54% of Bitcoin Supply Inactive for Over Two Years Amid Price Surge

On-chain data indicates that a majority of the Bitcoin supply has remained inactive for over two years, even as BTC experienced significant price increases during this time.

Bitcoin Inactive Supply Trend Suggests Strong HODLing Behavior

Rafael, co-founder of Glassnode, discussed Bitcoin's Active Supply trends in a recent post. The "Active Supply" refers to the portion of circulating BTC that has been involved in at least one transaction within a specific timeframe.

The following chart illustrates changes in Bitcoin's Active Supply across various age bands over the past few years:

The graph shows growth in younger age bands (1 month to 3 months and 3 months to 6 months), indicating recent transactions due to price surges. Conversely, older bands show relatively stable activity. Together, these Active Supply bands comprise 46% of the total supply, suggesting that less than half of Bitcoin's circulating supply has moved in the past two years.

The two-year benchmark dates back to November 2022, coinciding with the last Bitcoin bear market's lowest point. This trend implies that investors who acquired BTC during or before this period have predominantly chosen to HODL.

Despite a more than 500% increase in value since then, the Glassnode co-founder notes that "HODLing isn't just a meme." Statistically, longer holding periods correlate with decreased selling activity, suggesting that the 54% of supply remaining stagnant for over two years may continue to hold their positions.

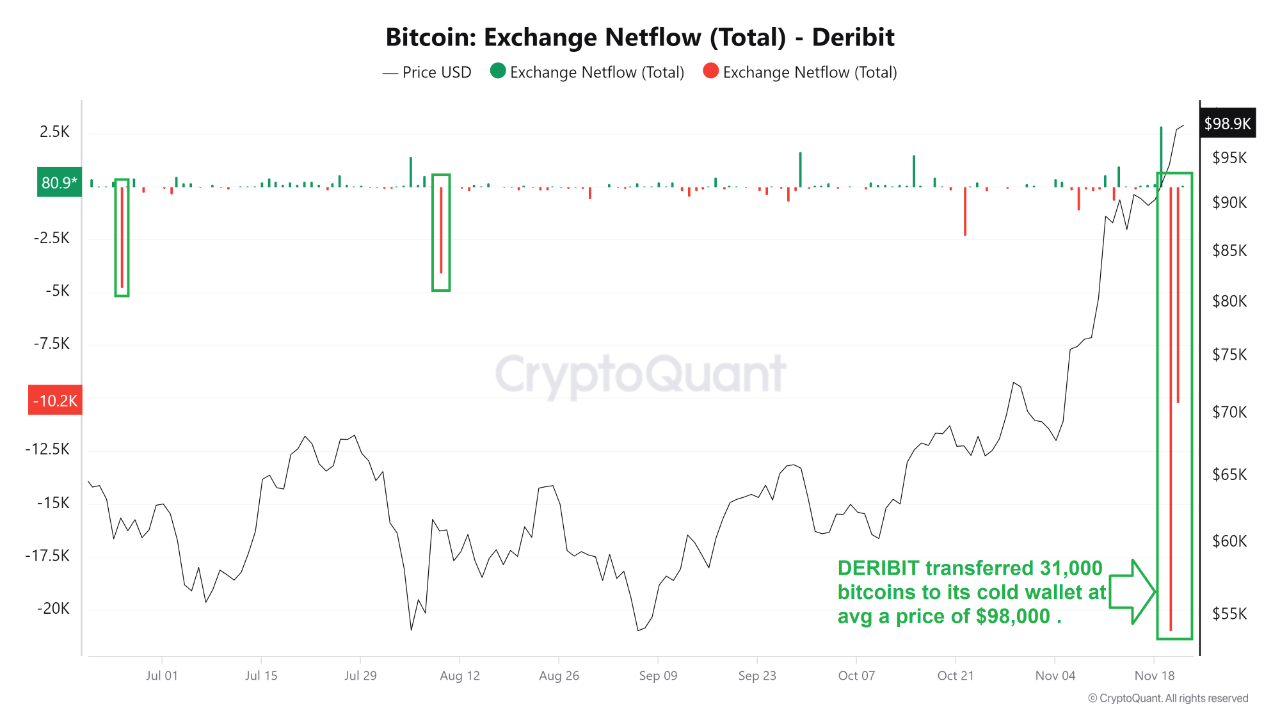

Additionally, the Deribit exchange reported substantial Bitcoin outflows recently, as noted in a CryptoQuant Quicktake post.

A net total of 31,000 BTC was transferred to self-custodial wallets, likely for accumulation purposes, which can indicate bullish sentiment for the asset's price.

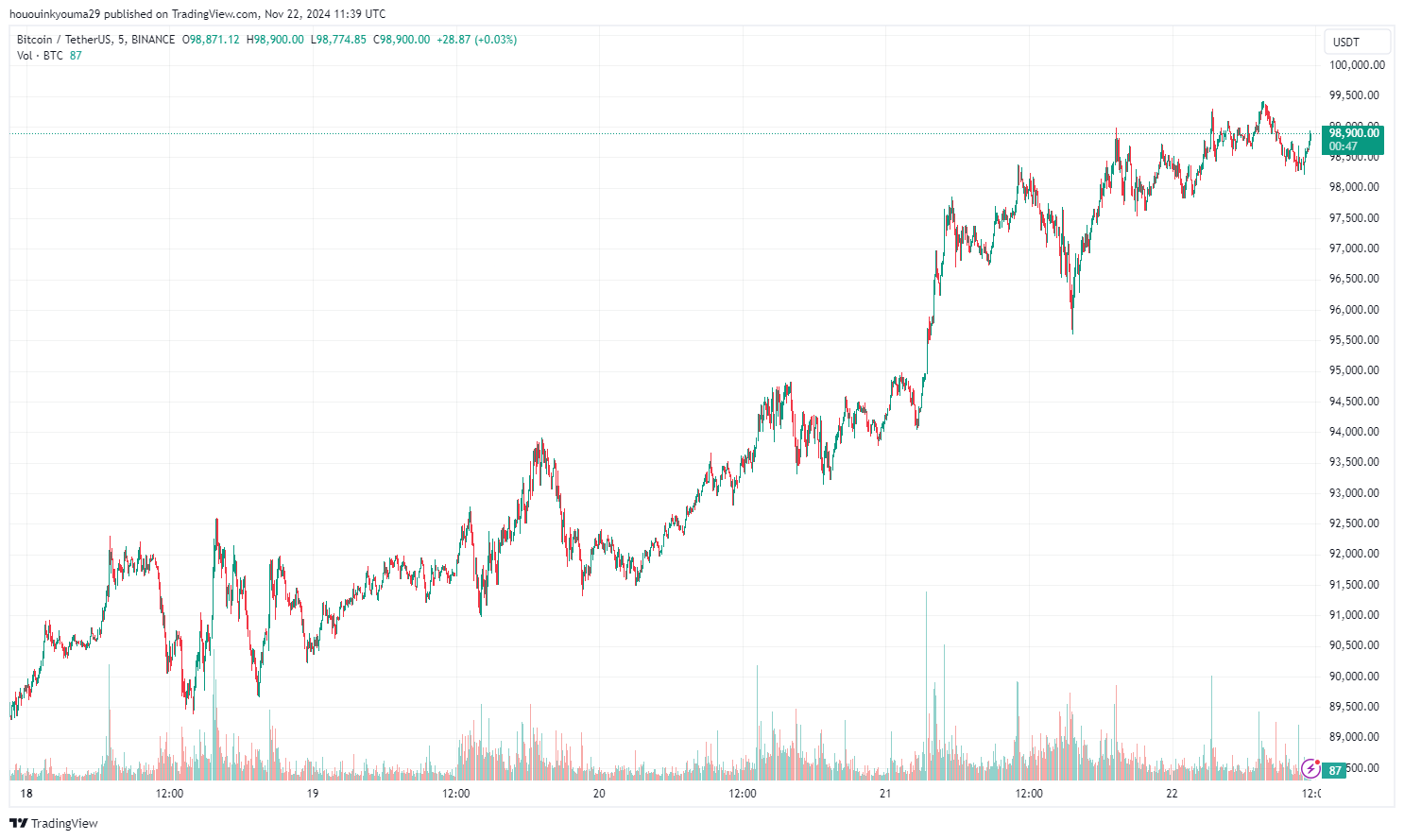

BTC Price

Bitcoin is approaching the $100,000 target, currently trading around $98,900.