Эфириум отмечает 10 лет как актив казначейства

30 июля исполнилось 10 лет с момента запуска Ethereum. Обсуждения подчеркивают растущую роль Ether как резервного актива среди публичных компаний.

Ethereum: Растущий резервный актив, меняющий корпоративные финансы

Ether становится стратегическим резервным активом для корпораций, изменяя корпоративные финансы. Основные моменты:

- Bitcoin доминировал в обсуждениях цифровых резервов, но Ether набирает популярность благодаря потенциальной доходности и реальной полезности.

- Переход Ethereum на proof-of-stake позволяет получать доход от стейкинга в размере 2% до 4%, создавая возможности для пассивного дохода.

- Ether демонстрирует дефляционные характеристики, поддерживая свою ценность как накопительного актива.

- Ethereum поддерживает децентрализованные приложения, токенизированные активы и смарт-контракты, что увеличивает его привлекательность для корпоративного использования.

Волна ETH в казначействе

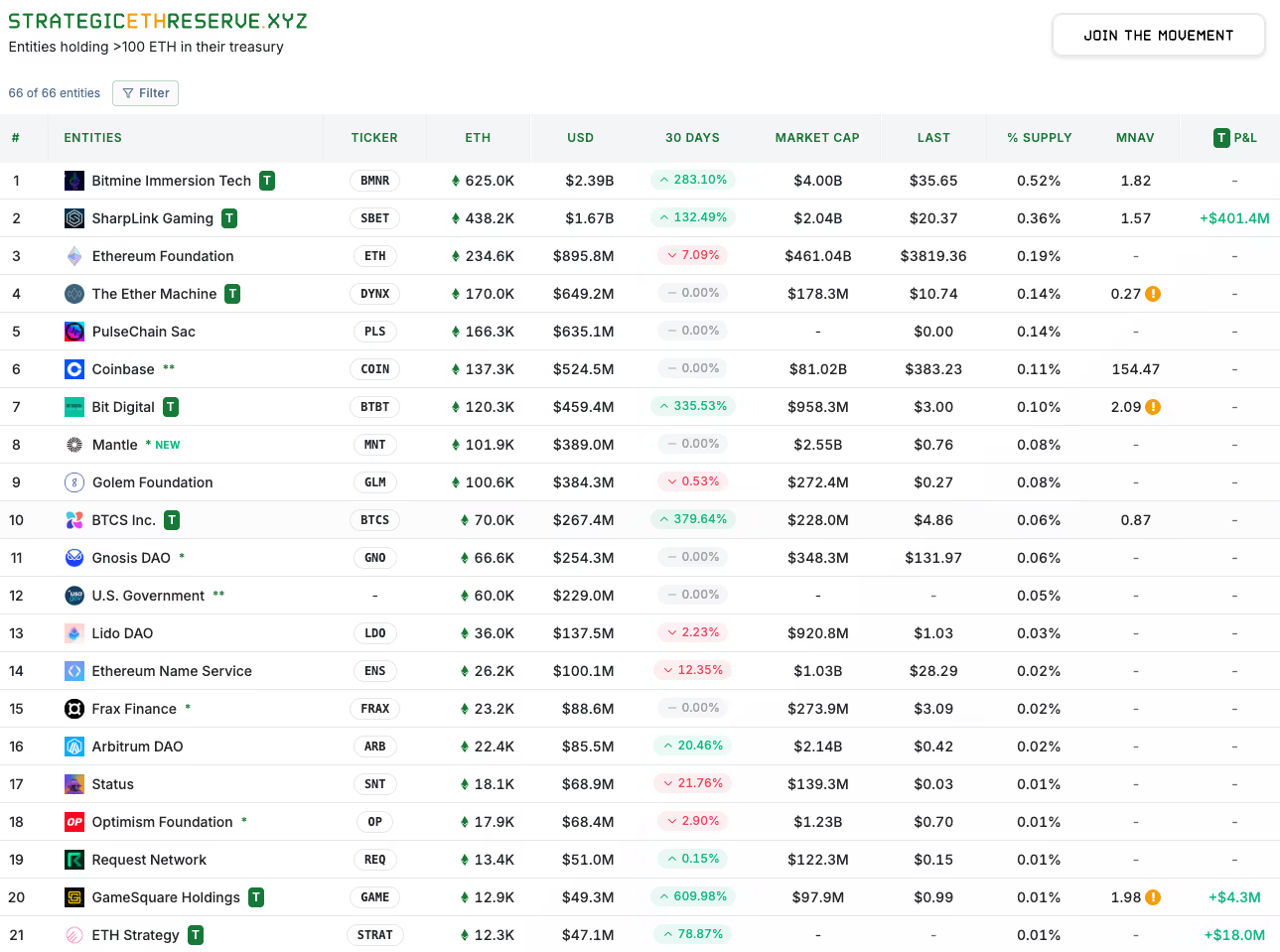

Публичные компании разрабатывают стратегии по управлению казначейством вокруг ETH:

- Bit Digital владеет более 120 300 ETH и планирует значительно увеличить свою долю.

- BTCS увеличила свои запасы до более чем 70 000 ETH и приняла стейкинг как стратегию.

- Bitmine Immersion стремится приобрести 5% от общего объема ETH, в настоящее время владея более 625 000 ETH.

- Sharplink Gaming держит $1,67 миллиарда в ETH и сосредоточена на стейкинге.

- Gamesquare выделила $30 миллионов в ETH с планами увеличить сумму до $250 миллионов, интегрируя DeFi и NFTs.

- The Ether Machine нацелена на $1,5 миллиарда в ETH перед выходом на биржу.

Эти компании демонстрируют долгосрочную уверенность в ETH, разрабатывая продукты внутри экосистемы Ethereum.

Дисбаланс спроса и предложения

Цена ETH растет, в основном из-за покупок публичных компаний. За последний месяц было куплено в 32 раза больше ETH, чем выпущено, что указывает на возможные шоки предложения. Модель proof-of-stake Ethereum снижает давление со стороны продавцов, выравнивая интересы держателей и безопасности сети.

Заключение

Ethereum превращается из платформы для разработчиков в широко используемый финансовый актив. С учетом возможностей получения дохода, дефляционных динамик и институционального интереса, ETH становится неотъемлемой частью стратегий корпоративного казначейства.

Вопрос эксперту

Почему ETH обсуждается как стратегический резервный актив?

A: Ethereum служит важной финансовой инфраструктурой, обеспечивая работу смарт-контрактов и финансовых услуг. Растущая экономическая активность делает ETH резервным активом.

Как корпоративные казначейства должны рассматривать ETH?

A: ETH можно рассматривать как "цифровой инфраструктурный резерв", предлагающий операционную полезность и генерирующий доход.

Что может подтвердить ценность ETH как резервного актива?

A: Увеличение расчетов финансовых операций непосредственно на Ethereum продемонстрирует доверие к сети.

Читать далее

- 30 июля Белый дом опубликовал свой первый отчет о политике цифровых активов.

- Миллиардер Рэй Далио рекомендует 15% биткойн-экспозицию в портфелях.

- Samsung сотрудничает с Coinbase для внедрения крипто-платежей для пользователей.