Alpha-Generating Strategies Transform Digital Asset Investment Landscape

Discussions around digital assets are evolving from price performance of bitcoin and ether to the pursuit of alpha, or returns exceeding market averages. The introduction of bitcoin ETFs and ETPs has attracted over $100 billion in institutional investment, making beta exposure more accessible.

The role of uncorrelated returns in diversification

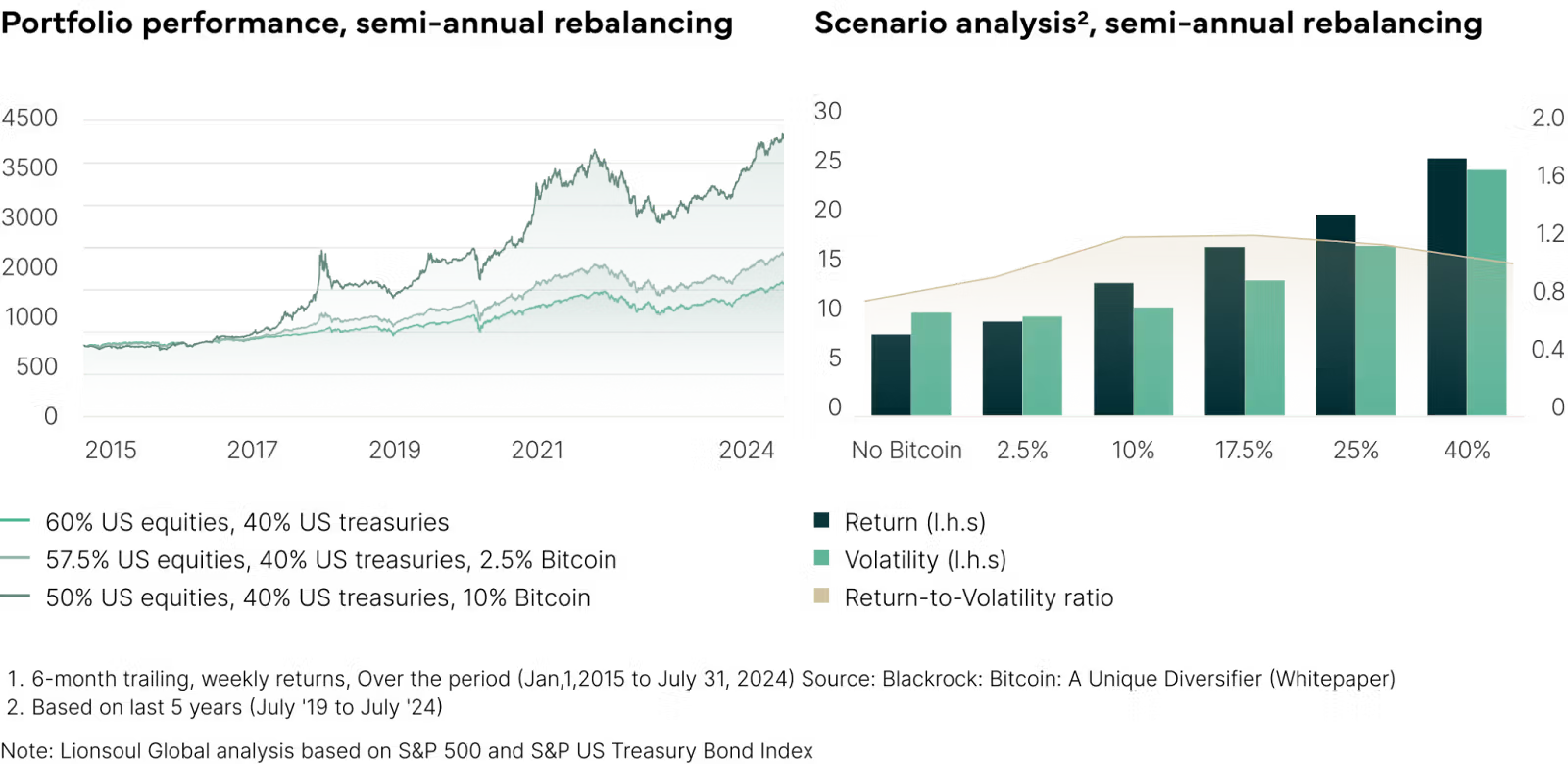

Digital assets provide low correlation with traditional investments, enhancing portfolio diversification. Key points include:

- Bitcoin's correlation to the Russell 1000 Index stands at 0.231.

- A 5% allocation to bitcoin in a 60/40 portfolio increases the Sharpe ratio from 1.03 to 1.43.

- Intra-asset diversification within crypto is supported by varying correlations.

Digital assets enter the active era

Active management is becoming significant in digital assets, mirroring trends in traditional finance where it represents over 60% of global assets. Digital markets still exhibit inefficiencies, creating opportunities for alpha generation through:

- Arbitrage strategies leveraging spreads between spot and futures prices.

- Market-making strategies that capture bid/ask spread profits.

- Yield farming using DeFi platforms for liquidity provision and trading fee earnings.

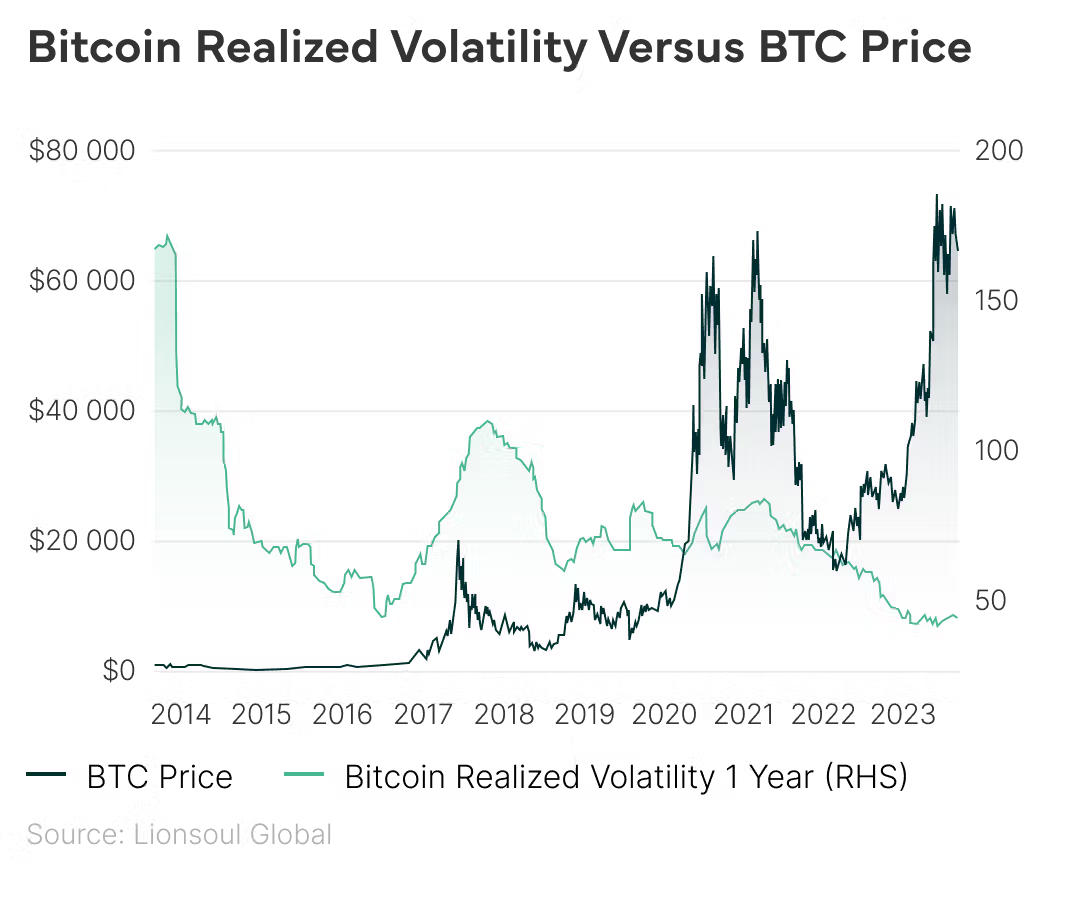

- Volatility arbitrage targeting discrepancies in options market volatility.

High upside and an expanding universe

New opportunities are emerging, including:

- Tokenized real-world assets projected to exceed $10.9 trillion by 2030.

- DeFi protocols expected to surpass $500 billion in value by 2027.

This growth indicates a developing ecosystem for investors seeking alpha-generating potential.