9 1

Abu Dhabi Investment Council Triples Bitcoin ETF Stake to $518M

The Abu Dhabi Investment Council (ADIC) has significantly increased its exposure to the Bitcoin market by tripling its position in BlackRock's iShares Bitcoin Trust ETF during Q3 2025. ADIC increased its stake from 2.4 million shares to 8 million shares, valued at approximately $518 million as of September 30.

- ADIC's investment occurred just before Bitcoin's value dropped by around 20% since the end of September.

- The ETF, IBIT, saw a 6.2% gain in Q3 but later losses have erased these gains.

- Abu Dhabi considers Bitcoin a long-term store of value akin to gold and plans to maintain this strategy.

The initial purchase was made in February 2025 for $436.9 million in the same ETF.

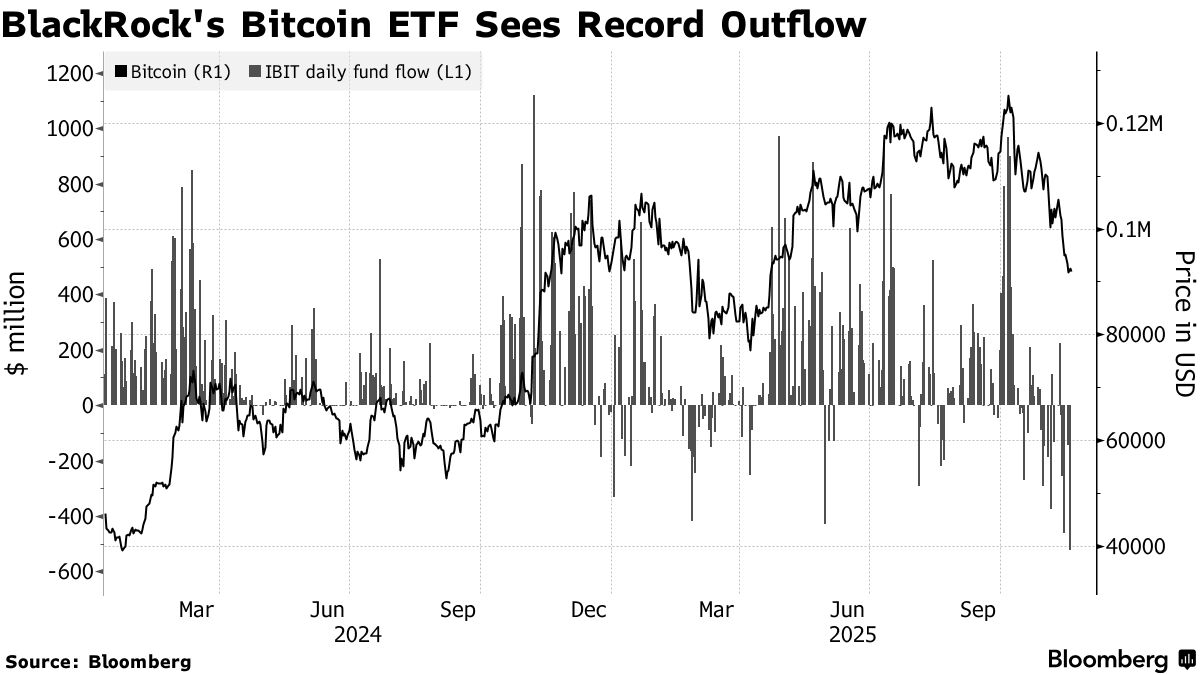

Market Outflows Increase

- ADIC's move happened alongside growing institutional interest in US-listed spot Bitcoin ETFs.

- Significant withdrawals have been noted: $3.1 billion left US Bitcoin ETFs in November, with IBIT alone seeing a $523 million outflow in one day.

Abu Dhabi is emerging as a crypto finance hub, with sovereign wealth funds managing over $1.7 trillion, investing in digital assets. This aligns with broader trends of financial institutions adopting regulated crypto products and licensing global companies like Bybit, Circle, and Tether in the UAE.

Sector Volatility and Strategy

- The timing of ADIC's investment, just before a market downturn, has attracted scrutiny.

- The Council remains confident in Bitcoin's long-term potential despite recent volatility.