How to get the maximum passive income in Stablecoins

DeFi allows you to earn even with simple and basic strategies using stablecoins. Unlike traditional bank deposits and instruments, where interest rates do not cover inflation, DeFi enables you to collect yields ranging from 5% to 30% annually — without leaving your couch and without any significant restrictions.

Below we have compiled a selection of relatively simple DeFi strategies for passive farming of stablecoins aimed at generating additional yield. However, to avoid losing money in pursuit of high APY, let’s first briefly discuss the mechanisms of DeFi and the risks they entail.

What do you need to know?

According to data from DeFiLama, the current TVL of the DeFi sector is around $90 billion and it is one of the fastest-growing areas in crypto. However, like any financial instrument, the use of DeFi tools carries certain risks, and returns often correlate with these risks.

❗️ How not to lose money:

Basic rules to mitigate risks:

- When using liquidity pools, use only verified and liquid pools (>$0.5 - 3 million). Pools with low liquidity usually offer higher APY but carry increased risks due to sharp changes in APY yields, withdrawal issues, and lack of liquidity;

- Gas fees – in Ethereum, stablecoin strategies can be unprofitable due to fees, so it's better to use L2 networks;

- Large and audited lending protocols like Aave and Compound are safer, but their rates are lower than those in new or niche projects;

- Using tools for finding and analyzing pools (Merkl, Revert) check pool data and APY directly on the platform, as the data may differ;

- Don’t forget about impermanent losses (IL), which are relevant for liquidity providers. In stablecoin pools, IL is minimal but still possible during depegging - when the price of a stablecoin deviates from its stated value (usually 1:1). To minimize risks, choose pools with large stablecoins (USDT, USDC, DAI);

- The risk of smart contract hacks — even verified platforms can contain vulnerabilities in their code. Always study the history of hacks and pay attention to audits;

- Unaccounted risks: since the crypto space is unpredictable, it’s important to remember other types of risks. For example, a recent hack of the anti-detect browser ADS Power allowed attackers to seize private keys from thousands of wallets with assets and liquidity locked in DeFi protocols, with no possibility of recovery. Secure your workspace and diversify your risks to avoid losing all funds.

Liquidity Pools on DEX

Stable Pairs

APY ~ 5-10%

When allocating funds into liquidity pools in stablecoins, keep in mind that yields in pairs can change, and liquidity can flow between pools and pairs, so it’s worth constantly monitoring your positions for more efficient use of your deposit.

At the time of writing, the following pools are interesting:

- Uniswap DAI/USDT on the Ethereum network with an APR up to 10% at a TVL of $8.5 million;

- TraderJoe USDt/USDC on the Avalanche network with an APR up to 8% (periodically up to 20%) at a TVL of $13.5 million.

- Ekubo USDC/DAI on the Starknet network with an APR up to 5% at a TVL of $650 thousand (there are additional rewards within the DeFi Spring program).

Hydration DEX

APY ~ 10%

Another appealing option for allocating your assets is the DEX exchange Hydration on the Polkadot network, which has been incentivizing liquidity attraction by rewarding LP providers for about a year.

By providing liquidity in the USDT-USDC pool, you can earn yields ranging from 10% to 15% in DOT and HDX tokens.

There are two options for depositing funds:

- Buy DOT on an exchange and withdraw it to a wallet Talisman or any other

Use the cross-chain bridge to send tokens from the Polkadot network to the Hydration network.

Exchange DOT for USDT and deposit it into the pool. - Send USDT from the Ethereum network to the Hydration network through the cross-chain bridge and add it to the pool.

By providing your assets to the pool, your yield will grow over time, and the longer you hold funds in the pool, the higher your yield. Rewards are accrued in real-time, so they can be periodically withdrawn or reinvested.

Platforms with Potential Airdrop

Meteora

APY ~ 3% + points for drops

You can send your stablecoins to pools on Meteora while receiving not only additional yield but also future MET tokens. As noted in our article about Meteora, one of the criteria for farming points is: 1 xp for providing $1 TVL per day, with xp awarded only for activity in Dynamic Pools, DLMM, and Multi-token pools.

In the Dynamic Pool, there is a pair USDT/USDC with an APY of around 3% and a TVL of about $10 million.

Spark.fi

APY ~ 3-7% + points for drops

This is a DeFi protocol and a long-standing project with a solid reputation that consistently ranks among the top 5 lending platforms with a TVL of $1.7 billion. The project is developed by Sky Project — the team behind MakerDAO and the launch of the DAI stablecoin.

The platform is designed to maximize the yield of DAI and other stablecoins through the use of Aave v3 technology with additional optimizations, as well as subsidies from MakerDAO, leading to higher yields compared to competitors.

With a simple deposit of stablecoins, you can earn 3.5-4.5% yield.

If you want to maximize profits, consider participating in the Spark Tokens campaign for providing liquidity and farming points that will be converted into project tokens. About 6,000 users have already joined this airdrop campaign, with only about 70% being active users.

How to participate in the program?

1. Basic option (without leverage)

- Deposit ETH → receive Spark Points

- Deposit DAI/USDC in the Savings section → convert to sUSDe (up to 6.5% APY)

- Collateralize sUSDe → borrow DAI (additional points)

2. Strategy with leverage (for experienced users)

- Deposit USDC/DAI in Savings (receive sUSDe)

- Use sUSDe as collateral to borrow DAI

- Repeat the cycle to increase your position

- Receive double points (for deposit + for borrowing)

3. As an additional activity, you can deposit USDS into the Aave pool. The APY here is close to zero, but points are also awarded for this.

⚠️ Important:

- The minimum recommended deposit is $5,000+ (otherwise, fees will eat into your profits)

- The Health Factor should remain above 1.5 to avoid liquidation

- For more details on how points are accrued, check here

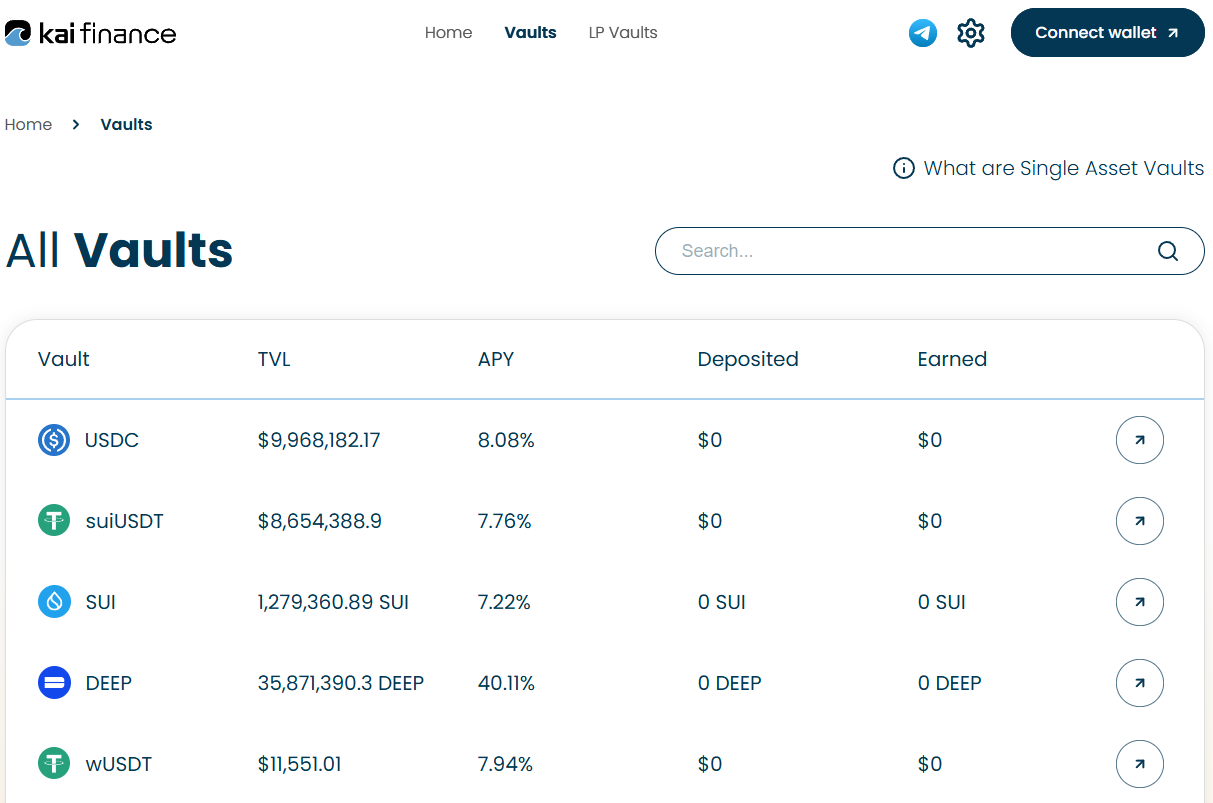

Kai Finance (Sui Network)

APY ~8%

This is a DeFi platform on the Sui network that offers Leveraged Farming tools for yield farming. Various stablecoin pools are available in the vaults.

- USDC APY 8% at a TVL of $10 million

- suiUSDT APY 7.7% at a TVL of $9 million

To find a suitable bridge and exchange tokens on the Sui network, you can use the Scallop platform.

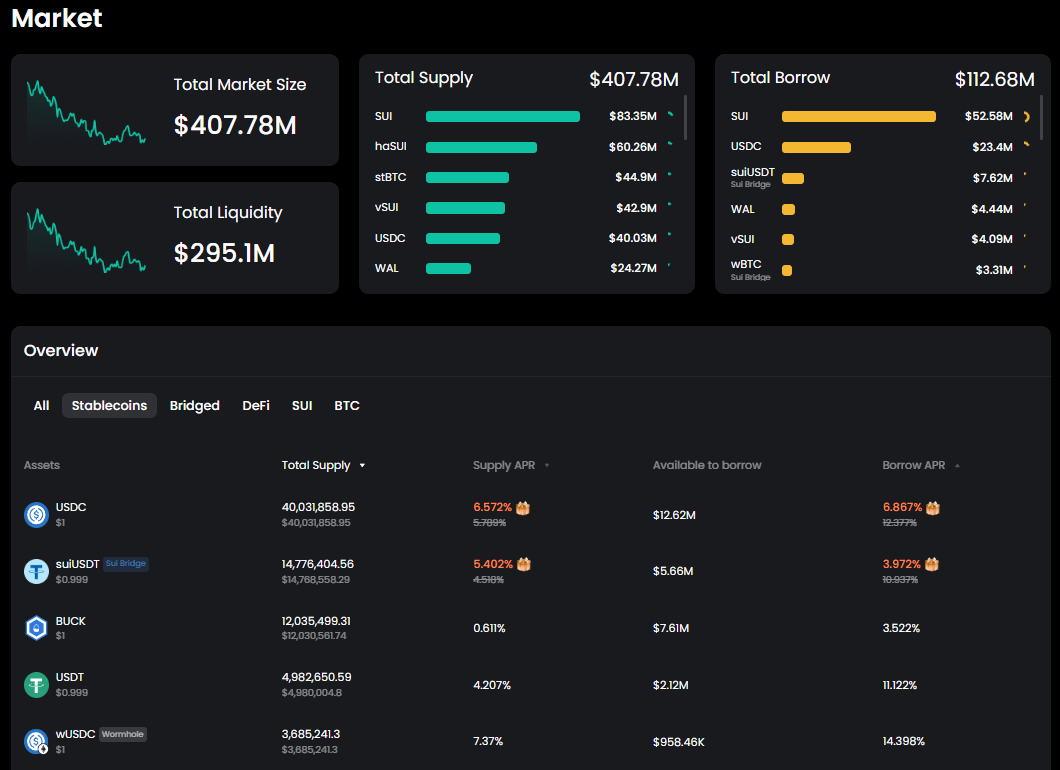

Lending Platforms

Fluid

APY ~7%

You can also deposit stablecoins on the Fluid lending platform from the Instadapp team. It combines DEX and lending protocol, offering both standard tools and innovative Smart Debt mechanisms that generate yields (up to 10%) even on loans (which compensates for high rates).

The protocol supports Ethereum, Arbitrum, Base, and Polygon networks, has about $1 billion TVL, and offers attractive rates on stablecoin deposits.

- USDC APY up to 6.7%

- USDT APY up to 7%

Aries Market (Aptos)

APY ~ 8%

This is a versatile DeFi platform on the Aptos network that also offers lending pools with attractive % on deposits. You can allocate stablecoins in lending pools:

- USDC APY up to 8.2% with a TVL of around $200 million;

- USDT APY up to 7.5% with a TVL of around $200 million.

Morpho

APY ~ 6-8% + points for drops

Morpho is an optimized lending protocol that operates on top of Aave and Compound, improving the yield on deposits and loans through more efficient liquidity distribution.

On Morpho, you can allocate USDC under an APY of up to 6-8% across various Vaults. Additionally, keep an eye on airdrop programs where Morpho distributes extra tokens. In such cases, yields can be significantly higher.

NAVI Protocol

APY ~ 4-7%

In the Sui network, decent yields on stablecoins can also be found on lending platforms. NAVI Lending is one of four financial products in the NAVI Protocol ecosystem. The lending platform has approximately $300 million in assets locked, and yields on stablecoins here range from 3% to 10%, taking into account promotions and incentive programs.

AAVE

APY ~ 3.5%

The yield for stablecoin deposits in pools on the largest lending platform is:

- USDC APY up to 3%

- USDT APY up to 3.3%

- DAI APY up to 3.7%

Tools for DYOR

As an effective tool for independently searching for profitable pools, lending protocols, and yield vaults, you can use the service Merkl, where you can filter and sort pools by the most popular EVM networks and platforms.

You can also find information about additional rewards and incentive rewards here.

Another useful service to use is the tool Revert.finance, which is designed for managing and analyzing LP positions, as well as finding liquidity and yield pools.

Currently, it supports exchanges like Uniswap, Pancakeswap, and Aerodrome. You can also sort pools and select the desired pair here. The protocol supports few networks, so it’s better to double-check and analyze through DefiLlama.

Summary

DeFi provides unique opportunities for passive income on stablecoins, offering returns from 5% to 30% annually, which is several times more than traditional bank deposits and instruments. However, it’s important to remember that high yields always come with risks, and it’s essential to approach investments thoughtfully.

- Safety first

- Use only audited protocols.

- Avoid low-liquidity pools with TVL < $1 million and dubious new projects.

- Optimal strategies

- For conservatives and whales: Lending on Aave/Fluid/Spark (3-10% APY).

- Moderate strategies: Liquidity pools on Hydration, Uniswap (8-25% APR).

- For experienced users: Farming airdrops (Morpho, Spark) + leveraged yield.

- Look for incentive programs and airdrops to boost your yield.

- Search for pools and vaults in newly launched networks. At early stages, yields in such pools will be higher

- Technical nuances

- Use L2 networks (Arbitrum, Base) to save on gas fees.

- Monitor the Health Factor when using collateral.

- Diversify assets among 3-5 protocols.

- Main risks

- Depegging of stablecoins (choose large stablecoins like USDC, DAI, etc.).

- Hacks of smart contracts (check audits and investments).

- Liquidity of pools (withdraw funds gradually and monitor asset movements in pools).

Do not chase maximum APY — a stable average yield is more reliable than short-term windfalls. Start with small amounts, test strategies, and only then scale up.