13 0

Analyst Predicts Bitcoin Bear Market, Expects 50% Drop to $61,000

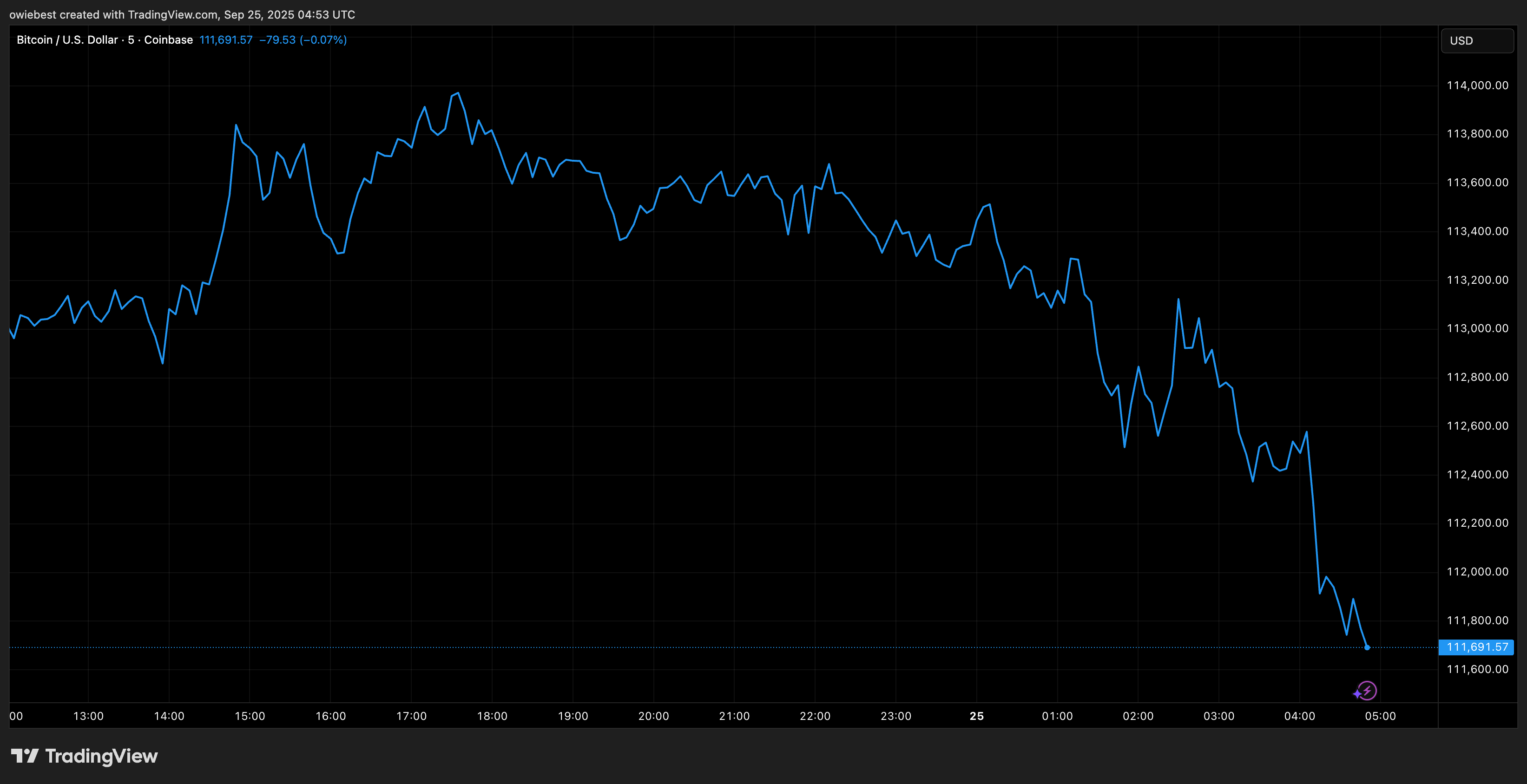

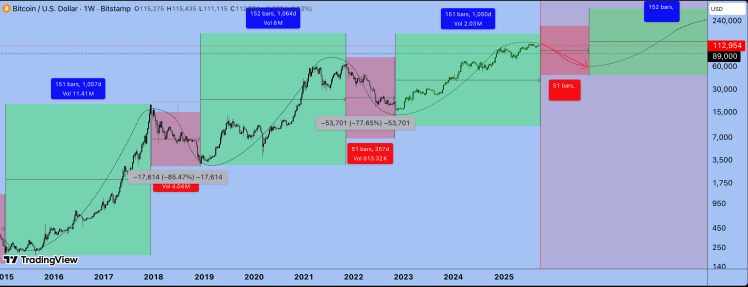

The Bitcoin price, after reaching an all-time high of $124,000 in July, is now experiencing consolidation. Analyst EXCAVO suggests this could indicate the start of a bear market.

Indicators of a Bear Market

- Universal Optimism: Many investors remain bullish, with governments accepting crypto and creating reserve funds.

- Corporate Accumulation: Companies like Strategy have accumulated substantial reserves of Bitcoin and Ethereum.

- Dominant Positive News: The prevalence of positive news in media and investor expectations for higher prices signal a market top.

Exit Strategy

- EXCAVO has sold their holdings, planning to re-enter the market in September 2026, predicting Bitcoin will drop below $61,000.

- The cycle theory suggests 151 weeks of growth followed by 51 weeks of decline, aligning with a reversal zone starting in mid-September to early October.

The analyst also argues against a widespread altcoin season due to the large number of cryptocurrencies. Instead, selective altcoin pumps are expected.

EXCAVO remains optimistic long-term, predicting Bitcoin could reach $300,000 in 2.5 years following a significant correction.