1 0

BEARISH 📉 : Bitcoin drops 15% in one of largest daily declines

Bitcoin Price Drop Overview

- Bitcoin experienced a significant drop, losing over 15% or approximately $10,800.

- The decline affected derivatives, spot venues, and the US Bitcoin ETF market.

- Implied volatility spiked, trading volumes surged, and momentum indicators suggested forced selling.

Analysis and Reactions

- Real Vision’s Jamie Coutts noted Bitcoin's implied volatility reached 88.55, nearing previous peaks during crises.

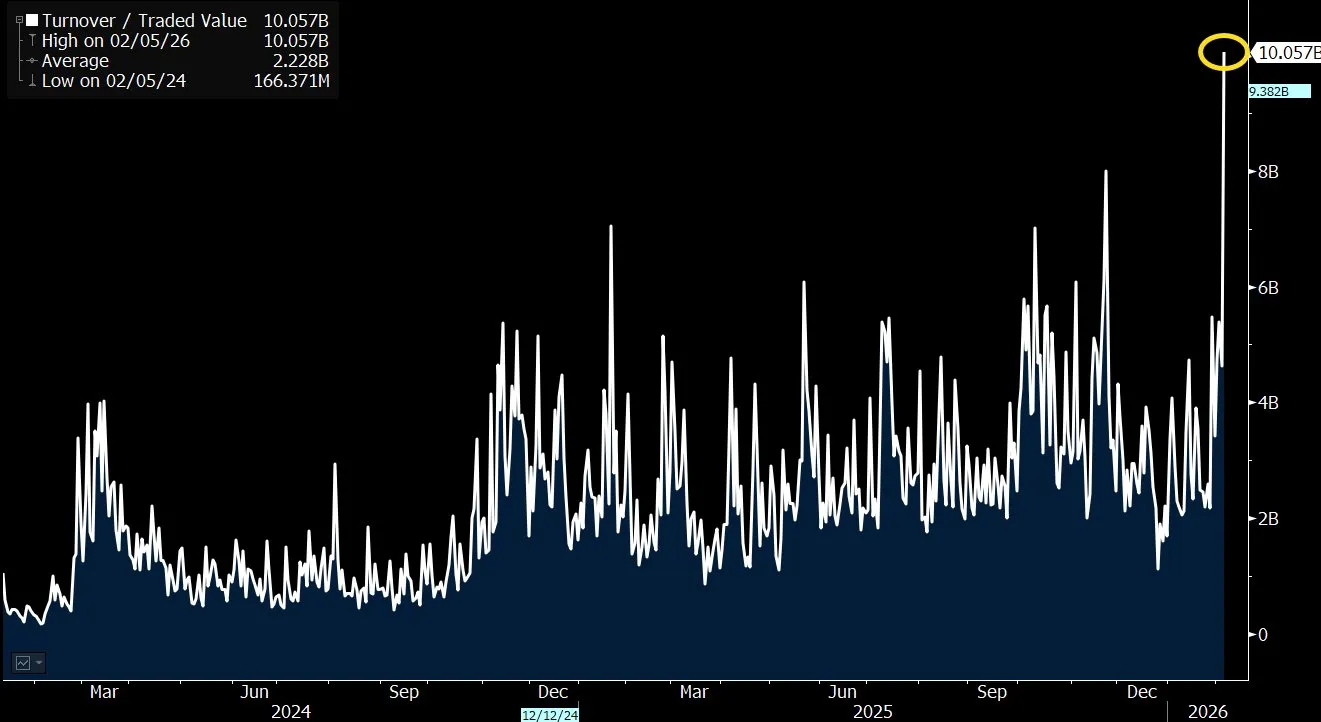

- Coinbase reported its eighth-largest trading day by USD value, with $3.34 billion traded.

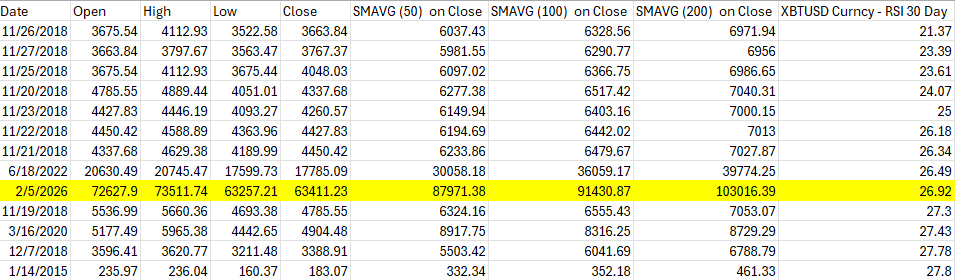

- RSI level dropped to 15.64, comparable to the March 2020 crash lows.

- Macro trader Alex Krüger indicated extreme conditions typical near market bottoms.

- Galaxy’s Alex Thorn highlighted that Bitcoin was among the most oversold, compared to historical events.

Impact on ETFs and Volatility

- The US Bitcoin ETF market amplified the day's activities, with BlackRock’s iShares Bitcoin Trust (IBIT) experiencing record trading volumes.

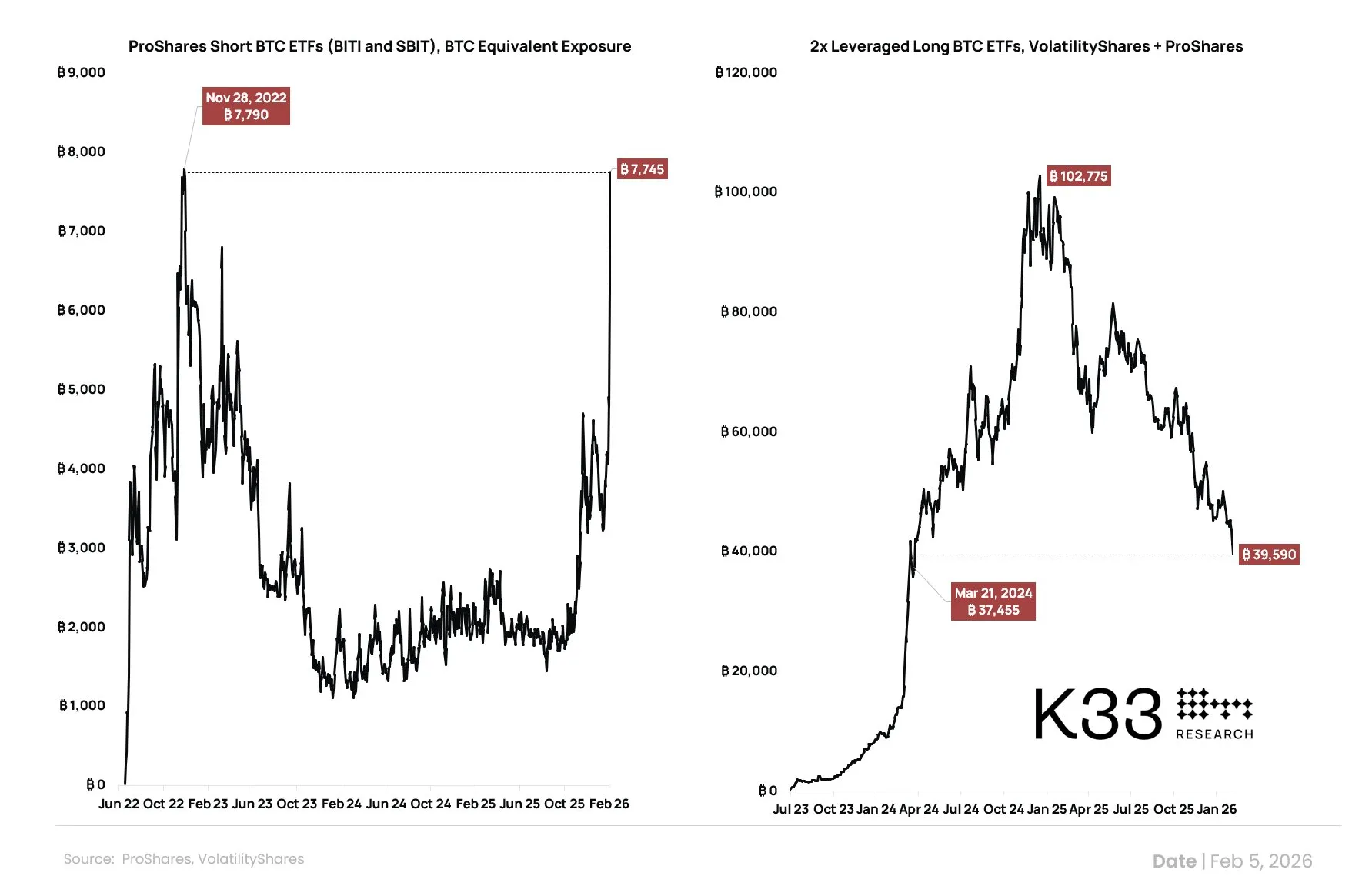

- Net short exposures in BTC ETFs approached previous highs as long BTC ETFs held significant positions.

- Bitcoin implied volatility reached 75%, surpassing gold's volatility and marking a high since the ETF launch.

At press time, BTC recovered from $60,000 to about $64,900, reflecting a 9% gain from the session low.