5 1

Crypto Analyst Predicts 2021-Style Breakout for Altcoins Following Chart Patterns

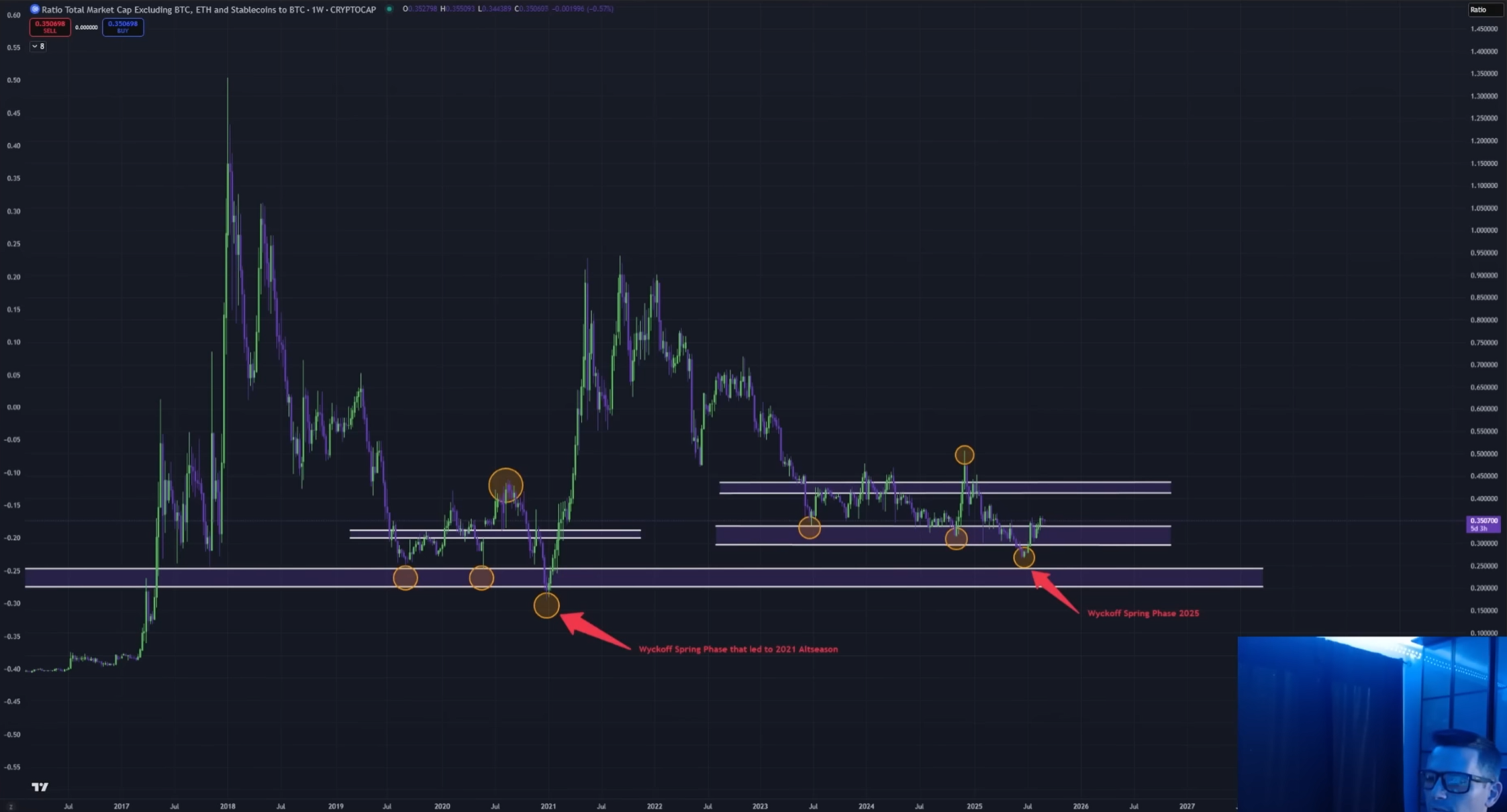

Crypto analyst Kevin (Kev Capital TA) indicates that altcoins are showing a structural pattern similar to the 2021 “altseason,” focusing on the Total3/BTC ratio, which excludes Ethereum and stablecoins. He highlights confluence in weekly and monthly timeframes, suggesting a Wyckoff-style bottoming process is underway.

Altcoins Set for Significant Movement

- Kevin identifies a historical setup where Total3/BTC has retraced into an accumulation range after a capitulation flush.

- He emphasizes the need for favorable macroeconomic conditions: lower or stable inflation, a soft labor market, and moderated growth.

- Critical macro data is expected in the coming weeks, with the FOMC meeting on September 17.

- Indicators show symmetry with the 2021 surge; Market Cipher shows a fresh weekly buy signal.

- Whale money flow and MACD indicators have crossed at levels similar to those before the last significant rise.

- The monthly momentum waves indicate a bullish divergence at major support levels.

Kevin notes a double-bottom pattern in the monthly L-MACD read, paralleling previous cycles’ bottoming formations. He suggests that if this pattern holds, the altcoin market may gain dominance over Bitcoin more rapidly than seen in prior cycles.

Potential for a Major Altcoin Surge

- Momentum signals are transitioning positively across different timeframes.

- Unprecedented alignment observed between linear weekly and log monthly charts.

- Kevin's analysis includes earlier Ethereum predictions, noting recent all-time highs for ETH and suggesting a strong foundation for upcoming altcoin movements.

- He cautions that September is typically weak, with stronger movement likely dependent on macroeconomic confirmation in Q4.

Total3 currently stands at $1.04 trillion.