1 0

BEARISH 📉 : Bitcoin Exchange Reserve Surges, Market Needs Fresh Demand

Bitcoin Price Movement

- Bitcoin dropped to $74,000 after failing to maintain November lows, affecting short-term momentum.

- Currently trading around $78,000 amid short-term market relief.

- The 14-day Relative Strength Index indicates an oversold condition.

- Spot trading volume increased, suggesting risk repositioning rather than new demand.

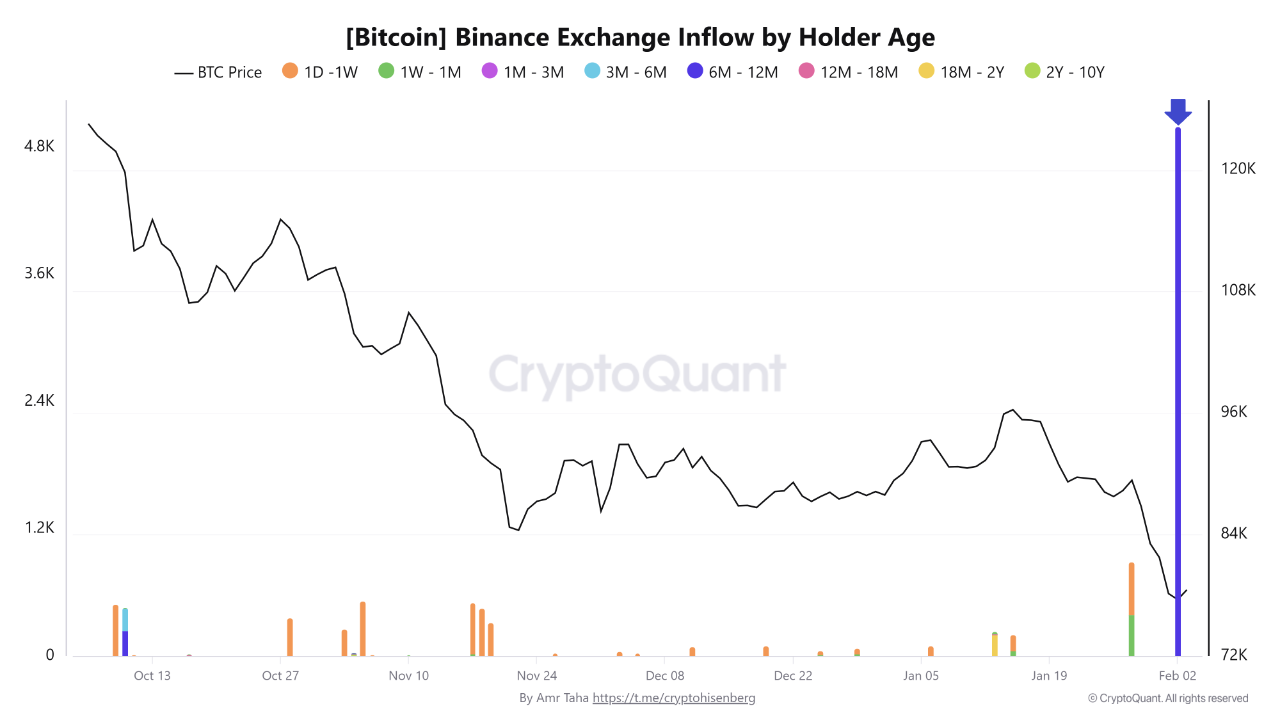

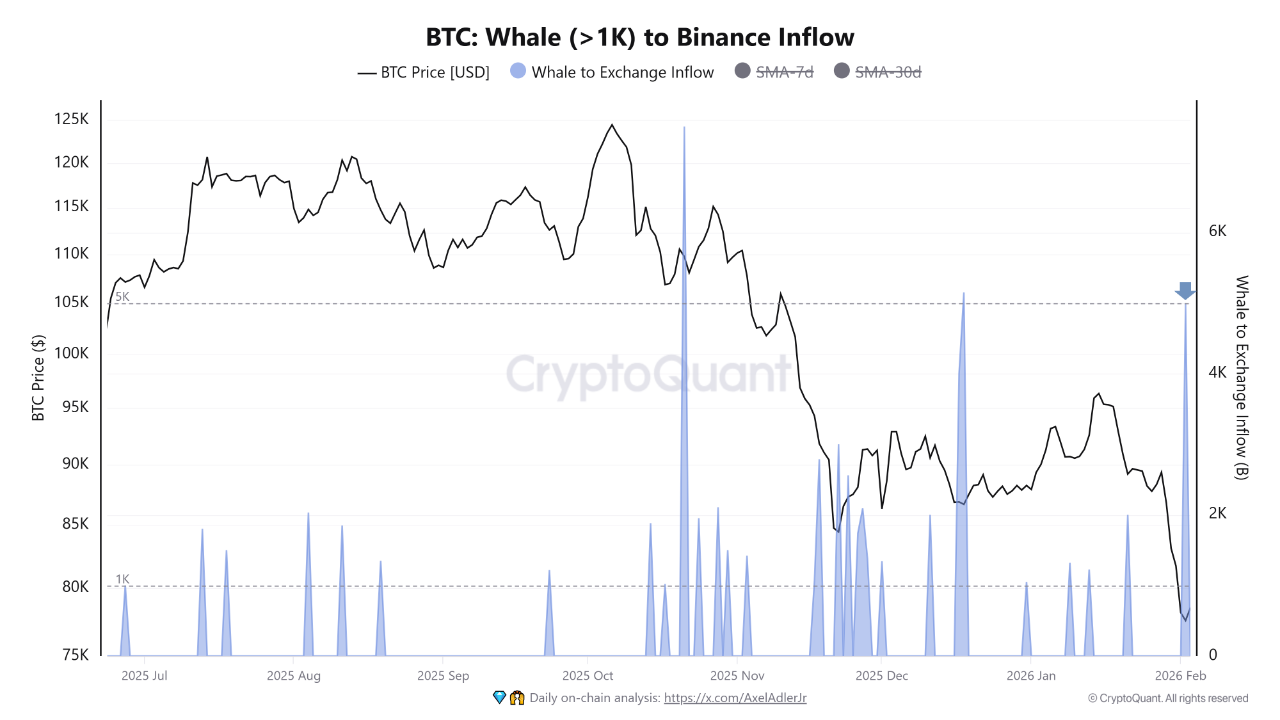

On-Chain Activity

- Significant Bitcoin transfers to Binance from whales and mid-term investors.

- 6-12 month-old coins moved approximately 5,000 BTC to Binance on Feb. 2, a first since early 2024.

- Whale wallets transferred another 5,000 BTC to Binance, mirroring a spike from Dec. 18.

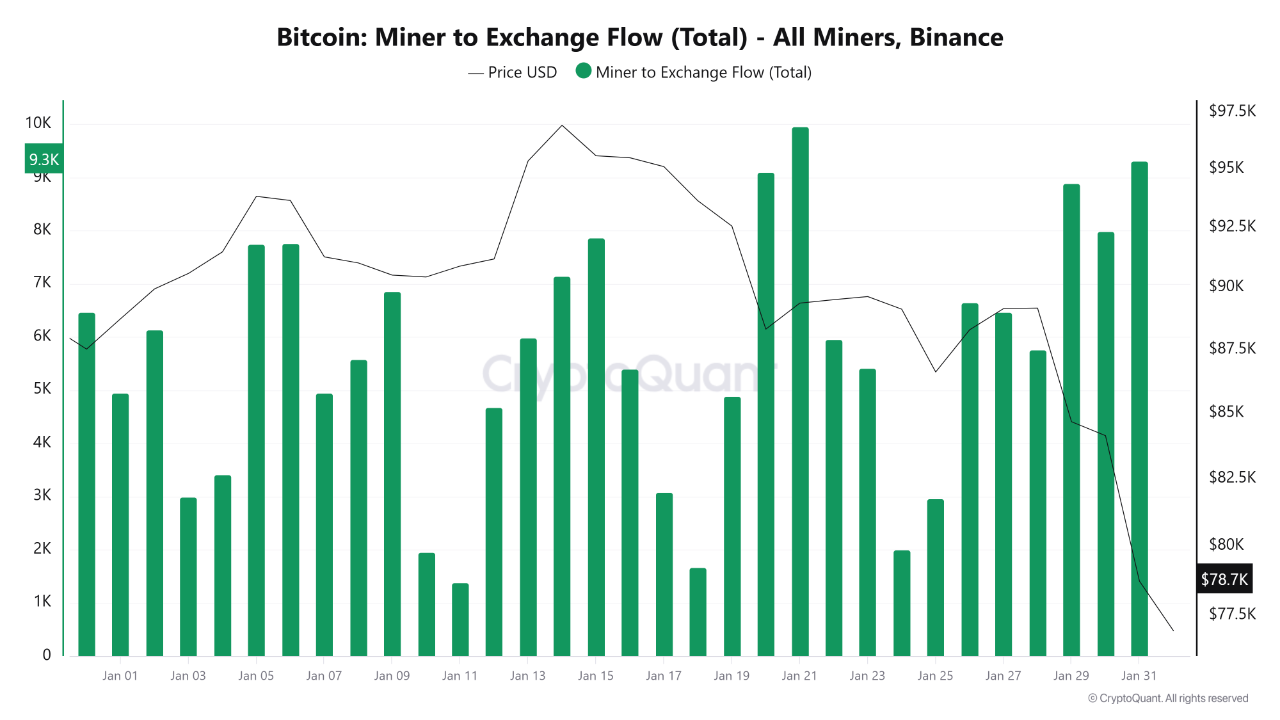

Miner Activity

- Miners moved about 175,000 BTC to Binance in January, with some days nearing 10,000 BTC transfers.

- These transfers occurred as Bitcoin traded near $95,000 before declining to $78,000.

- Increased supply could lead to price drops if demand remains low.

Market Conditions

- Spot market conditions weak; Spot CVD at new lows, indicating sell-side dominance.

- ETF outflows continue despite slowing, pointing to ongoing distribution.

- Derivatives markets show reduced futures open interest and cooling funding rates.

- A risk-off phase is evident as profitability declines and realized losses increase.