BEARISH 📉 : Strategy Bettors Lose 60% as Bitcoin Crashes, Capital Rotates

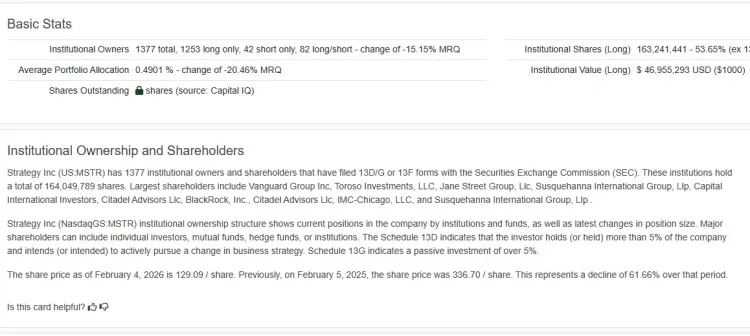

- Corporate Bitcoin proxies and strategy bets have experienced 60% drawdowns due to premium contraction during the recent market correction.

- Capital is shifting from passive holding vehicles to active infrastructure protocols addressing blockchain limitations.

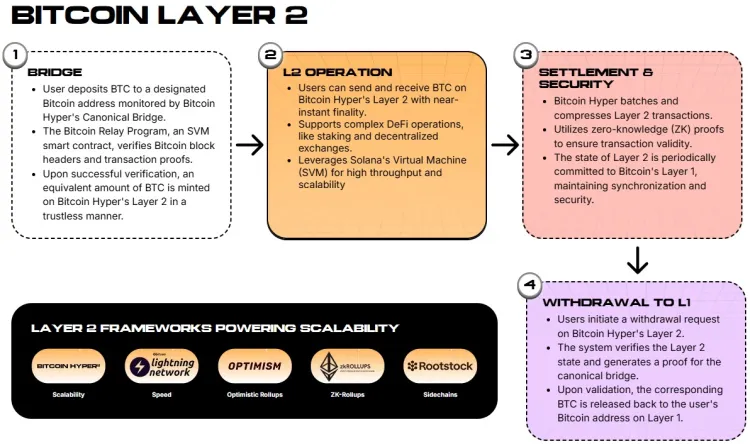

- Bitcoin Hyper utilizes Solana Virtual Machine (SVM) to enhance Bitcoin with high-speed smart contracts and sub-second finality.

- Despite the market crash, whale activity remains strong with over $31 million raised and significant large-wallet accumulation in January.

The market correction has severely impacted proxy bettors. Leverage and premium contraction led to over 60% drawdowns for investors in entities like MicroStrategy. This volatility highlights the risk of using corporate vehicles trading at high premiums to their Net Asset Value (NAV).

Capital is not leaving the crypto ecosystem but rotating into active infrastructure layers, indicating a focus on utility over store-of-value speculation.

Bitcoin Hyper emerges as a notable project, solving Bitcoin's scalability issues by integrating SVM, facilitating rapid transactions, and enabling complex DeFi applications.

- Bitcoin Hyper integrates SVM for faster transactions and cost efficiency, supporting Rust-based smart contracts compatible with Solana developers.

- The architecture uses a Decentralized Canonical Bridge for seamless BTC transfers and modular design for settlement and execution.

Whales are accumulating positions in infrastructure plays like Bitcoin Hyper, which raised $31.2M, reflecting institutional confidence in its long-term utility value despite market downturns.

This trend suggests that sophisticated investors see current prices as discounted relative to the project's potential benefits.