Investing in cryptocurrency — How to make money in the crypto market

Cryptocurrency started in 2008 as an interesting but questionable technological experiment, and today many are interested in whether investments in cryptocurrency can provide passive income for institutional traders and investors.

Against the backdrop of the crisis and the pandemic of 2020, the traditional economy is collapsing, and more and more people are looking for options for protective assets that will safeguard their funds from inflation. In these conditions, crypto (in particular, Bitcoin) is reaching a new level, as evidenced by the explosive growth since September — less than 5% remains to reach the historical maximum of BTC. Before reading, we recommend familiarizing yourself with the introductory article on trading cryptocurrencies.

We offer to explore the methods and prospects of cryptocurrency investments. Ignoring this topic today is no longer possible even for the most conservative investor.

Prospects of the Cryptocurrency Market

The crypto market is characterized by the following features:

- Presence of institutions. Just 2-3 years ago, the head of the financial holding JPMorgan spoke unfavorably about cryptocurrency, calling it a fraud and traders "stupid." Moreover, he threatened to fire any employee for trading bitcoins. Today, however, JPMorgan is actively participating in the crypto market and collaborating with several crypto brokers. The same can be said for other large investors and investment companies, whose interest in digital coins has increased manifold.

- The development of the decentralized finance (DeFi) market, whose tokens grow by hundreds and thousands of percent in just a few days. The most famous case is the YFI token, which grew by 100,000% in two months and became more expensive than bitcoin. We should not forget about altcoins, which have proven themselves well in the summer of this year.

- The halving of Bitcoin, meaning the reduction of the reward for a block, has typically had a positive impact on the price — a decrease in supply combined with an increase in demand, including institutional demand, has produced a noticeable effect. And bitcoin, as has long been noted, pulls along the entire rest of the market.

Thus, the rise in the exchange rate and market capitalization that we are currently observing resembles the growth of 2017 only in trajectory, but not in fundamental reasons. Back then, it was an ICO boom, which many considered a bubble and did not want to take seriously. Today, cryptocurrency has proven that it deserves the attention of investors.

Safety and Risks of Investing

There are certain risks in the crypto market that either do not exist or are less pronounced in traditional financial markets. Nevertheless, it cannot be overlooked that many of the risks that were applicable to digital coins in previous years are gradually diminishing — the field is developing and improving.

Let's consider everything in order.

- High volatility is the main risk that makes many wary of investing in crypto. Indeed, active growth cannot continue forever: at some point, fortunate traders will sell the asset to lock in profits, and then a drop in the exchange rate of 20 or even 40% may occur. However, it should be noted that Bitcoin is usually bought as a long-term investment (analogous to gold), and fluctuations over a period of 1-2 years from entry to exit from a position do not matter — the main thing is that in the end, the asset still increases in value, and almost no one doubts this.

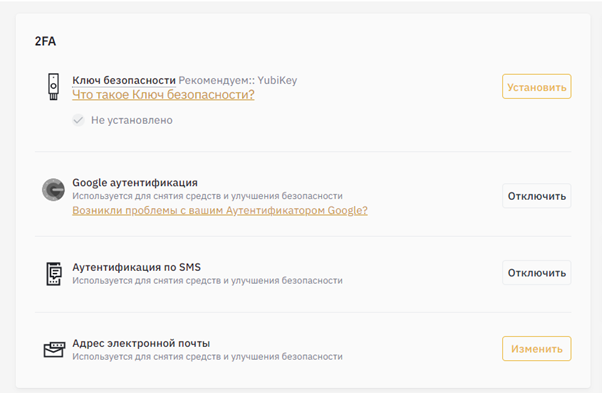

- Hacks of cryptocurrency exchanges. This problem used to be much more acute. Users had to trust their funds to centralized custodial storage, which did not always handle their protection well. Today, dozens of non-custodial decentralized exchanges operate, where clients do not need to trust anyone with their money to make an exchange — it simply sits in their wallet. And speaking of centralized platforms, the top ones have become much more reliable, information about large-scale hacks appears less frequently, and users can additionally protect themselves using 2FA and payment passwords.

- Fraudulent projects. If we recall the ICO boom, millions of people lost money because they did not bother to choose a reliable project and trusted the first ones they came across. Today, developers prefer to conduct IEOs instead of ICOs, which automatically increases reliability — the quality of the project is pre-verified by exchange specialists. And when investing in DeFi projects, no one can unilaterally withdraw funds, as processes are controlled by smart contracts. Of course, there remains the risk that the project may simply fade away and not bring profit.

- Storing cryptocurrencies also creates certain risks. It is recommended to choose cold wallets for the long term, which store private keys isolated from the internet. But at the time of making outgoing transactions, it is still necessary to connect to hot software.

- Novelty of technologies. Humanity has known traditional money for several thousand years, while cryptocurrency and blockchain have existed for just over a decade. New developments are truly fascinating, watching them is very interesting, especially since they are developing very quickly. However, there is also a downside — potential vulnerabilities and shortcomings that will only be revealed once someone gets burned by them.

The blockchain industry is becoming stronger every day. Large corporations like MicroStrategy have made investments in cryptocurrency totaling hundreds of millions of dollars — both in BTC and in other digital assets. There is no need to mention private investors. The potential of cryptocurrency is quite clear. Further progress depends on how widely cryptocurrency adoption unfolds. There are already moves in this direction; for example, PayPal recently announced that it will start supporting crypto transactions.

Types and Methods of Investing in Cryptocurrency

The crypto market has stood the test of time, and now the possibility of investing in it is being considered quite seriously, rather than as a whim. Let's explore the current ways to earn on cryptocurrency.

Trading

Price fluctuations contain not only risks but also opportunities, and the higher the market volatility (which is maximal for cryptocurrency), the higher the potential earnings can be even in one day. For a beginner, this method is quite risky, but you can try it using a demo account on some exchange or by investing a small amount of money that would not be critical to lose. Due to insufficient attention to training, more and more beginners make basic mistakes.

The essence of regular spot trading lies in the principle of "buy low, sell high." But you can also earn from a price decline if you learn to trade derivatives.

Popular exchanges for trading cryptocurrency:

We have compiled a rating of 10 reliable exchanges.

Long-term Investment in Cryptocurrency

The HODL strategy implies holding an asset for a long time (up to several years) in anticipation of such significant price growth that selling will compensate for all the waiting. Bitcoin is most often considered for HODLing, although other options are possible.

The standard rule for forming an investment portfolio: 80/20. This means — 80% coins with high capitalization, 20% — with low or medium. This method allows for substantial profit during any sudden surge of "weak" cryptocurrencies while continuing to hold the strongest coins.

A comparison of the advantages and disadvantages of long-term investing in cryptocurrencies versus stocks:

The pros of investing in cryptocurrency compared to the stock market:

One opinion regarding crypto-investing

Mining

Transactions in the blockchain are confirmed by miners, who receive financial rewards for this process. Some cryptocurrencies already have such high network difficulty that significant investments in equipment (ASIC miners) are required for their mining. The payback is questionable: it depends on both the price of the mined currency and the cost of electricity, which is consumed in huge quantities. Additionally, the equipment generates a lot of heat and noise — it is advisable to allocate a separate non-residential space for it.

There is another option — to mine promising currencies with low difficulty. However, in this case, one cannot expect significant passive income.

There is an opinion that private mining has practically exhausted itself by 2020; now it is entirely a corporate business; large companies have enough resources and space to organize giant mining farms. Unfortunately, this partly leads to the centralization of the network and increases its vulnerability.

Staking

Staking cryptocurrencies is the process of delegating or locking cryptocurrencies to receive rewards.

The rewards can be tokens, voting rights in DAOs, or even NFTs.

There are cryptocurrencies that use the proof-of-stake mining model; in their case, staking is a way to add new transactions to the blockchain.

In the traditional Proof-of-work, where miners extract cryptocurrency using graphics cards and processors, validators are the miners themselves who solve tasks. In Proof-of-stake, validators are owners of crypto addresses with locked amounts.

⭐️ For example, Ethereum transitioned to Proof of Stake in September.

Initially, participants stake their coins in the cryptocurrency protocol. From these participants, the protocol selects validators to confirm blocks of transactions. The more coins you stake, the greater the likelihood that you will be chosen as a validator.

Every time a block is added to the blockchain, new cryptocurrency coins are minted, which are distributed as rewards to the validator of that block. In most cases, the same cryptocurrency that validators stake is used as a reward.

Drop Hunting

Investment Level: Low

Sometimes crypto startups distribute cryptocurrency to early users. Early users are those who supported the project at its initial stage of development. For example, they looked for vulnerabilities, participated in testnets, or helped develop social networks. Loyal users receive from a few dollars to several thousand.

Types of airdrops and how much can be earned from them - Link

In the crypto community, a type of person has formed who professionally engages in catching drops. They study projects, subscribe to social networks, and actively participate in their lives. Instructions for drop hunters.

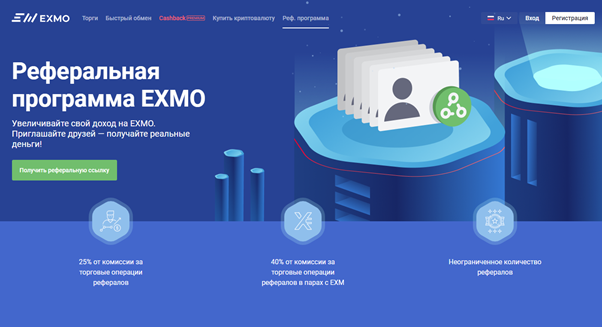

Earnings from Affiliate Programs

Many exchanges and exchangers pay rewards to users for participating in referral (affiliate) programs. In other words, for inviting new active users. Profit is usually expressed as a share of the commission fees from referrals, but sometimes a fixed bonus is paid for each referred user. Conditions may vary.

Thus, if you have your own website or a promoted social media page, you can use these platforms to spread your referral links.

Affiliate programs are available on all the best cryptocurrency exchanges:

Earnings from DeFi

There are several main ways to earn from the popular topic of decentralized finance. DeFi projects are characterized by actively incentivizing users for various activities within their protocols. Examples of real methods through which income can be safely generated in DeFi include:

- Yield farming. Rewards for providing liquidity to lending protocols or AMMs. Implemented in Compound, Curve Finance.

- Margin lending at interest on decentralized exchanges, for example, dYdx.

- Staking. Rewards for supporting the network by holding a certain amount of tokens locked in your wallet.

- Interest deposits in lending pools, such as Maker, Aave.

Promising Cryptocurrencies for Investment Over the Next 5 Years

The future of cryptocurrency can never be certain, so making predictions is difficult — especially considering periods of volatility after the coronavirus pandemic. However, the short history of digital currency tells us that there is a trend among cryptocurrencies that provide passive income in the long term. Mainly, these are projects that work on a physically existing product, solving some specific problem, or alleviating consumer pain (forgive the pun).

If we cannot provide a TOP 10 cryptocurrencies for investment, we can certainly give 4-5 ideas for your own analysis:

Binance Coin (BNB) - Internal Token of Binance Exchange

It is the internal token of the Binance exchange. Binance is among the leading crypto exchanges, and judging by its updates, it is focusing on the fiat market. Currently, Binance's asset list includes futures division, a decentralized exchange, and several exchanges for different markets. The BNB token is used for paying commissions, rewarding active traders, and various giveaways. We often conduct analytics on BNB in our Telegram channel and advocated for its growth when it was still worth $2. The coin reflects the actual state of affairs in the cryptocurrency exchange. It is sufficient to follow its news.

Bitcoin (BTC) - Main Asset

Although bitcoin does not serve as a surrogate for any working product, it is on the list of investment-attractive cryptocurrencies because it has become a separate currency in the market. Bitcoin is always represented in the face of all cryptocurrencies. Also, when trading cryptocurrencies, bitcoin is often used as a medium of exchange. As is known, the status of other altcoins still depends on its price. We recently wrote a detailed review of the cryptocurrency.

Tron (TRX) - Also Known as Torrent

Traded on all rated cryptocurrency exchanges. One of the largest promoters of cryptocurrency after the Tron project acquired Torrent in May 2018. You could say that all who have ever used torrent have involuntarily become clients of Tron.

Trust Wallet Token (TWT) - Cryptocurrency Wallet

Traded on decentralized Binance DEX. TWT is the internal token of the Trust Wallet project. TW is the most popular cryptocurrency wallet. So far, the token is only used for distributing votes among stakeholders for further development of the project. Keep an eye on it. Trust Wallet belongs to the cryptocurrency exchange Binance. However, it is not yet traded on it, and as soon as it is added, its price will increase significantly.

Uniswap (UNI) - Decentralized Exchange

The situation with cryptocurrency UNI is similar to BNB. UNI is the internal token of the Uniswap exchange. Many cryptocurrency exchanges have their own cryptocurrency, but Uniswap was one of the first to enter the decentralized market. Understanding the advantages better will help our review of Uniswap.

Investing in DeFi tokens should be done cautiously: at present, these are the highest-risk assets, trading them is the domain of professionals. If desired, one can invest a small amount of money in this type of instrument that would not be critical in case of a price drop.

Books on Investing in Crypto

What to read about trading and investing next year:

- Matthew Smith — Cryptocurrency Investor Handbook. The guide teaches everything you need to know about the TOP-5 cryptocurrencies on the market right now. It stands out for its down-to-earth perspective, as evidenced by numerous reviews.

- Stephen Satoshi — Day Trading: Absolute Beginners Guide to Trading Cryptocurrency including Bitcoin, Ethereum & Altcoins. A book about daily trading of bitcoin and altcoins and how to choose a cryptocurrency for investment.

- Alpha Bull Traders — Online Trading Masterclass: Complete Beginners Guide to Trading Stocks, Forex & Cryptocurrency with Swing, Position & Day Trading Guides + Investing Techniques from Great Investors. A book by professional traders that includes a wealth of useful information on ways to profit and hedge risks.

- Steve Good — BE LEFT BEHIND: Discover Bitcoin and Cryptocurrency Before Your Grandma Beats You to It. Key information about cryptocurrencies, their principles of operation, and investment nuances. Written in accessible language for readers of any skill level.

- Dave Raymond — Cryptocurrency Trading: A Beginner’s Guide to Learn How to Trade Bitcoin and Altcoins. Identify Top-Performing Cryptocurrencies and Understand Why You Need to Be Investing Digital Currencies. A book about cryptocurrency exchanges and tools, fundamental and technical analysis, safe storage, etc.

Reviews and Opinions of Experts

The latest research from Chainalysis confirms that at present, cryptocurrency is attractive to large long-term investors due to declining trust in traditional markets.

The CEO of analytical software provider MicroStrategy, Michael Saylor, ordered to invest over $250 million in BTC and does not plan to lock in profits yet, promising to hold bitcoins for 100 years. Today, this investment is already worth over $700 million. Thus, MicroStrategy set an example for other institutions, which they immediately followed.

Famous trader Paul Tudor Jones considers trading bitcoin futures as capital insurance against the existing policy of central banks printing money to combat the pandemic.

Thus, it can be concluded that at present, cryptocurrency is viewed more as a protective asset than as a tool for generating returns. And this makes its growth more sustainable.