4 0

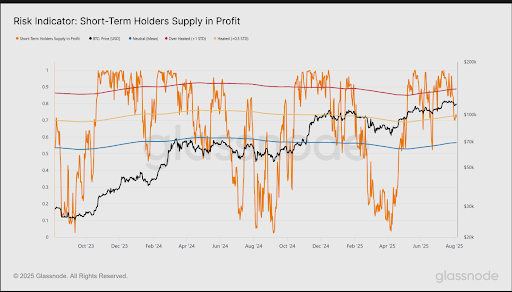

70% of Bitcoin Short-Term Holders Are Currently in Profit

Onchain analytics platform Glassnode reports that 70% of Bitcoin short-term holders are currently in profit. This situation raises the potential for a sell-off during periods of sideways price action.

Key Points

- 70% of Bitcoin short-term holders' supply is profitable despite recent price declines.

- A deeper correction may lead to increased losses among these holders, affecting their confidence.

- The current sell pressure from short-term holders is low, with only 45% of spent coins taking profits.

- Bitcoin ETFs recorded a net outflow of 1,500 BTC on August 5, contributing to sell-side pressure.

- Monitoring ETF flows is important to determine shifts in investor sentiment.

- Bitcoin price needs to break above $116,900 to gain momentum; failure to do so could increase the risk of a drop toward $110,000.

- As of now, Bitcoin is trading around $116,800, reflecting a 2% increase in the last 24 hours.