Research: Advantages and Disadvantages of the Berachain Blockchain

Berachain is one of the most talked-about projects among new L1 blockchains. The project has gained attention due to its Proof of Liquidity (PoL) mechanism and strong community, but the launch raised many questions.

Let's analyze the key issues and positive aspects to objectively assess the project's prospects.

Problematic Aspects

1. High Inflation of $BERA

The main issue is the excessive level of inflation, which can significantly impact the token's price.

- The annual inflation of BGT is 10% of the total supply.

- Total supply: 500M, with 50M new tokens released in the first year.

- In the first year, circulation will be around 21.5% (110M), plus 2% from Boyco over 30–90 days.

- If all BGT were burned (which is unlikely), the actual inflation would be around 50%.

By the end of the second year, it is expected:

- 55M new BGT (10%) + 196M from various allocations (mostly private investors).

- Total circulation: 418M tokens (second-year inflation around 150%).

In comparison, most L1 blockchains have high inflation rates in the early years, but Berachain significantly outpaces them. Historically, such a model leads to price declines as the market fails to absorb liquidity.

2. Token Sales to Private Investors

Berachain sold over 35% of the token supply to private investors.

- Seed round: $50M FDV valuation

- Second round: $420M FDV

- Final round: $1.5B FDV

Most projects sell no more than 20% of the supply to private investors, as this creates constant selling pressure.

- The long vesting of these tokens will lead to a slow but steady decline in price until the entire supply is unlocked.

- The situation is similar to "high FDV, low float" — when a token launches with a high market cap but low trading volume, making growth unlikely.

3. Staking $BERA for Private Investors

Private investors can stake $BERA and receive liquid rewards that can then be sold on the market.

- 15% of BGT inflation (7.5M BGT) is distributed among validators, with most going to stakers.

- If the entire supply (500M) were staked, the APY would be 1.6%, but in reality, about 60% will be staked, resulting in an APY of 2.8–3.2%.

The comparison with Celestia is not entirely accurate, as Celestia had an APY of around 20%, but in the case of Berachain, this will create additional selling pressure.

- Issue: Most rewards will be sold immediately, creating downward pressure on the price.

- Plus: Every user can participate in staking and dilute the rewards of private investors.

4. Recent Changes and Poor Documentation

- The mechanics of staking $BERA for private investors were not known until the last weeks before the launch.

- Documentation makes it difficult to find information about staking, and the team did not explain this mechanism in advance.

- Lack of information caused FUD even among OG participants, negatively impacting the price.

This creates the impression that the team intentionally withheld the staking conditions until the last moment. Although after explanations, it turned out that the APY is only 3%, the problem lies in insufficient communication.

5. Proof of Liquidity Not Yet Launched

The main idea of Berachain is Proof of Liquidity (PoL). However, at the time of launch, this mechanism is not operational, making Berachain an ordinary PoS fork.

- Since nothing can be done with BGT, many users feel disappointed.

- If the deployment of PoL takes several months, it will seriously damage trust.

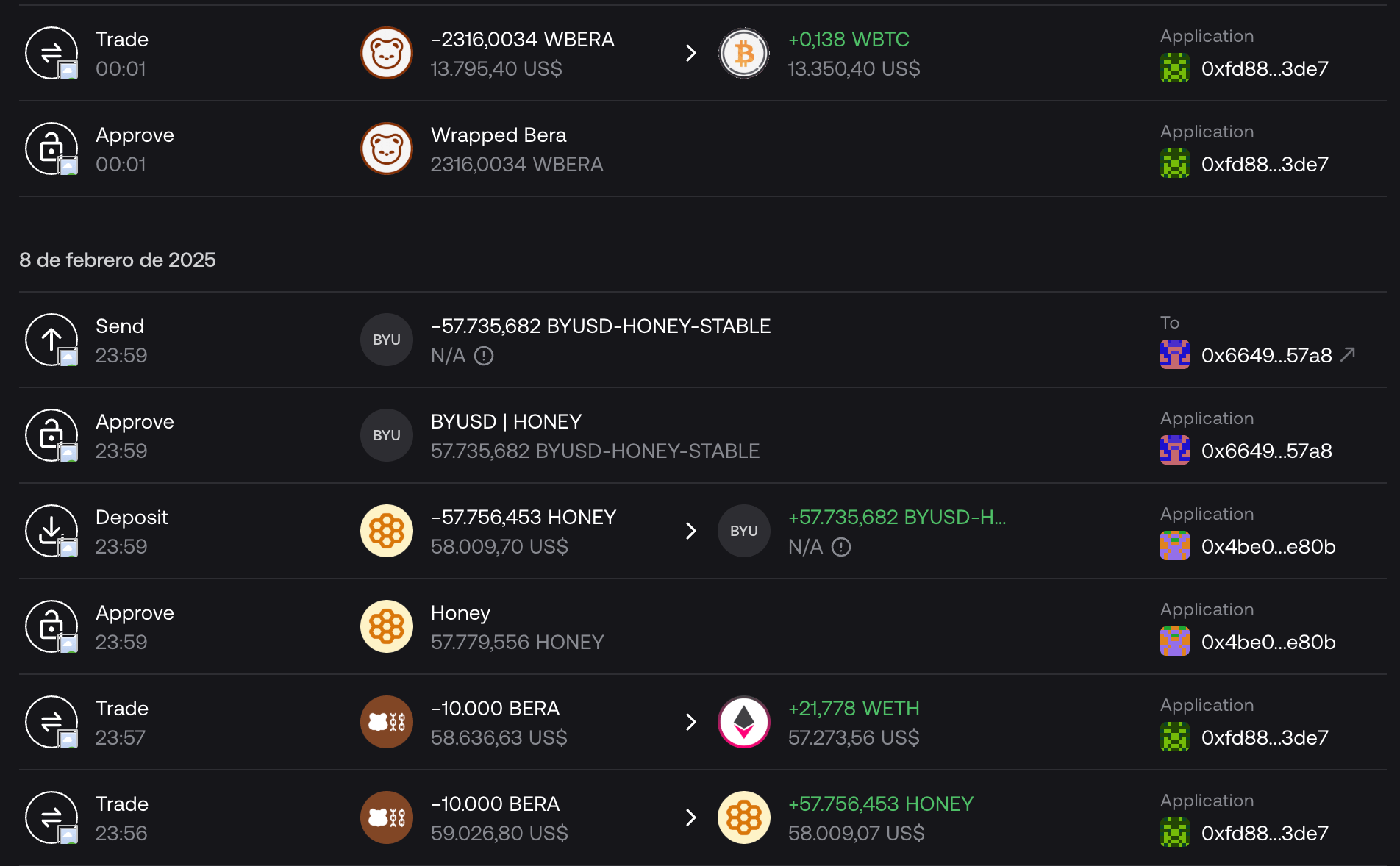

6. DevBear Selling Tokens

- One of the project founders (DevBear) is selling tokens from a public wallet.

- He received 200k BERA from the airdrop and then exchanged some tokens for WBTC, ETH, BYUSD, and other assets.

- This appears unethical, as the team itself distributed the airdrop, and such a large allocation for DevBear is a bad signal.

Even if he was just testing liquidity, this should have been explained immediately to avoid panic.

Positive Aspects

1. Strong Community

Despite the issues, Berachain has one of the most dedicated communities in the industry.

- Even after mistakes, many participants support the project and continue to develop the ecosystem.

- The community is actively building infrastructure, which is a key factor for long-term success.

2. Number of DApps

At launch, there are already many applications ready to be launched in the coming weeks.

- Most new L1s face the issue of lacking an ecosystem, but Berachain already has one.

- This makes the project promising in the medium term.

3. High Level of Security

- The project moves slowly but pays great attention to security.

- Unlike many new L1s, Berachain is not rushing to launch and conducts thorough checks.

- This is beneficial in the long run as it reduces the risks of hacks and vulnerabilities.

4. Proof of Liquidity Could Change the Game

- Once PoL is fully deployed, it could create a "flywheel" effect — where the mechanism self-sustains liquidity.

- This will lead to high APYs, attracting farmers and new users.

Conclusions

- Simply holding $BERA is a poor strategy, as inflation and selling pressure are too high.

- However, participating in the PoL mechanism could be very profitable.

- Berachain is a "Yield Chain," not just an L1 for holding tokens.

If the ecosystem attracts liquidity and active farmers, the project will succeed.

Despite the poor launch and mistakes, if the team and community continue their active work, Berachain could become a leading platform for DeFi farming.