3 0

BEARISH 📉 : Bitcoin’s Bullish Cycle Ends, Expert Predicts Significant Downtrend

Crypto expert Tony Severino argues that Bitcoin may no longer be in an expansion phase, contrary to popular belief. His analysis, based on traditional cycle theory and macroeconomic indicators, suggests the primary cycle could be complete.

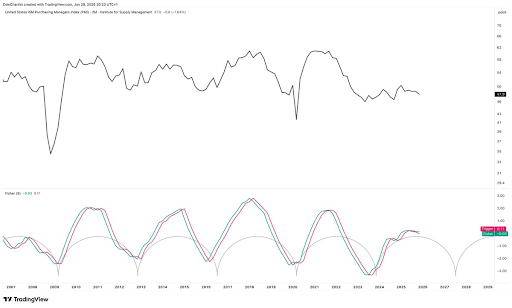

PMI and ISM Data Insights

- Severino believes Bitcoin's bullish cycle has ended, citing economic data and historical patterns.

- The U.S. ISM Purchasing Managers' Index (PMI) indicates a weakening manufacturing environment with lower highs and lows.

- Current PMI at 47.9; a drop below 46 signals an intermediate downtrend, while below 41.6 would have serious implications.

A sustained decline in PMI may echo conditions from past financial crises, challenging the notion of a new Bitcoin bullish phase.

Valuation Model Critique

- Severino criticizes Bitcoin valuation models comparing it to gold, noting Bitcoin lags behind gold and silver in attracting inflows.

- Bitcoin shows signs of fatigue around $80,000.

Shift from Bullish to Bearish

- Severino's stance shifted from bullish to bearish as Bitcoin broke below a key moving average on monthly charts.

- Historical breakdowns led to declines of 40% to over 60%, suggesting a potential downside target of $45,000 before a reversal.