11 1

Amundi to Launch Bitcoin ETNs in 2026 Amid Crypto Demand

Amundi, managing €2.3 trillion in assets, is set to enter the crypto ETF market by launching Bitcoin Exchange-Traded Notes (ETNs). This marks a strategic move to offer inflation resilience and portfolio diversification through crypto-linked investment products.

- Amundi plans to introduce Bitcoin ETNs in early 2026, capitalizing on Europe's evolving regulatory landscape under the Markets in Crypto-Assets Regulation (MiCA).

- The move follows BlackRock's lead in the US, where spot Bitcoin and Ethereum ETFs began trading in 2024.

- Amundi's entry may enhance Bitcoin's legitimacy among European institutional investors, rivaling Wall Street's influence.

- BlackRock's iShares Bitcoin Trust currently holds over 4% of Bitcoin's circulating supply.

The emergence of Amundi's Bitcoin ETNs could significantly impact the global crypto secondary market, providing institutional investors with more compliant exposure to cryptocurrencies.

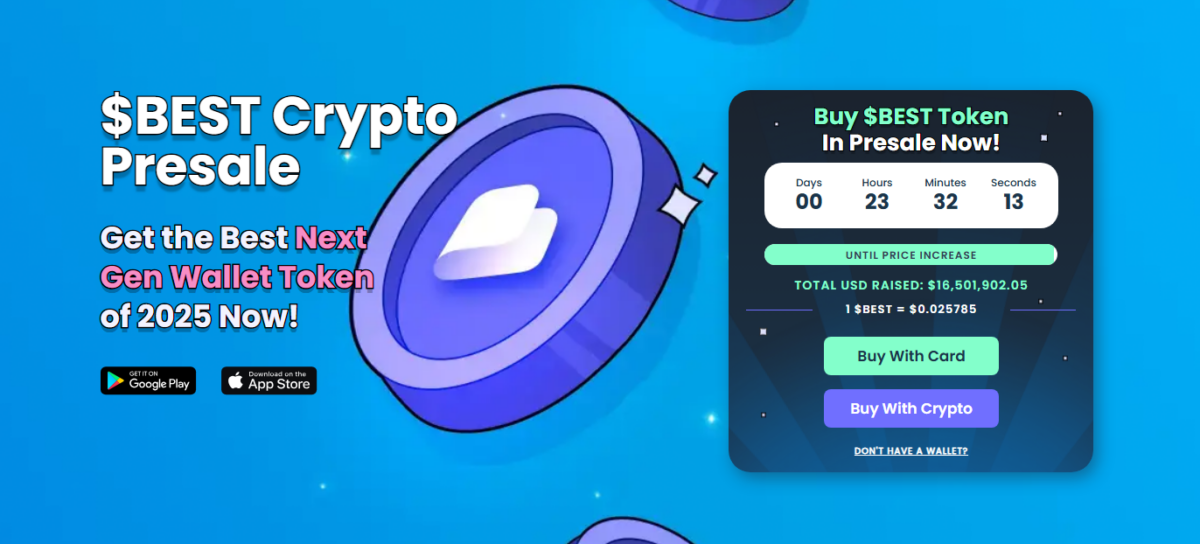

Meanwhile, Best Wallet's presale has reached $16.5 million, signaling renewed investor interest as Amundi prepares for its ETN launch.