4 0

BEARISH 📉 : Bitcoin ETF’s Record $545M in Outflows as $LIQUID Packs Muscle

- U.S. Bitcoin ETFs experienced $545M in outflows over a week, reflecting a retreat by institutional investors due to macroeconomic uncertainties.

- Despite these outflows, investment is shifting towards infrastructure protocols addressing liquidity fragmentation rather than exiting the crypto ecosystem.

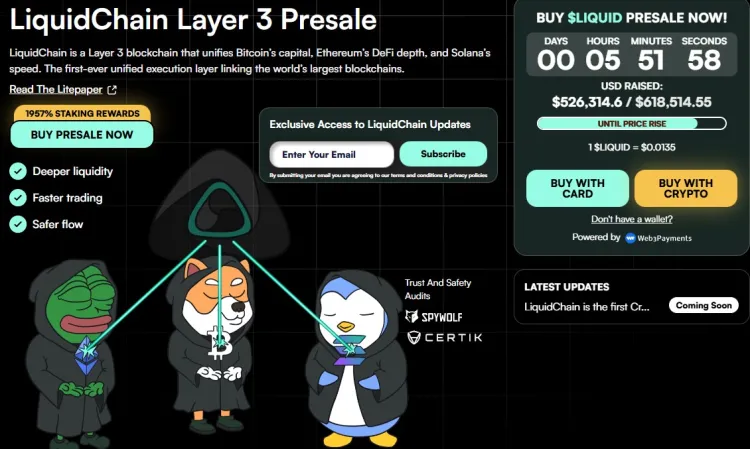

- LiquidChain ($LIQUID) is gaining traction by creating a unified execution layer for Bitcoin, Ethereum, and Solana. It has raised over $526k in its presale.

- The main challenge in the market is the inability to move value seamlessly between major chains, making cross-chain solutions essential for future growth.

- LiquidChain aims to solve this by offering a "Cross-Chain Liquidity Layer" that merges liquidity from Bitcoin, Ethereum, and Solana into one environment, reducing bridging risks and transaction complexities.

- The protocol's presale success, despite bearish market conditions, indicates strong investor belief in interoperability as a key theme for the next market cycle.

- The focus on Liquidity Staking suggests a strategy to maintain capital within the ecosystem, emphasizing infrastructure development over speculative activities.