0 0

BEARISH 📉 : Bitcoin Decline Hits Crypto-Exposed Company Stocks Hard

The recent downturn in Bitcoin (BTC) is significantly impacting publicly listed companies that have invested heavily in the cryptocurrency.

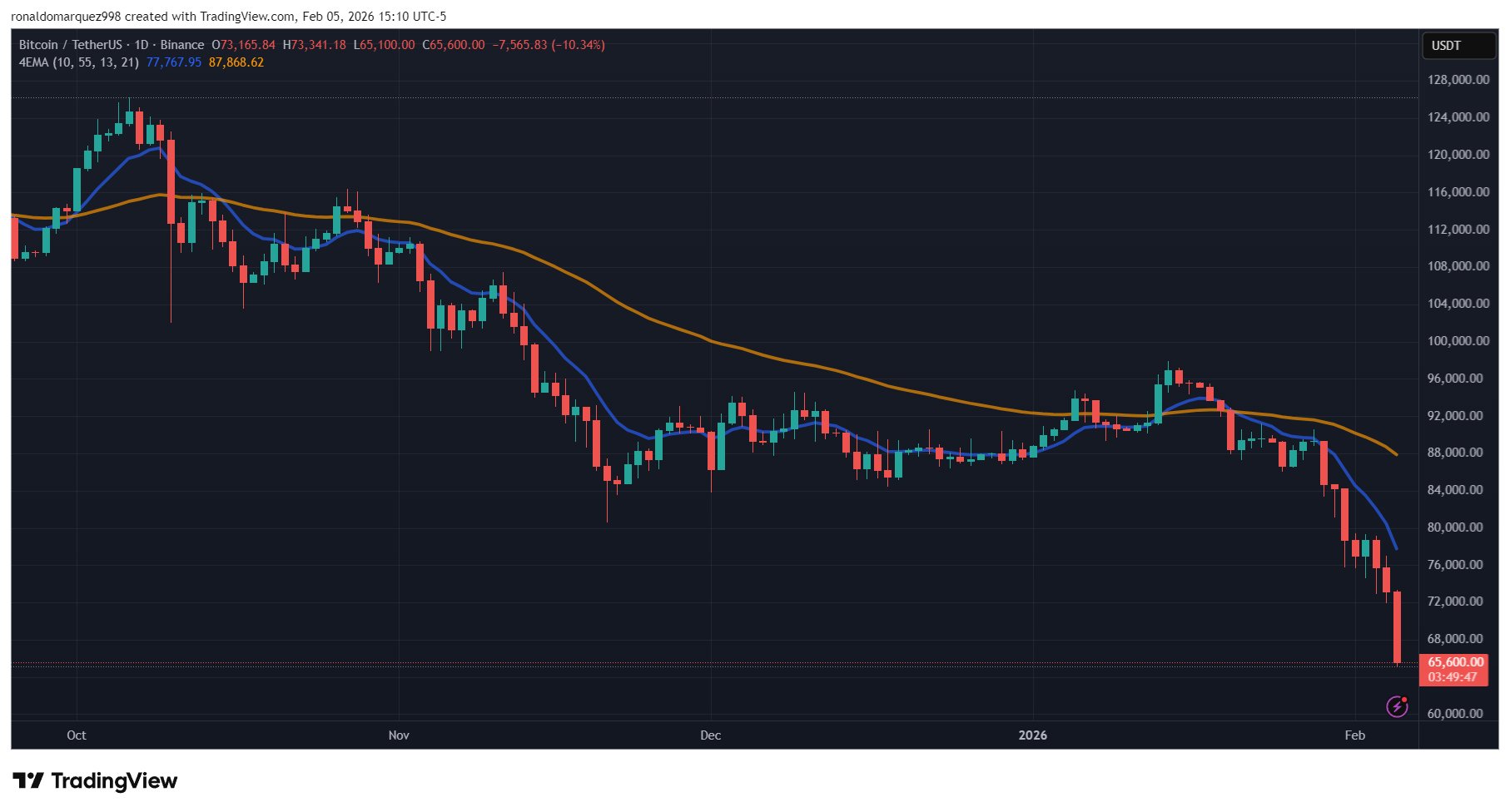

- Bitcoin's ongoing decline, hovering near $65,000, has caused stock prices of crypto-exposed firms to drop sharply.

- The volatility in digital assets is affecting companies holding Bitcoin and other tokens, with concerns about broader sector stress.

- Many firms had bet on the long-term appreciation of digital assets, but current market conditions have shifted.

- Investor anxiety over AI stocks and uncertainty regarding Fed interest rate cuts are affecting risk assets overall.

- As a result, Bitcoin has reached its lowest level since October 2024, pressuring companies reliant on digital assets.

Impact on Major Companies

- MicroStrategy, the largest corporate BTC holder, saw its shares plummet from around $457 in July to $106.

- The company revised its 2025 earnings outlook, citing weakness in Bitcoin prices, with expected results ranging from a $6.3 billion profit to a $5.5 billion loss.

- Other firms like UK-based Smarter Web Company, Nakamoto Inc, and Japan’s Metaplanet also experienced significant share declines.

- Crypto-related firms holding other tokens also faced pressure: Alt5 Sigma dropped 8.4%, SharpLink Gaming fell by 8%, and Forward Industries slid nearly 6%.

The situation highlights the risks associated with corporate investments in volatile digital assets.