0 0

Analyst Predicts Positive Crypto Trends Amid Israel-Iran Conflict

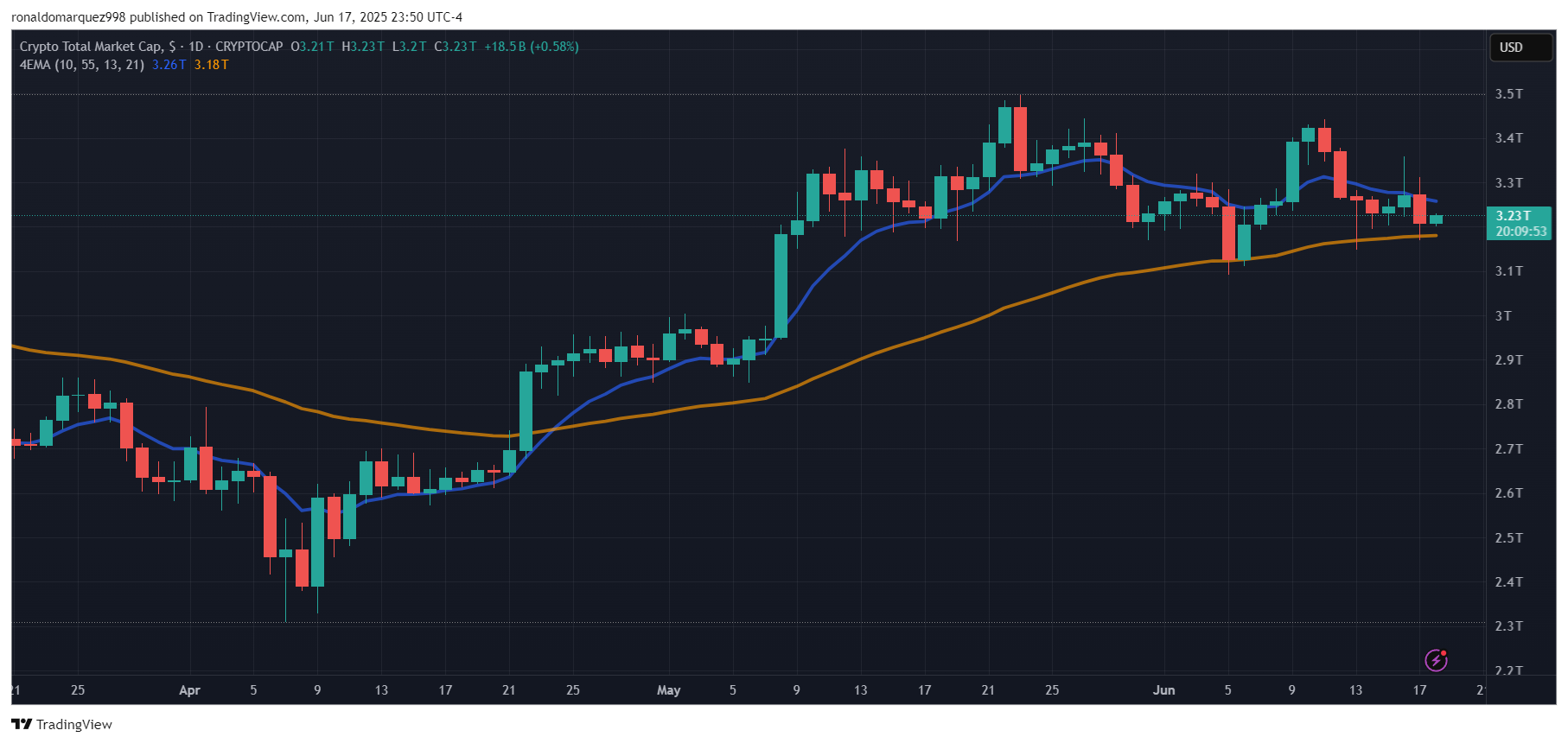

Crypto analyst Cyclop indicates that the Israel-Iran crisis may enhance digital asset performance. Despite recent volatility leading to a $140 billion sell-off, Cyclop's long-term view remains optimistic.

Predicted Trends for Crypto Amid Geopolitical Conflicts

- Geopolitical tensions historically correlate with bullish trends in cryptocurrencies.

- Cyclop cites past instances where Bitcoin dropped during conflicts but rebounded significantly afterward.

- Short-term bearish movements due to conflicts can lead to long-term growth.

- Investors often turn to crypto as a hedge against inflation and instability during wars.

- Cryptocurrencies are increasingly viewed as "digital gold," offering safety during geopolitical unrest.

Positive Macroeconomic Factors

- Current market dynamics resemble those seen during the Russia-Ukraine conflict.

- The US-China compromise on tariffs is expected to stabilize supply chains and reduce inflation, enhancing investor confidence.

- President Trump's delay of new tariffs contributes to a more favorable risk environment for crypto.

- The latest Consumer Price Index report shows a modest increase, with year-over-year inflation at 2.4%.

- Anticipated interest rate cuts by the Federal Reserve could boost liquidity in crypto markets.

Historical data suggests cryptocurrencies may thrive despite immediate challenges from conflicts like the current Israel-Iran situation.