7 0

63K Bitcoin Moves from Long-Term Holders to Short-Term Buyers

Bitcoin is experiencing significant selling pressure, trading below $90,000, with fears of a new bear market emerging. Analysts point to a potential peak in early October around $126,000, leading to a shift towards risk-off positions among investors.

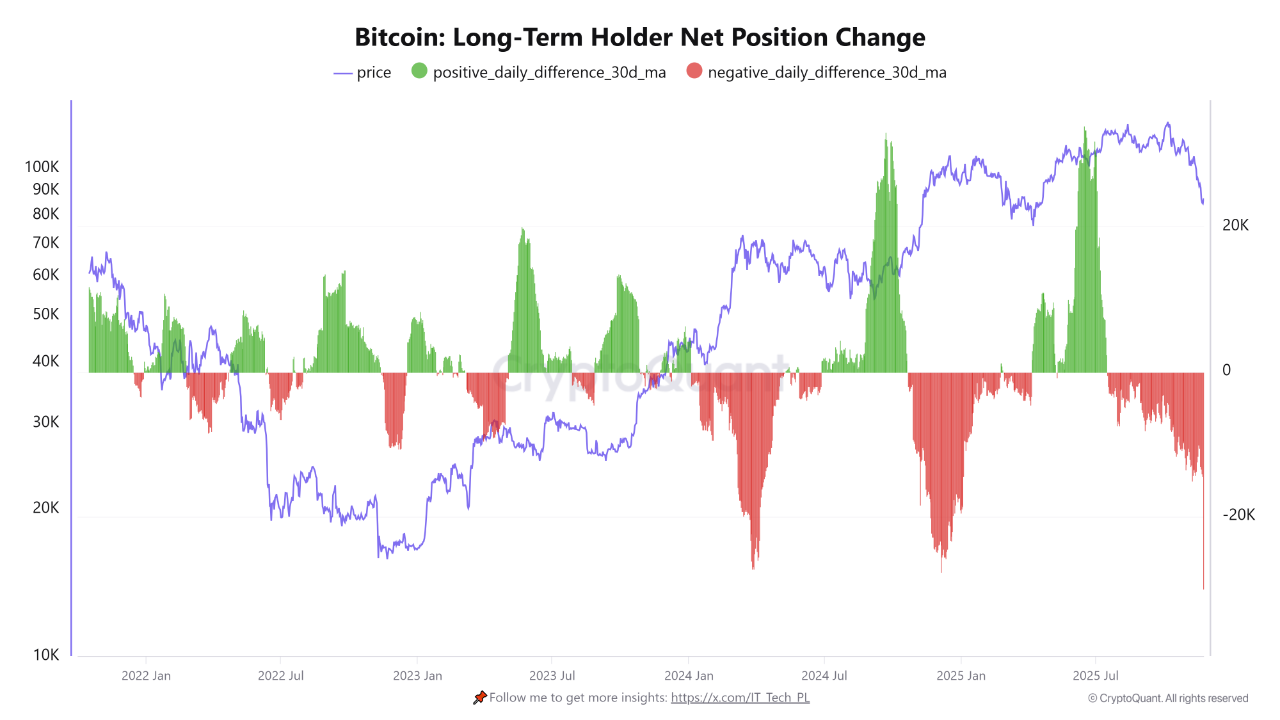

- A CryptoOnchain report highlights a historic movement of 63,000 BTC from long-term holders (LTHs) to short-term holders (STHs), indicating heavy outflows from LTH wallets.

- This pattern suggests late-stage bull market behavior, where LTHs take profits and STHs buy at elevated prices.

- The current dynamic shows LTHs distributing Bitcoin while STHs accumulate, a common occurrence in late bull markets but raises risks if demand doesn't absorb supply.

Technical Analysis

- Bitcoin aims to stabilize around $87,000 after a sell-off hit $85,946. It now tests the 100-week moving average, a key support during past retracements.

- The breakdown from the $110K–$100K zone increased selling pressure, with high-volume distribution dominating recent weeks.

- Maintaining above $83K–$86K is crucial for the bull structure; a fall below could lead to further declines toward $56K–$60K.

Overall, Bitcoin's current market behavior reflects uncertainties with both potential risks and opportunities as it navigates this critical phase.