17 March 2025

0 0

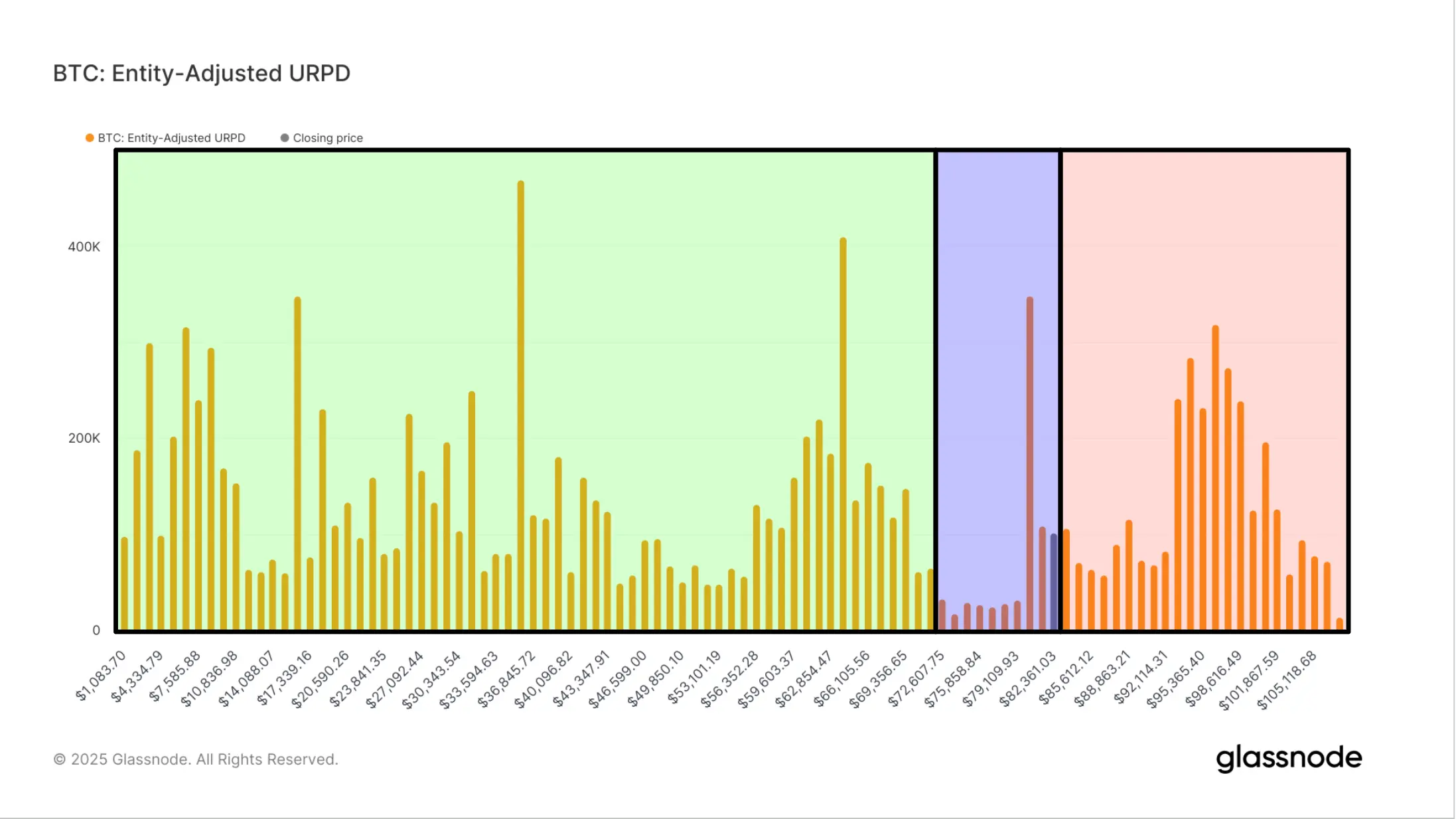

Bitcoin’s Supply Gap Emerges as Price Pullback Threatens Below $80K

Bitcoin's price pullback could accelerate if it falls below $80K, according to on-chain analysis from Glassnode. Key points include:

- The $10K range beneath $80K reflects weak economic activity from late last year.

- BTC prices surged from $70K to above $80K in early November following Donald Trump's presidential win.

- This rapid increase resulted in a "supply gap," with minimal BTC trading between $70K and $80K.

- Glassnode’s UTXO Realized Price Distribution indicates fewer traders acquired BTC in this range.

- Moving below $80K may lead to limited buying interest, with support likely at $73K, the all-time high set in March 2024.

- Currently, about 20% of total BTC supply is held at a loss, which may increase selling pressure if prices drop below $80K.

- Approximately 100,000 BTC have been sold by short-term holders amid the price correction, contributing to a 30% decline from the all-time high of $108K.