4 February 2025

1 0

Bitcoin Price Falls to $91,000 Amid Tariffs and Panic Selling

Bitcoin (BTC) dropped to $91,000 early Monday due to unfavorable macroeconomic conditions, including new US tariffs.

Key points:

- Market analysts are monitoring for signs of price reversal or further decline.

- A CryptoQuant analysis indicates panic selling as BTC falls below critical support levels.

- Institutional investors continue to accumulate BTC despite retail selloffs, suggesting strategic buying during the dip.

Market Dynamics and Institutional Activity

TraderOasis highlights:

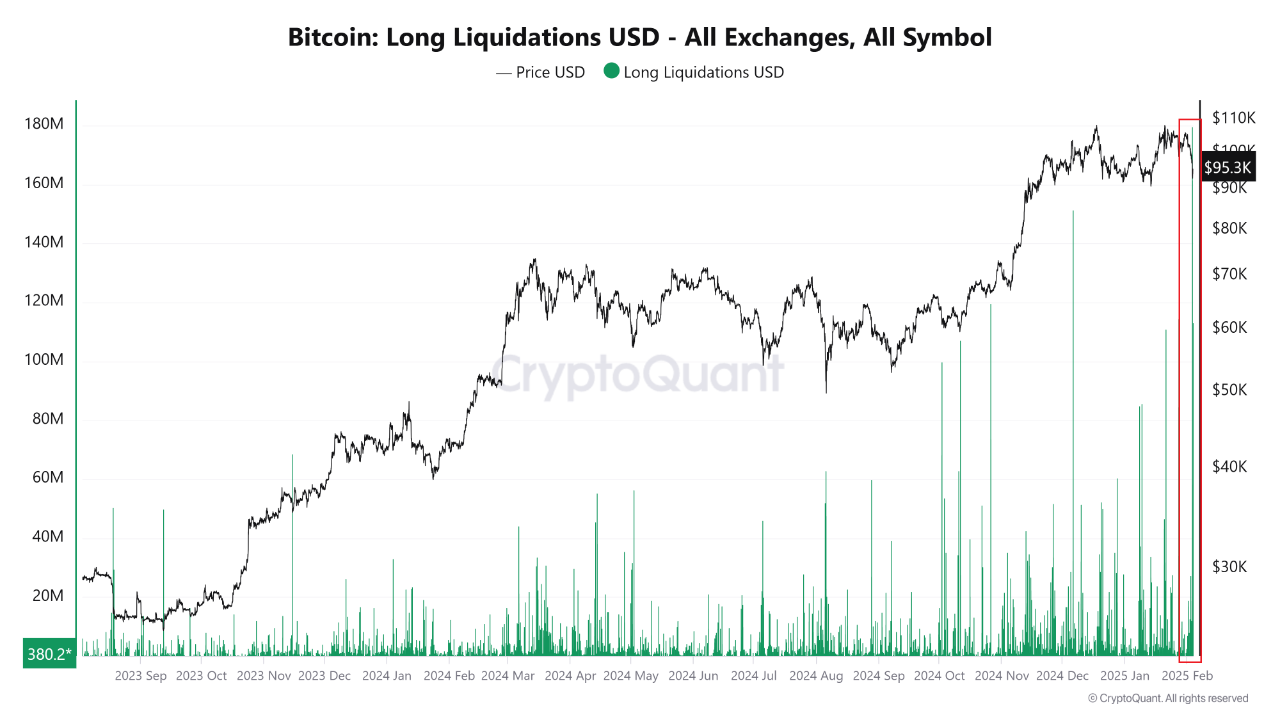

- Open interest has decreased significantly, indicating forced liquidations among leveraged traders.

- Funding rates drop point to increased short positions and bearish sentiment.

- Larger investors, or "whales," appear to be absorbing discounted BTC amidst retail liquidations.

Rising Liquidations and Signs of Recovery

Mignolet from CryptoQuant noted:

- The current liquidation volume is the highest since September 2023, triggered by the recent price drop.

- This event is compared to past market shocks like the FTX collapse.

- Despite liquidations, the Coinbase Premium Gap suggests institutional buying activity is strong.

Overall, the market remains volatile but shows potential for recovery as institutional players buy into the dip.