating capitulation by long-term holders.

In contrast, Maxi Doge leverages current market psychology with its 'Leverage King' culture, catering to high-risk traders through gamification and community engagement.

As [Monero](https://holder.io/coins/xmr/) struggles with compliance issues, $MAXI demonstrates significant market demand, raising $4.5M in its presale. The tokenomics support growth, with mechanisms like dynamic APY staking and a treasury for ecosystem support.