0 0

Arthur Hayes predicts dollar liquidity surge will boost Bitcoin in 2026

- Arthur Hayes links Bitcoin's weak 2025 performance to reduced dollar liquidity, with Bitcoin falling 14.4% while gold rose 44.4%.

- US tech stocks outperformed due to state-backed capital flows instead of free-market demand.

- Hayes suggests Bitcoin's price is tied to fiat debasement; it drops when liquidity contracts and rises with liquidity expansion.

- He anticipates increased dollar liquidity in 2026 from Federal Reserve balance sheet growth, easing mortgage conditions, and more bank lending to strategic sectors.

- Credit expansion through military production could boost Bitcoin, potentially reaching $100,000 or higher by 2026.

Bitcoin Price and Market Trends

- Bitcoin currently trades near $96,200, up 11.5% in the past month, breaking a resistance at $94,200 and hitting $97,600.

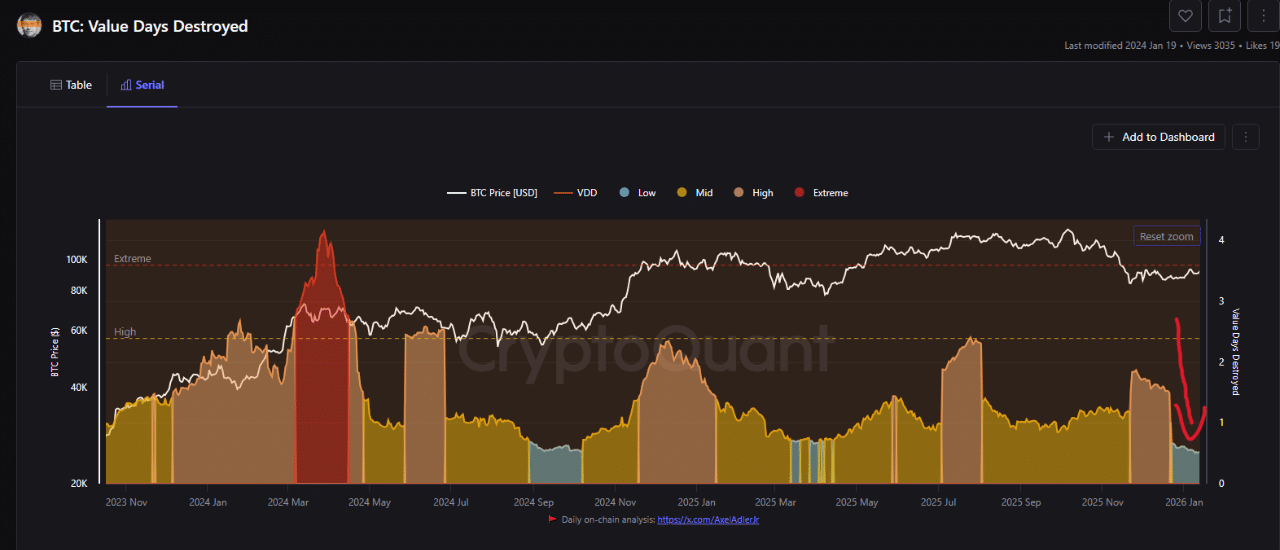

- On-chain data shows the Value Days Destroyed indicator at a low 0.53, indicating young coins are moving, while long-term holders remain inactive, showing investor confidence.

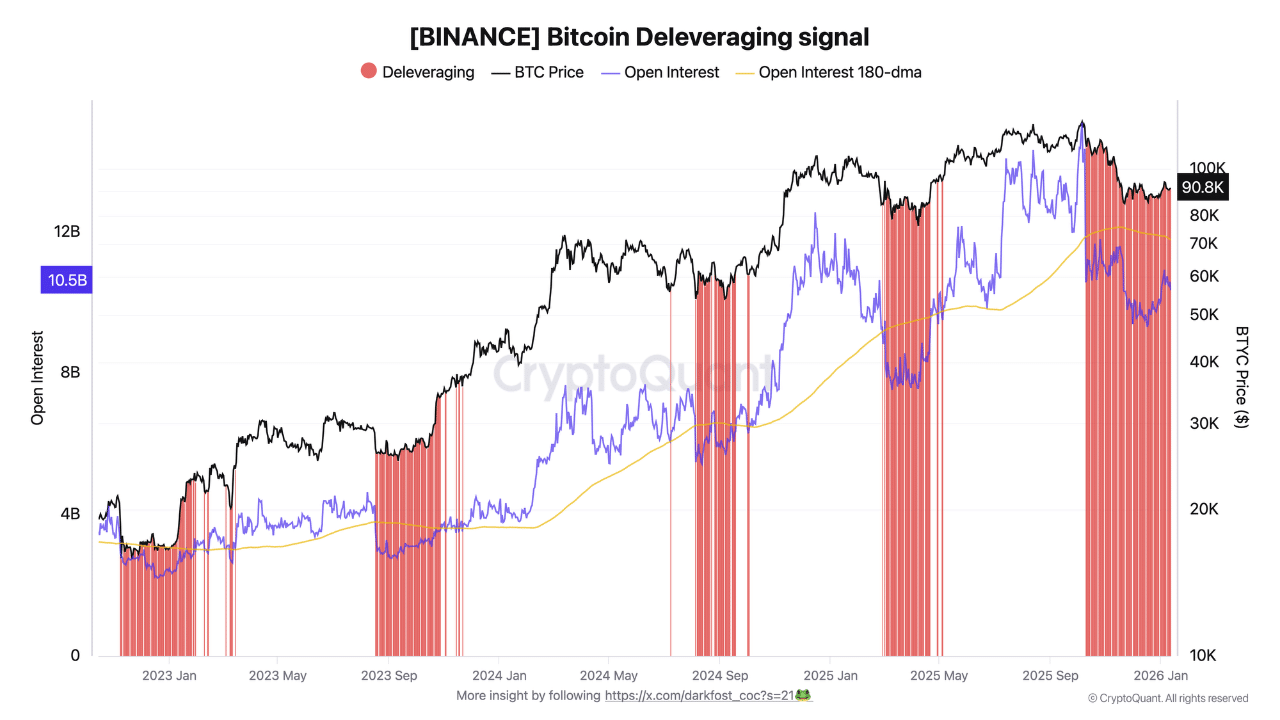

- The Bitcoin derivatives market has seen a significant deleveraging, with open interest dropping over 31% from $15 billion to $10 billion since October 2025.

- This deleveraging phase follows a speculative year with Binance futures volumes surpassing $25 trillion.

- Reductions in leverage have historically led to market resets and major bottoms, with predictions of Bitcoin reaching $150,000 in early 2026.