7 0

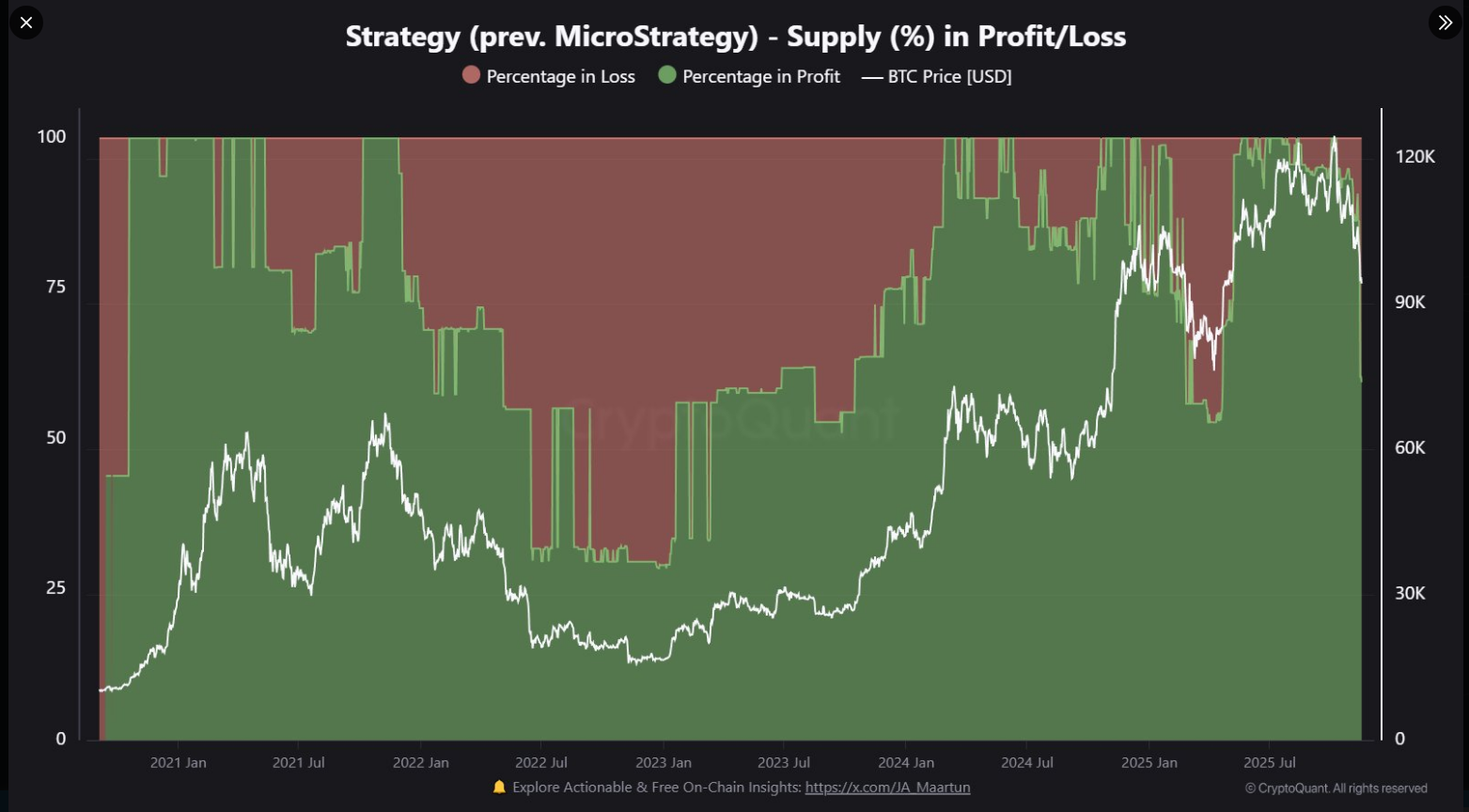

40% of Strategy’s Bitcoin Holdings Show Unrealized Losses

Bitcoin Price Movement

- Bitcoin experienced a sharp decline, dropping nearly 15% over the past week to around $90,300.

Strategy’s Bitcoin Purchases

- Strategy, led by Michael Saylor, bought 8,178 BTC for $835.6 million at an average price of $102,171 per coin.

- With this purchase, Strategy now holds 649,870 BTC, approximately 3.2% of the circulating supply.

- The total cost of their holdings is about $48 billion, with the market value currently estimated at $59.38 billion, marking a paper gain of 22% or $11 billion.

Current Position and Market Impact

- CryptoQuant reports that roughly 40% of Strategy's holdings are showing unrealized losses due to recent purchases.

- The latest 8,178 BTC purchase is down about 10.5%, translating to an $88 million paper loss.

- Total November purchases amounted to 9,062 BTC for $931.1 million, now valued at about $827 million, an 11% decrease.

Long-Term vs Short-Term Outlook

- Despite short-term losses, Strategy maintains a long-term positive outlook with a 22% profit ratio.

- Previously, Strategy faced up to 75% of their holdings in losses between mid-2022 and early 2023.

Criticism and Opinions

- Peter Schiff criticized Strategy’s rising average cost per BTC, suggesting it could limit future gains if prices do not rebound.

- Schiff labeled Strategy's Bitcoin focus as "a fraud" and challenged Saylor to a debate at Binance Blockchain Week.

Investor Takeaway

- Even major holders can face inventory losses during market downturns.

- While new purchases impacted short-term returns, Strategy still retains substantial paper profits.

- Future gains depend on Bitcoin price movements.