$3.42 Billion in Bitcoin and Ethereum Options Expiry Signals Market Volatility

The cryptocurrency market is experiencing a significant moment as Bitcoin price #BTC reaches an all-time high of $99,502, with a market cap of $1.95 trillion. Today, $2.86 billion in Bitcoin options expire, suggesting potential volatility.

Bitcoin Options Expiry Data

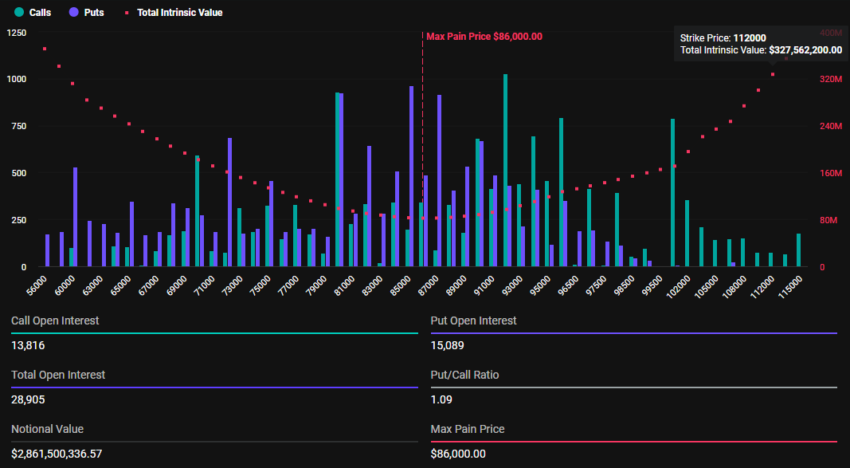

Data from Deribit indicates that 28,905 Bitcoin options contracts are expiring today, with a put-to-call ratio of 1.09 and a maximum pain point of $86,000. The put-to-call ratio above 1 suggests bearish sentiment despite recent growth driven by Bitcoin whales and long-term holders.

-

Courtesy: Deribit

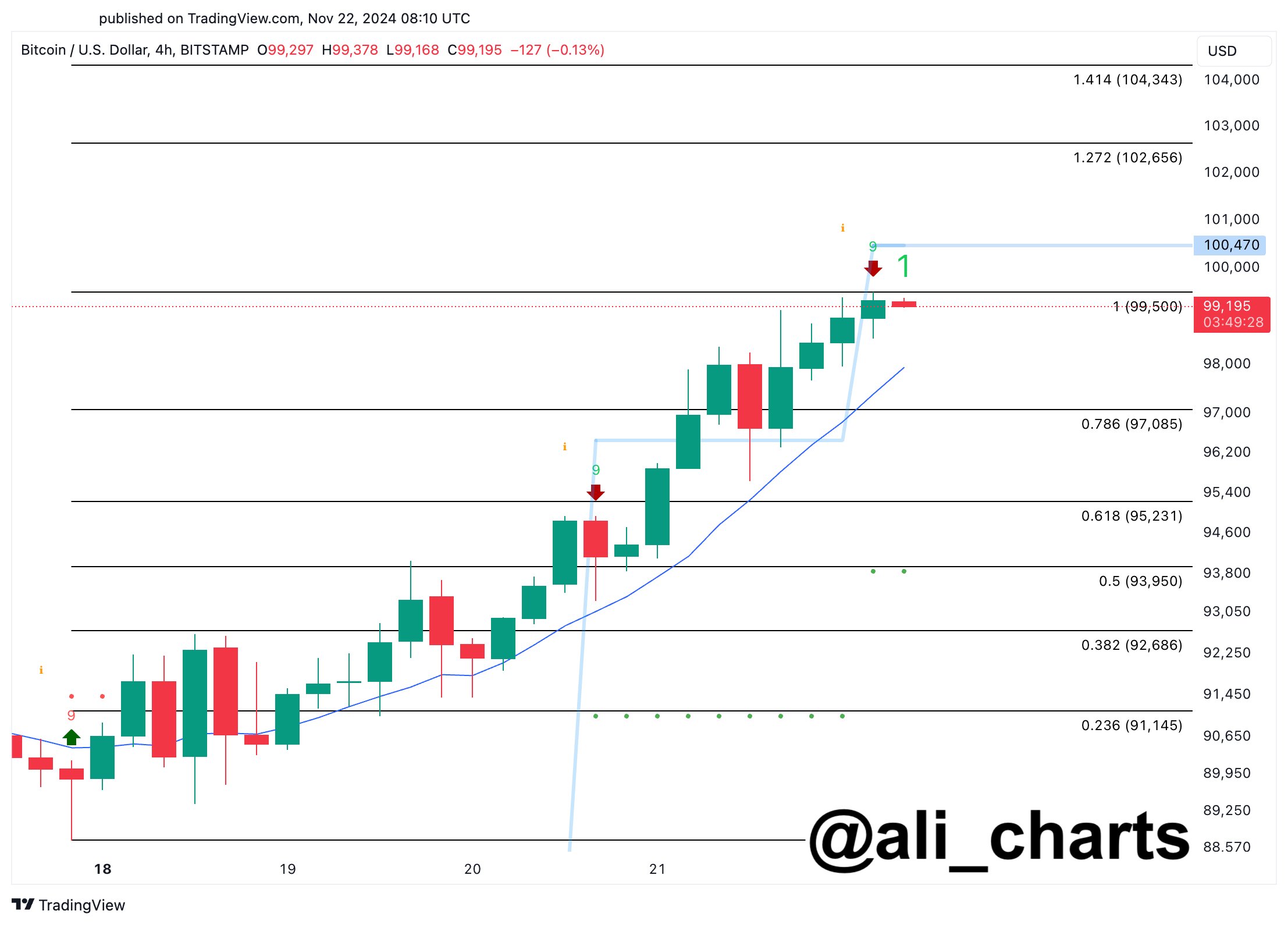

While expectations for Bitcoin to break the $100,000 mark are high, a brief correction may occur. Analyst Ali Martinez notes that the TD Sequential indicator shows a sell signal on Bitcoin's 4-hour chart, indicating a potential drop to $97,085.

-

Courtesy: Ali Charts

If Bitcoin closes above $100,470, it could invalidate the bearish pattern, leading to targets of $102,656 or $104,343, according to Martinez.

Ethereum Options Expiry and Predictions

Today, 164,687 Ethereum options contracts are set to expire, with a put-to-call ratio of 0.66 and a maximum pain point of $3,050. This lower ratio indicates a bullish sentiment in the ETH market.

Currently, Ethereum is trading at $3,389. Analysts at Greeks.live suggest that Ethereum #ETH could maintain upward momentum due to its bullish put-to-call ratio, while Bitcoin faces potential corrections. They noted:

“With about 8% of positions expiring this week, the big rally in Ethereum has led to a significant increase in ETH major term options implied volatility, while BTC major term options implied volatility has remained relatively stable. Market sentiment remains extremely optimistic.”

Despite Bitcoin's risk of correction, analysts believe the broader market rally may mitigate significant pullbacks, supported by substantial capital inflows into ETFs, especially BlackRock's newly launched IBIT options, which reported $5 billion in trading volumes yesterday. Spot Bitcoin ETF inflows exceeded $1 billion, with IBIT contributing over $600 million.