7 0

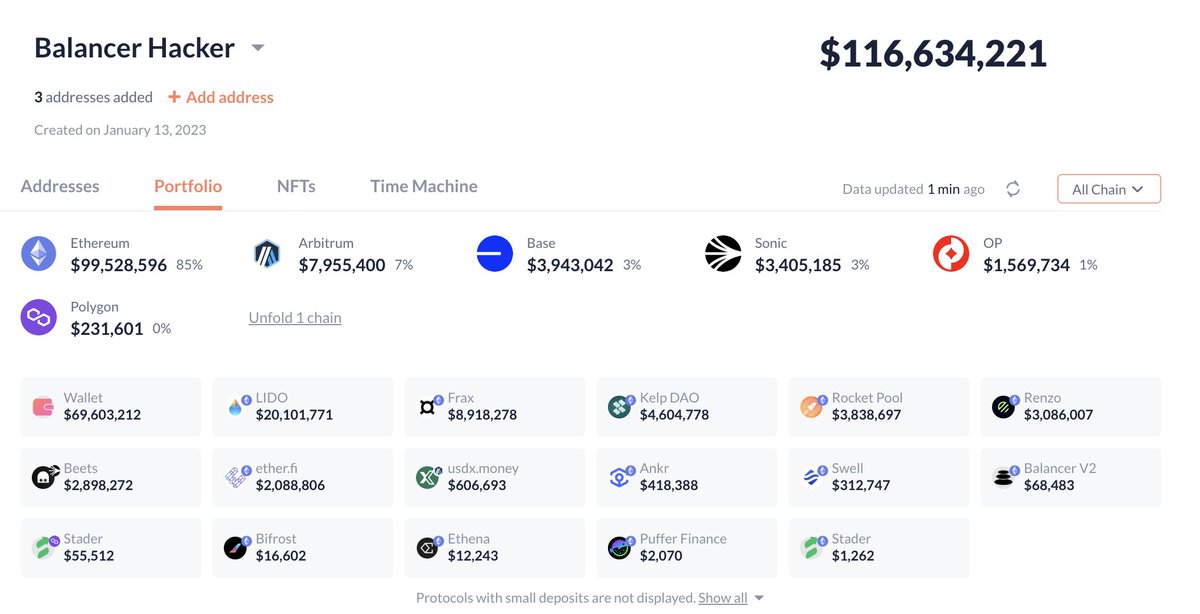

Balancer Exploit Drains $116 Million From V2 Pools, Hacker Swaps Assets

Balancer, a key DeFi protocol, experienced a major exploit with approximately $116 million drained from its vaults. Large outflows were identified from Balancer's address to an external wallet, including significant amounts of WETH, osETH, and wstETH. The attack targeted high-value assets across multiple vaults.

- The breach occurred in Balancer V2 Composable Stable Pools, which have been operational for years.

- Pools that could be paused are now in recovery mode; V3 and other pools remain secure.

- Balancer is collaborating with security researchers and legal teams for investigation.

- Users are warned about fraudulent communications, with updates only via verified channels.

Hacker Offloads Stolen Tokens Into ETH Amid Market Selloff

The hacker has begun converting stolen assets into ETH, indicating an intention to exit rather than negotiate. This has heightened concerns as the market faces a significant selloff.

- Ethereum has fallen below $3,500, while Bitcoin dropped under $105,000, increasing fears of further declines.

- Altcoins face heavy losses amid macro-driven derisking.

- The timing of Balancer's breach during this market downturn exacerbates the crisis, affecting liquidity and confidence.

BAL Faces Intense Downward Pressure

The BAL token continues its downward trend, trading around $0.80 after the exploit. The weekly chart shows sustained weakness with increased selling volume.

- BAL remains below key moving averages, signaling a bearish trend.

- Attempts to establish support have failed, with persistent distribution and lack of buyer interest.

- Market sentiment is low, requiring BAL to reclaim support near $1 to show recovery potential.