Arthur Hayes Declares Bitcoin’s Four-Year Cycle Over, Boosts Bitcoin Hyper

Key Points:

- Arthur Hayes declares the end of Bitcoin's traditional four-year cycle.

- Federal Reserve rate cuts and global liquidity expansion create favorable conditions for Bitcoin.

- Bitcoin Hyper ($HYPER) presale surpasses $22.9M, aligning with the new market dynamics.

Arthur Hayes, former BitMEX CEO, suggests in his Substack post, Long Live the King, that Bitcoin's cyclical behavior is undergoing a fundamental shift due to macroeconomic changes.

The Federal Reserve's monetary easing and China's policy shifts enhance Bitcoin's growth potential.

Hayes argues that institutional investments with solid risk-management strategies could alter Bitcoin's historic volatility patterns.

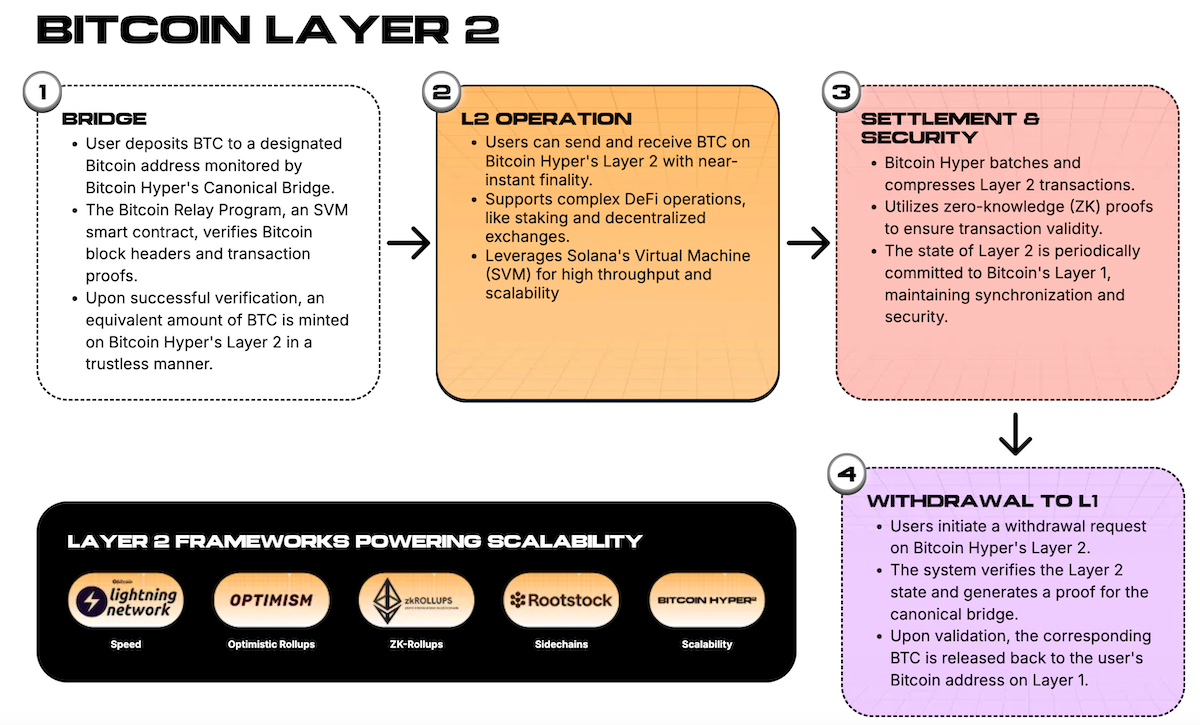

Bitcoin Hyper positions itself as a Layer-2 solution, integrating Solana's speed with Bitcoin's security.

The project aims to facilitate high-speed transactions while maintaining decentralization through a Canonical Bridge connecting Bitcoin's main chain with its L2 infrastructure.

Bitcoin Hyper's tokenomics focus on sustainability, supporting staking rewards and ecosystem development.

The presale success of $HYPER, reaching over $22.9M, indicates strong investor interest in this evolving landscape.

Investors are increasingly attentive to these structural changes, as evidenced by significant investments in $HYPER.