$15B in Bitcoin Options Set to Expire Today

Bitcoin is currently priced at $107K, with $15B in options expiring today. A drop below $102K could create a 'pain point' for the market.

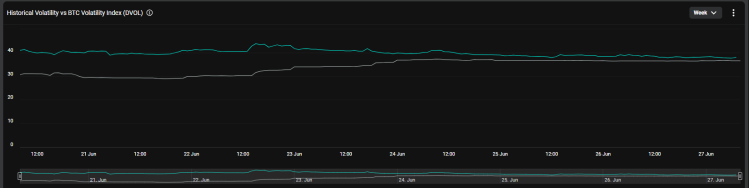

Narrowing Volatility Indicates Positive Outlook

The volatility index for Bitcoin has narrowed, suggesting traders expect minimal price fluctuations. Deribit’s CCO highlighted low open interest and depressed implied volatility as indicators of limited expectations for sharp movements.

Crypto treasury strategies continue to expand, with Metaplanet adding 1,234 $BTC, increasing total holdings above 12K $BTC.

ETFs Notch 13 Days Consecutive Inflows

Bitcoin ETFs have experienced positive inflows for 13 consecutive days, totaling:

- $350M

- $588M

- $547M

- $226M

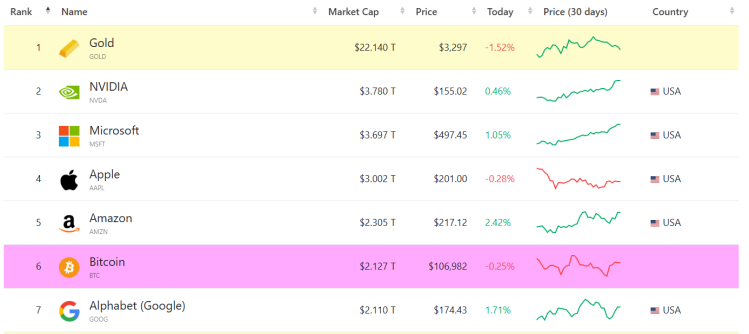

This trend indicates sustained long-term interest from investors. The largest Bitcoin ETF, BlackRock’s iShares Bitcoin Trust, now holds over $70B in assets, allowing Bitcoin to surpass Google as the sixth-largest asset globally.

BTC Bull Token ($BTCBULL)

The BTC Bull Token ($BTCBULL) aims to capitalize on Bitcoin's potential rise to $250K through milestones that include token burns and airdrops at various price points.

- Burn at $125K

- Airdrop at $150K

- Burn at $175K

- Airdrop at $200K

- Burn at $225K

- Airdrop at $250K

The presale has raised $7.5M, with three days remaining.

Conclusion

The expiration of $15B in Bitcoin options, narrowing volatility, and consistent ETF inflows contribute to a bullish outlook for Bitcoin.