6 0

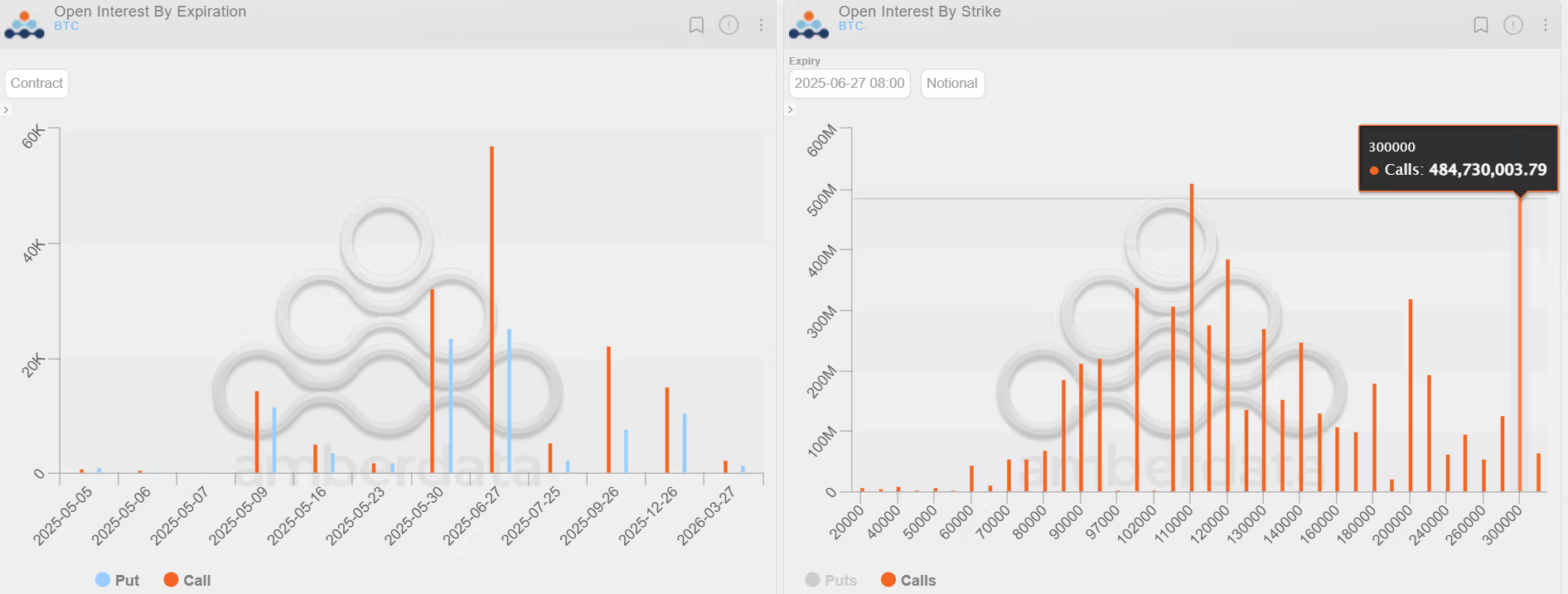

$300K Bitcoin Call Option Becomes Second-Most Popular Bet for June Expiry

In the crypto market, significant option plays are emerging, notably the $300,000 strike bitcoin call option expiring on June 26. Key details include:

- This call option bets on BTC's price tripling to over $300,000 by mid-year.

- Over 5,000 contracts are active, with a notional open interest of $484 million, making it the second-most popular option for the June expiry after the $110,000 call.

- Deribit, accounting for over 75% of global crypto options activity, lists these contracts, where one contract represents 1 BTC.

- These deep out-of-the-money (OTM) calls are cheaper and require large price movements to become profitable, drawing comparisons to lottery tickets.

- The June 26 expiry is the largest settlement due this year, indicating increased market activity and volatility.

- Recent statements from Senator Cynthia Lummis highlight pro-crypto sentiments in U.S. policy discussions, further influencing market dynamics.

- Notable selling in the $300K calls occurred in April as part of a covered call strategy, generating income against long positions.