5 0

BULLISH 📈 : Analyst predicts Bitcoin recovery could take 12 months or more

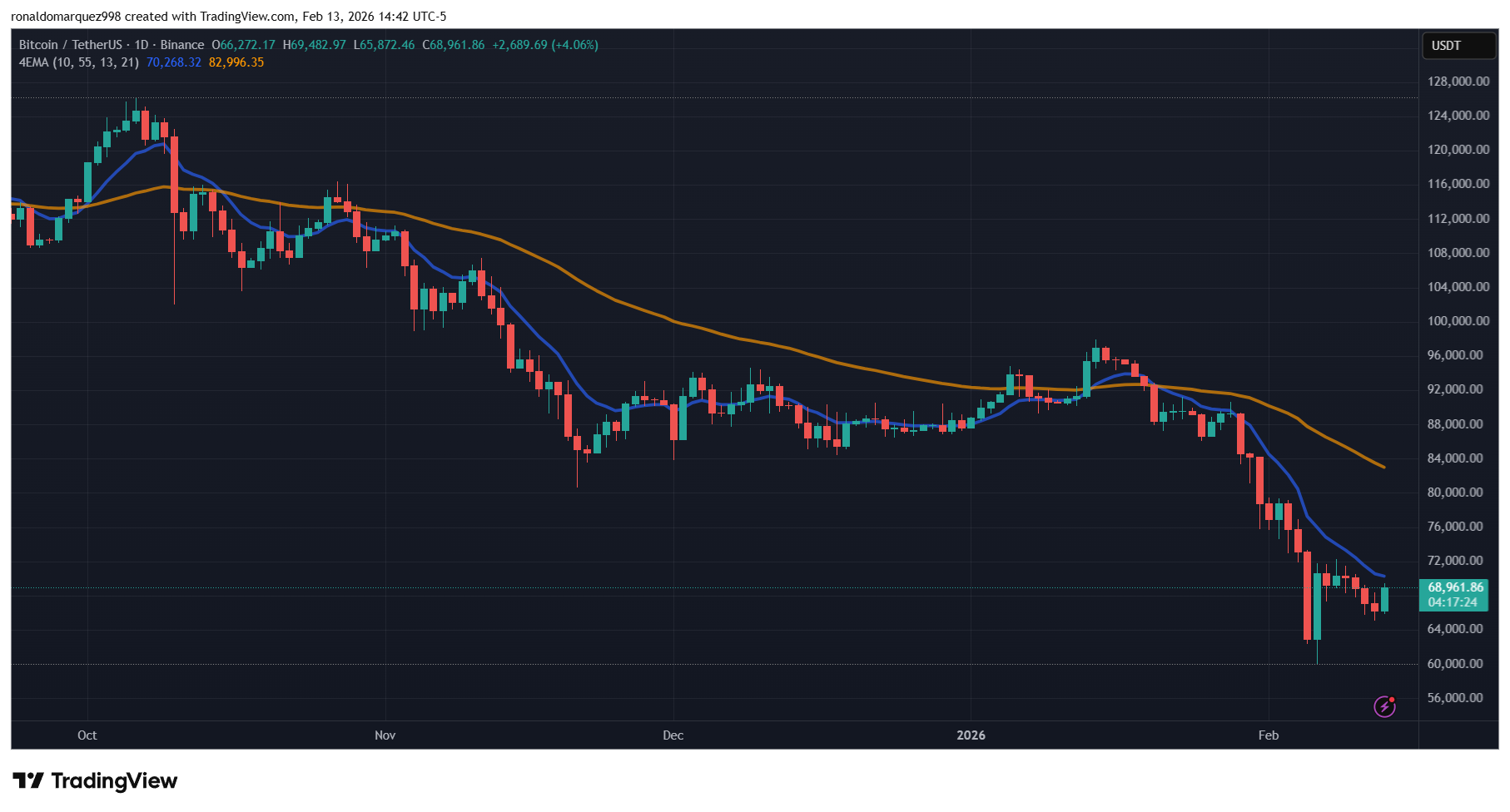

Bitcoin (BTC) is trading at roughly 50% below its all-time high. Market analyst Sam Daodu analyzes historical patterns to predict recovery timelines.

Key Observations

- Bitcoin has faced over 20 pullbacks exceeding 40% since 2011. Mid-cycle declines of 35% to 50% have not typically derailed long-term trends.

- In scenarios without systemic market collapses, Bitcoin usually recovers prior highs in about 14 months.

- The current environment contrasts with 2022's structural failures; no comparable system-wide collapse is currently observed.

- BTC's realized price near $55,000 could act as a psychological and technical support level.

- Global liquidity conditions and investor sentiment are critical for determining the duration of the current downturn.

Historical Selloffs

- During the 2021-2022 cycle, Bitcoin fell 77% from $69,000 to $15,500, taking 28 months to surpass previous highs.

- The 2020 COVID-19 crash saw a 58% drop, but Bitcoin rebounded within six weeks and reached its 2017 high by December 2020.

- In 2018, Bitcoin dropped 84% from $20,000 to $3,200, requiring nearly three years to revisit prior peaks due to ICO implosion and regulatory actions.

Current Outlook

- Drawdowns in the 40%-50% range typically reverse in about nine to 14 months, while those over 80% take three years or more.

- Bitcoin's current decline is moderate-to-severe but not indicative of full capitulation.

- A return to previous highs may take 12 months or more, depending on macroeconomic factors.

At the time of writing, BTC trades at $68,960, up 5%, attempting to break short-term resistance at $70,000.