Trading strategies in the cryptocurrency market with minimal risks

Trading in the cryptocurrency market raises concerns for many. Given the volatility of this market and recent declines, these concerns are quite justified. The situation is further exacerbated by newcomers' misunderstanding of basic trading principles and their strategy in a market with predictable and, most importantly, controllable risk. As a result, they make well-known mistakes. In this article, we will try to highlight several key approaches and types of trading suitable for both beginner traders and more experienced ones, designed for short-term and long-term periods, possessing the lowest level of risk.

The level of risk directly depends on the profitability of transactions. The higher it is, the greater the profit can be obtained. However, often the risks do not justify themselves, depriving the trader not only of income but also of invested funds. The lowest-yielding type of investment in cryptocurrency is long-term.

TOP Trading Strategies with Minimal Risks

A trading strategy allows you to choose the right course of action during chaotic market movements. It is important to select a method that helps trade effectively and feel comfortable. At the same time, it should correspond to the trader's character and the amount of time the trader is willing to allocate for trading. Excessive excitement, greed, or excessive fear will only lead to detrimental consequences, and earning on cryptocurrency will be minimal or even zero.

1. Classic Strategies Based on Technical Analysis

These strategies are based on analyzing past price movements through charts and patterns formed by prices on the chart.

- Graphical Method. Based on the postulate "history repeats itself." Helps identify recurring patterns (figures) of trader behavior in the market using charts. For example, one can visually detect a "corridor" of price on a chosen asset, where it "walks," or strong price levels whose breakout serves as a strong signal to enter (or exit) the market.

- Algorithmic (Mathematical Method). Involves the use of technical indicators – moving averages, RSI, Bollinger Bands, etc. Allows for a quick visual tracking of possible price movement probabilities in the market.

- Volume-Based. Involves determining the dynamics of trading volume changes for an asset over a certain period. Changes in trading volumes are a powerful indicator – indicating which market movement currently receives more "votes" from market participants.

- Candlestick Method. Provides instant information about current market sentiment. They predict the price direction at the end of previous trades.

Strategies based on technical analysis imply the use of various tools to identify entry and exit points in the market and forecast situations. A popular service in the trading community that greatly assists with this is tradingview.com. It provides price movement charts for various assets, allows for marking support and resistance lines, and overlaying various indicators on the charts. The service has a paid subscription, but all main functionalities are also available for free. Since the service aggregates prices not only for cryptocurrencies but also for fiat currency rates, as well as stock prices and other instruments, there is an opportunity to track sometimes curious correlations between, for example, crypto assets and fiat currencies.

Trading Strategy for Breaking Price Levels

One of the basic and effective trading strategies within the technical approach. It involves monitoring prices near past historical highs or lows. Trading near price levels poses a significant risk, as the tension in the market may lead either to a rebound from the level in the opposite direction or, conversely, to a breakout and a continuing trend.

The basic recommendation is to wait for the resolution of this situation in one direction or another, and then "trade" depending on which way it resolved. It is worth noting that price levels exist not only near historical highs and lows but also near "round" (or psychological) price values.

Based on the Moving Average Indicator

This strategy is characterized by simplicity and high effectiveness. It is also referred to as the simple moving average line. The indicator constructs a line based on the logic of averaging.

The main parameter of the indicator is the averaging period. For instance, if it equals 20, the last point of the indicator curve will be located at the level of the average closing price of the last 20 candles. It is suitable for short-term and medium-term trading.

It is also worth mentioning that the crossing of moving averages with different averaging periods is also an independent indicator of market movement. For example, when the "fast" moving average (e.g., with an averaging period of 9) crosses the "slow" moving average (e.g., with an averaging period of 20), one should open a position in the direction where the fast moving average goes.

There are many similar (technical) strategies based on various indicators and mathematical models. All of them aim to automate the ability to predict market movements, and they form the basis of the overwhelming majority (if not all) of algorithmic trading algorithms. Unfortunately, these strategies do not provide a 100% guarantee of profit and regularly miss opportunities, especially when serious external events affecting the market occur; nevertheless, they remain relevant in the crypto market.

2. Scalping

For active intraday trading in cryptocurrencies, terminals are connected to cryptocurrency exchanges. We have discussed their advantages in a separate article. Against the backdrop of long-term trading strategies, medium-term, and even short-term (within a day), scalping is ultra-short-term. The essence of the strategy lies in earning on the spread – the difference between the buying and selling price. The trader executes a large number of transactions in a unit of time, constantly buying at the ask price and instantly placing sell orders at the bid price.

This strategy is popular among both experienced traders and beginners. The strategy is applicable to any cryptocurrency assets. However, the method requires calm market conditions to avoid sharp jumps and breakouts. In the event of a breakout, it can instantly negate all profits earned from scalping in the preceding period. Nevertheless, if an asset behaves relatively stably throughout the day or week, this method of earning can be quite viable.

3. Cryptocurrency Arbitrage

Here we will elaborate further, as the strategy is quite simple and has a truly low level of risk. The essence lies in buying a token on one exchange at one price and selling the same token on another exchange at a higher price. Since transactions are constantly occurring on exchanges, situations often arise where the price for the same asset differs significantly across different exchanges. And since the number of cryptocurrency exchanges and cryptocurrencies today reaches hundreds and thousands, such (arbitrage) situations arise frequently enough to earn consistently from them. This strategy has been actively used and continues to be used in traditional stock and currency markets to this day.

The strategy is good because it does not depend on the direction of market movement but requires constant monitoring of prices on different exchanges. Also, one should not forget about transaction fees and that arbitrage trades will be profitable if the price difference on different exchanges is at least 1%, which is not uncommon.

In addition to the mentioned inter-exchange arbitrage, there is also intra-exchange arbitrage, where a trader conducts a chain of transactions between three or more coins on one exchange. For example: if there is token X in the balance, it is exchanged for token Y, then token Y is exchanged for token Z, and finally, token Z is exchanged back for X. As a result of executing such a chain, profit is generated (there will be more tokens X at the end than initially).

However, finding and calculating such chains and inter-exchange pairs independently is extremely difficult (again due to the number of exchanges and cryptocurrencies) – a person simply cannot process such a volume of information. Therefore, for effective arbitrage trading, traders use an arbitrage scanner. It automatically finds profitable token pairs and forms the process of sequential exchange, leaving the trader to choose one of the arbitrage pairs and execute the trade.

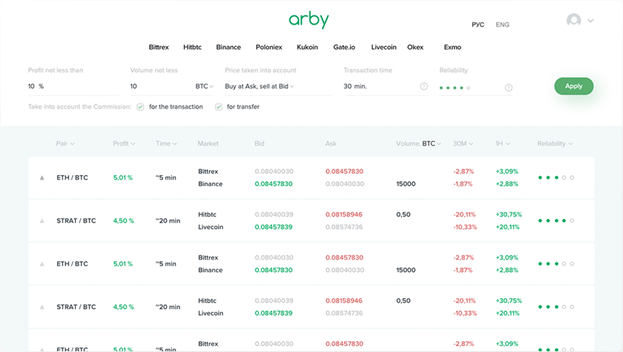

Let's consider the example of the scanner Arby.Trade – it is specifically designed for arbitrage trading in cryptocurrency, aggregating data from all major crypto exchanges and calculating all possible arbitrage situations at the moment across these exchanges. The data is provided in the form of two tables – for inter-exchange and intra-exchange arbitrage.

When talking about arbitrage and the service that helps facilitate it, it is necessary to warn that today there are quite often cryptocurrency pyramids that often present themselves as arbitrage bots (while not being so). In this article, we mention the service Arby.Trade, as it is not a bot, does not require connecting your wallets to it, and does not require funding a "bot" account for pseudo-robotized trading; the service only provides data on found market trades, while trading is conducted directly by the user.

4. Cryptocurrency Portfolio and Rebalancing

This strategy falls more into the category of long-term investments and is suitable for more experienced traders, or rather investors, as it does not imply daily or even weekly trading.

The essence is to create a balanced portfolio of top and undervalued tokens. This way, potential declines in some assets are hedged by others. The formation of such a portfolio occurs considering the ratio of potential profit and risks for each instrument. That is, assets in the portfolio are not present in equal proportions but based on the calculated risks by the trader for each asset. Thus, an overall risk and return indicator for the entire portfolio is formed. An optimal case would be a beta-neutral portfolio concerning Bitcoin. Part of the portfolio will grow along with Bitcoin, while another part will increase in value when it falls.

Once the portfolio is formed, the investor's next task is to periodically rebalance the portfolio. Over time, some assets will rise in price, while others will decline, thus creating an imbalance relative to the proportions established by the trader in the portfolio. The task of rebalancing is to maintain the initially set risk level of the portfolio. That is, the trader periodically buys some assets, partially sells others, thereby bringing their portfolio back to a balanced state.

For portfolio formation purposes, an excellent service is coinmarketcap.com. It allows assessing the picture across the entire market, the capitalization of all tokens, and the dynamics of price changes both relative to fiat currencies and Bitcoin.

The interval for rebalancing is usually once a quarter or half a year.

We have only covered part of the approaches that help earn relatively steadily in the market. For a deeper dive into the field, we recommend familiarizing yourself with such a classic work as "Technical Analysis of Futures Markets" by John J. Murphy (do not be misled by the term futures markets – the behavior of markets is roughly the same) and studying in more detail the services and their functions mentioned in the article, as it is precisely thanks to their information that earnings occur regardless of the chosen strategy.