2 0

Analyst Predicts Potential Collapse of Strategy Exceeding FTX Fallout

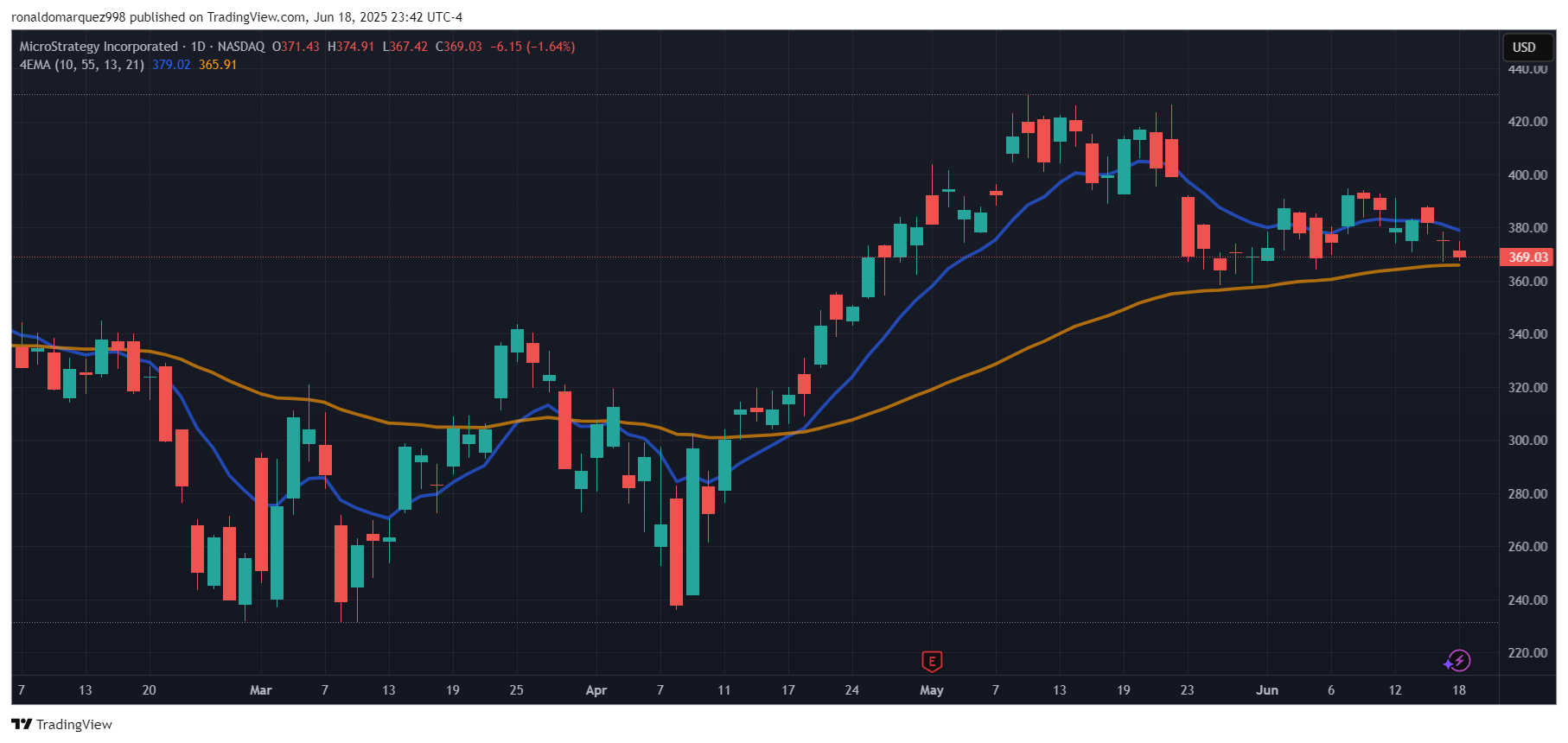

On-chain analyst OxChain has raised concerns about the potential collapse of Strategy, formerly MicroStrategy, co-founded by Michael Saylor. He suggests that this downfall could exceed the FTX collapse.

Concerns About Strategy’s Operations

- OxChain claims Strategy's aggressive Bitcoin accumulation resembles a Ponzi scheme.

- The company holds approximately 582,000 BTC, valued at nearly $61 billion.

- This valuation relies on leverage, debt, and shareholder dilution rather than true confidence in Bitcoin.

- Strategy raises funds via shares or bonds, buys Bitcoin, inflates stock prices, then raises more capital.

- A new $1 billion share sale may increase risk exposure for Strategy.

Liquidation Risks Highlighted

- Strategy's average cost per Bitcoin is around $70,000, creating vulnerability if prices drop significantly.

- The company's treasury could face losses if Bitcoin's price falls below this threshold.

- In Q1 2025, Strategy reported $5.9 billion in unrealized Bitcoin losses due to new accounting standards.

- This transparency has led to a class action lawsuit from shareholders regarding concealed risks associated with Bitcoin's volatility.

Market Implications

- OxChain notes that Strategy's relevance as a Bitcoin access point is declining amid institutional interest in more regulated options like BlackRock's iShares Bitcoin Trust.

- Should Strategy fail, it could trigger significant market disturbances, given it holds about 2.77% of Bitcoin's total supply.

- A 22% decline in Bitcoin's price from its average buy price could initiate one of the largest liquidation events in history.

- OxChain describes Strategy as a risk vector reliant on leverage and market sentiment.