[toc]

Proof of Stake простыми словами

Proof of Stake (PoS) – это механизм консенсуса, который позволяет блокчейнам достигать согласия о состоянии сети. В отличие от Proof of Work (PoW), где майнеры решают сложные математические задачи для создания новых блоков, в PoS участники сети становятся валидаторами, ставя свои криптовалюты на кон.

Зачем переходить с PoW Ethereum

Переход с PoW на PoS для Ethereum был необходим по нескольким причинам:

- Экологичность: PoW требует огромного количества электроэнергии, что негативно сказывается на окружающей среде. PoS значительно снижает потребление энергии.

- Безопасность: PoS делает сеть более защищенной от атак, так как злоумышленнику нужно иметь значительное количество токенов, чтобы контролировать сеть.

- Доступность: В PoS любой желающий может стать валидатором, просто поставив свои токены, что делает участие в сети более доступным.

- Скорость транзакций: PoS может обеспечить более быстрые и эффективные транзакции по сравнению с PoW.

Cryptocurrencies operate on a blockchain. The blockchain itself runs on consensus mechanisms that verify compliance with certain rules.

UPDATE: The Merge has taken place. We followed it on our Telegram channel

Consensus is a way to confirm the signature of a block in the blockchain

In incredibly simple terms

What is Proof-of-Stake

First came Proof-of-Work (PoW) – Proof of Work. It powers Bitcoin, Ethereum, and other networks.

Blocks are signed through mining using cryptocurrency farms consisting of graphics cards, processors, and ASIC hardware.

Then, to improve scalability, Proof-of-Stake (PoS) emerged – Proof of Stake. It powers Solana, BNB, and will power Ethereum 2.0, but more on that later.

Here, blocks are signed by users who have staked their coins in the blockchain.

Each consensus mechanism has its own characteristics. Transitioning from one to another makes sense only when the current one becomes outdated, as was the case with Ethereum, whose popularity was not anticipated. The existing network became insufficient, requiring a technical upgrade. Current networks are designed for such loads, so they do not need to transition.

Comparison of PoW and PoS

Besides the difference in the way blocks are signed, consensus mechanisms have their own features.

PoW

- To become a validator, expensive equipment is needed, along with subsequent setup and maintenance. A small mining farm now costs around ~1 million rubles.

- High energy consumption for operating the equipment. A transaction in the Bitcoin network requires about 200 kWh.

- Security. To control the network, you need to capture >50% of validators. Mining farms are spread all over the world, making it impossible to capture them all.

PoS

- To become a validator, you only need to stake coins in the network.

- Low energy consumption – no farms consuming electricity.

- Security. The same >50%, but here you need to hold more than half of all issued tokens. This would cost billions of dollars. Not to mention that tokens are distributed across the wallets of millions of users.

- Scalability is higher than that of PoW – More transactions per second means lower transaction fees.

How PoS Works in Ethereum

Ethereum - Top-2 network operating on PoW. If five years ago its transaction per second (TPS) rate of ~35 was sufficient, with community growth, this has become inadequate. There are many transactions, and users pay for priority on their transactions. High fees have appeared, ranging from $10 to $30, and during large token sales or NFT launches, they can reach $300-$500.

There arose a need to improve the network, such as transitioning to PoS to increase TPS. This will also reduce transaction prices.

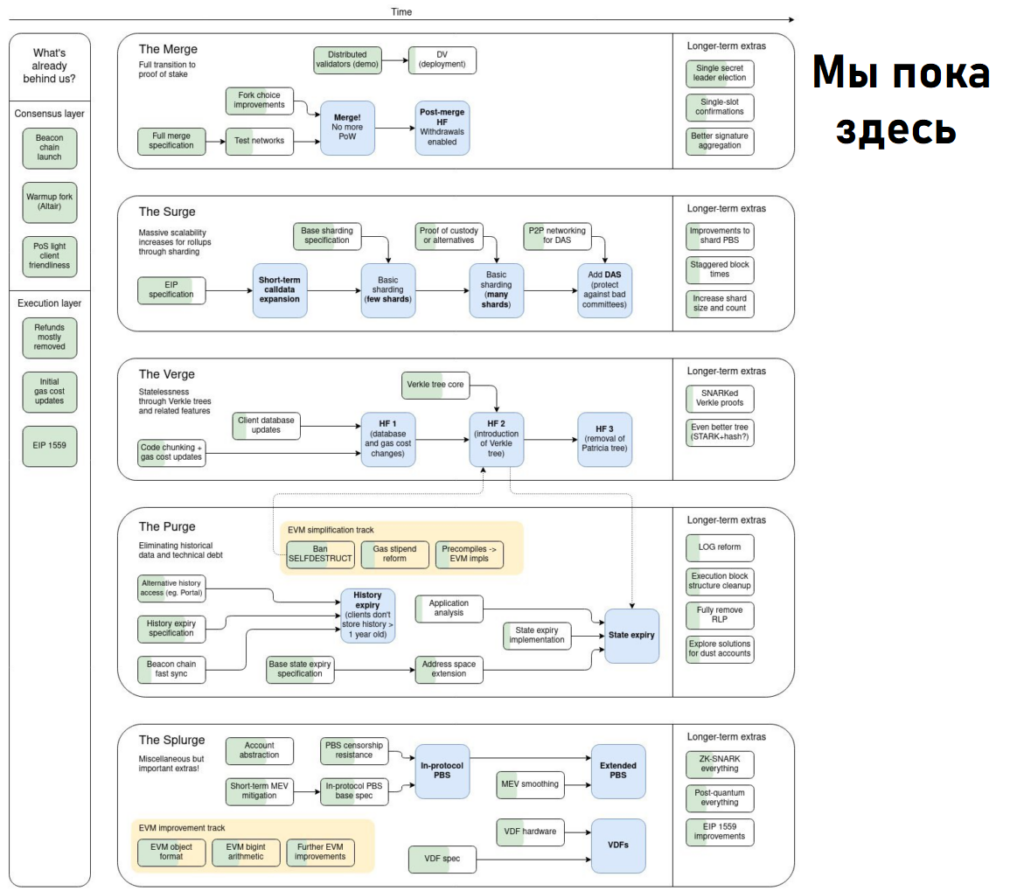

For this, there will be a merge with the Ethereum Beacon Chain, resulting in Ethereum 2.0. This is the first step out of five - “The Merge.” While the merge has not yet occurred, let's consider staking using this network as an example.

How to Mine Ethereum 2.0

So, if you want to become a validator, you need to stake 32 ETH on the blockchain website.

Not everyone has $51,000 (at the time of writing) to buy Ether. Therefore, you can partially become a validator and invest money in a common pool. It's similar to a crowdfunding approach.

For example, Petya has 2 ETH. He cannot become a validator, but he can invest his funds in the Lido pool at 3.8% annual interest. Once he stakes them, the Ether will be locked in the blockchain and used to sign blocks. Petya will receive annual returns but can withdraw his 2 ETH at any time.

The Lido pool will control the Ether of thousands of such Petya's, which will allow it to influence the fate of the network through voting.

When Will Ether Transition to PoS

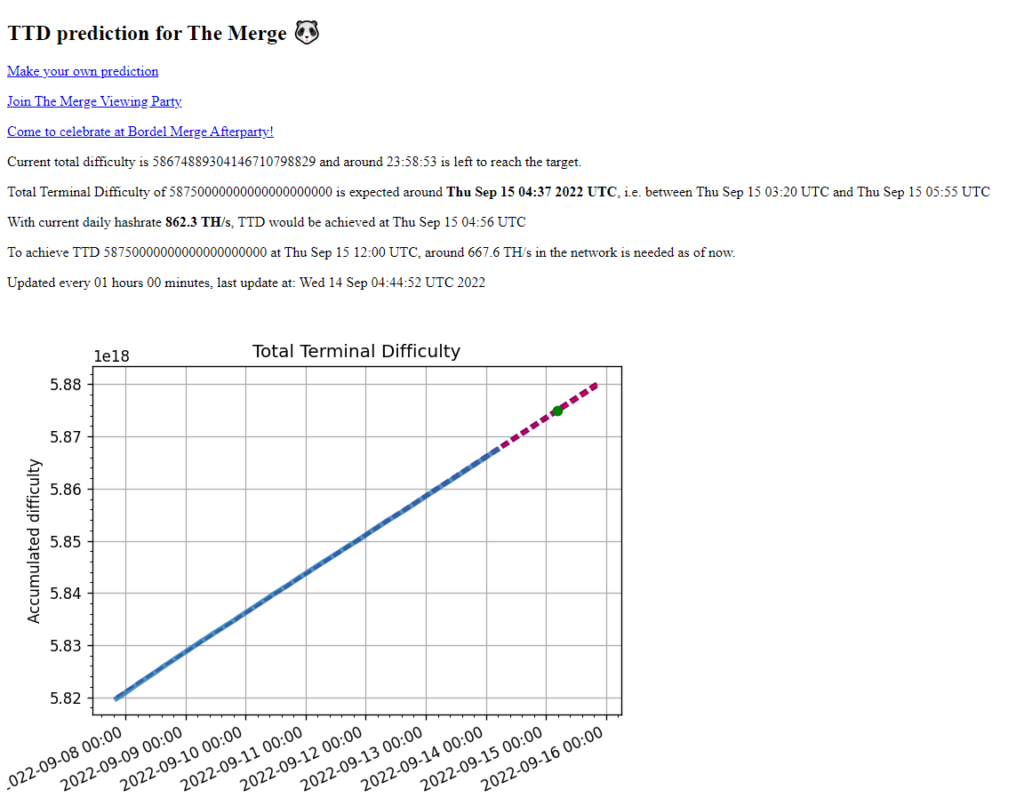

The transition to Proof-of-Stake will occur with the update The Merge on September 15-16. It is not scheduled for a specific date but rather for a terminal difficulty of 58750000000000000000000. This daunting number indicates the point at which the last block will be mined.

You can follow this here.

⚡️⚡️⚡️ In the Telegram channel of Holder, we tracked the merge

What Will Happen When Ethereum Transitions to PoS

We've discussed when the transition will happen. Now let's figure out – What will happen to Ether after the merge.

New Tokens

The Ethereum network will split into two parts. The main one will be EthS. This is Ether on staking. All exchanges and wallets will transition without consequences, so your Ether will not be lost. EthS will hold most of Ether's liquidity, so significant price changes are not expected.

Additionally, there will be an unofficial Ethereum network on PoW with the token EthW - a fork. The situation with it is less favorable. Firstly, people must have motivation to pour their funds into “outdated Ether.” Secondly, most DeFi will not support EthW. The price is likely to be at the level of the Ethereum Classic fork from 2017, around ~$40.

Most exchanges, such as Binance, will split Ether on your balance into two tokens 1 to 1. For 1 ETH, you will receive 1 ETHS and 1 ETHW.

Scalability Issues

The transition to staking is the first step towards increasing scalability. A full upgrade will be considered after the update The Splurge, which will take place in a few years. At that time, the number of transactions per second will grow from 35 to hundreds of thousands.

Adoption Worldwide

After the transition, it will no longer be necessary to consume gigawatts to maintain the network's operation. Validators will only need to stake Ether instead of maintaining a farm of three hundred graphics cards.

Recently, the world has been moving towards “green production.” The new Ether fits perfectly into this trend.

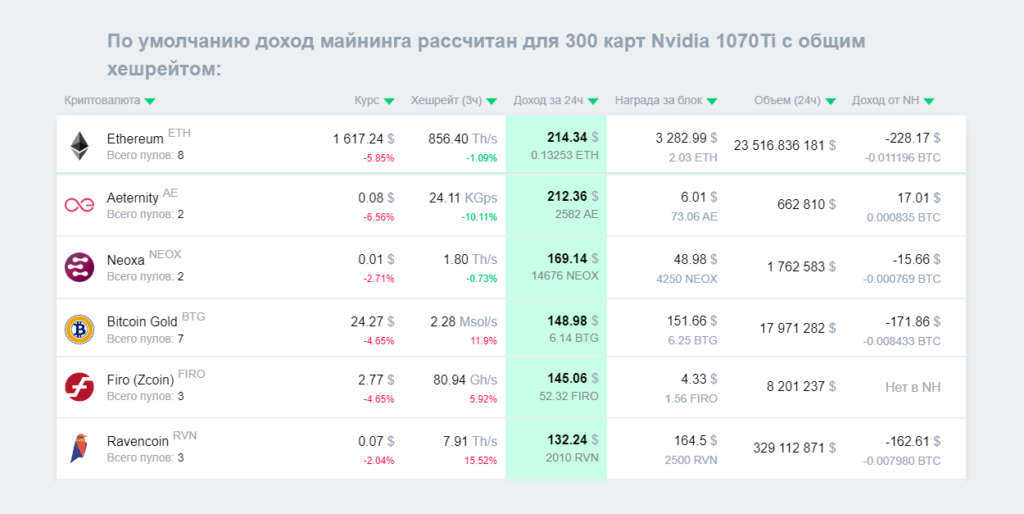

What to Mine After Ethereum Transitions to PoS

If you are a miner, you can at least continue to mine the EthW fork of Ether. But until the transition happens, we won't know the profitability. So here are the TOP-5 cryptocurrencies by mining profitability.

- Aeternity

- Neoxa

- Bitcoin Gold

- FIRO

- Ravencoin

In Conclusion

The average user will not notice Ethereum's transition to staking. Transaction costs and speeds will not change significantly. The upcoming update The Merge is just the first step.

When it comes to PoW and PoS – it's a matter of security and energy efficiency. Proof-of-Work is more secure because controlling over 50% of devices is physically harder than controlling 50% of the network's coins. Proof-of-Stake drastically reduces energy consumption; it is more environmentally friendly and provides high scalability. The choice is already up to blockchain creators.