3 0

Arthur Hayes Forecasts BTC Drop Below $80K Ahead of Fed QT Halt

Key Highlights:

- Arthur Hayes, BitMEX co-founder, anticipates early signs of macro liquidity improvements potentially leading to a Bitcoin price recovery.

- The U.S. Federal Reserve is expected to halt quantitative tightening on December 1, which may enhance liquidity conditions.

- U.S. banks have increased lending activity in November, further suggesting improved liquidity, potentially benefiting BTC and digital assets.

- Hayes predicts Bitcoin might dip below $90K, possibly reaching the low-$80K range, but he believes the $80K level will hold as support.

- He plans minor accumulation of BTC now but will delay larger purchases until next year.

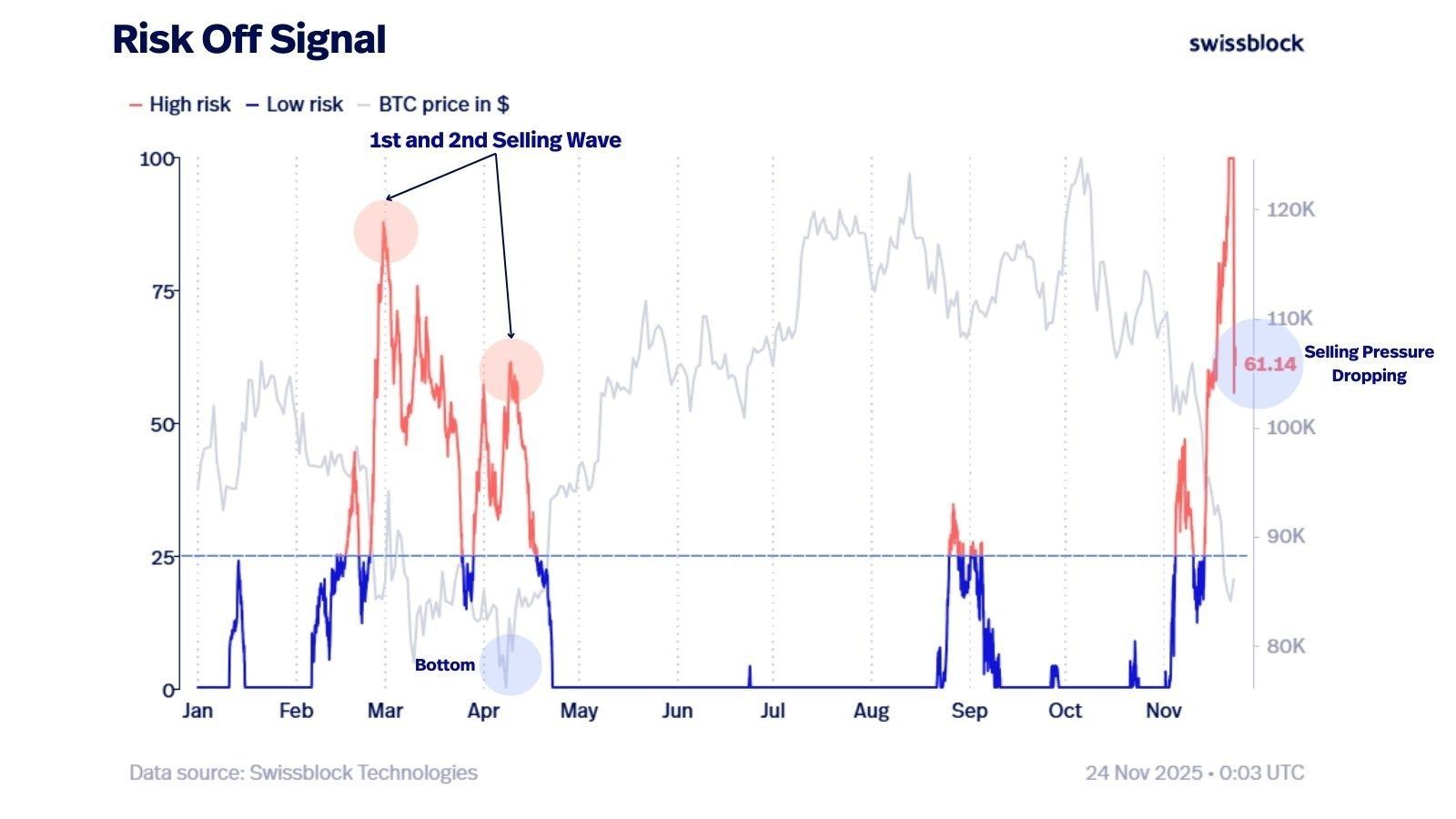

- Swissblock notes a decline in its "Risk-Off Signal," indicating possible seller exhaustion and a shift towards buying momentum.

- CoinShares reports US$1.94 billion in outflows from digital asset investment products last week, totaling US$4.92 billion over four weeks.

- Bitcoin recorded the largest share of outflows at US$1.27 billion, but saw a partial reversal with US$225 million inflows on Friday.

- Ethereum faced significant withdrawals, with US$589 million withdrawn, representing 7.3% of its total AuM.

- BlackRock Bitcoin ETF experienced record outflows, continuing negative trends in early trading hours.