3 0

BEARISH 📉 : Bitcoin lags as gold and silver hit record highs

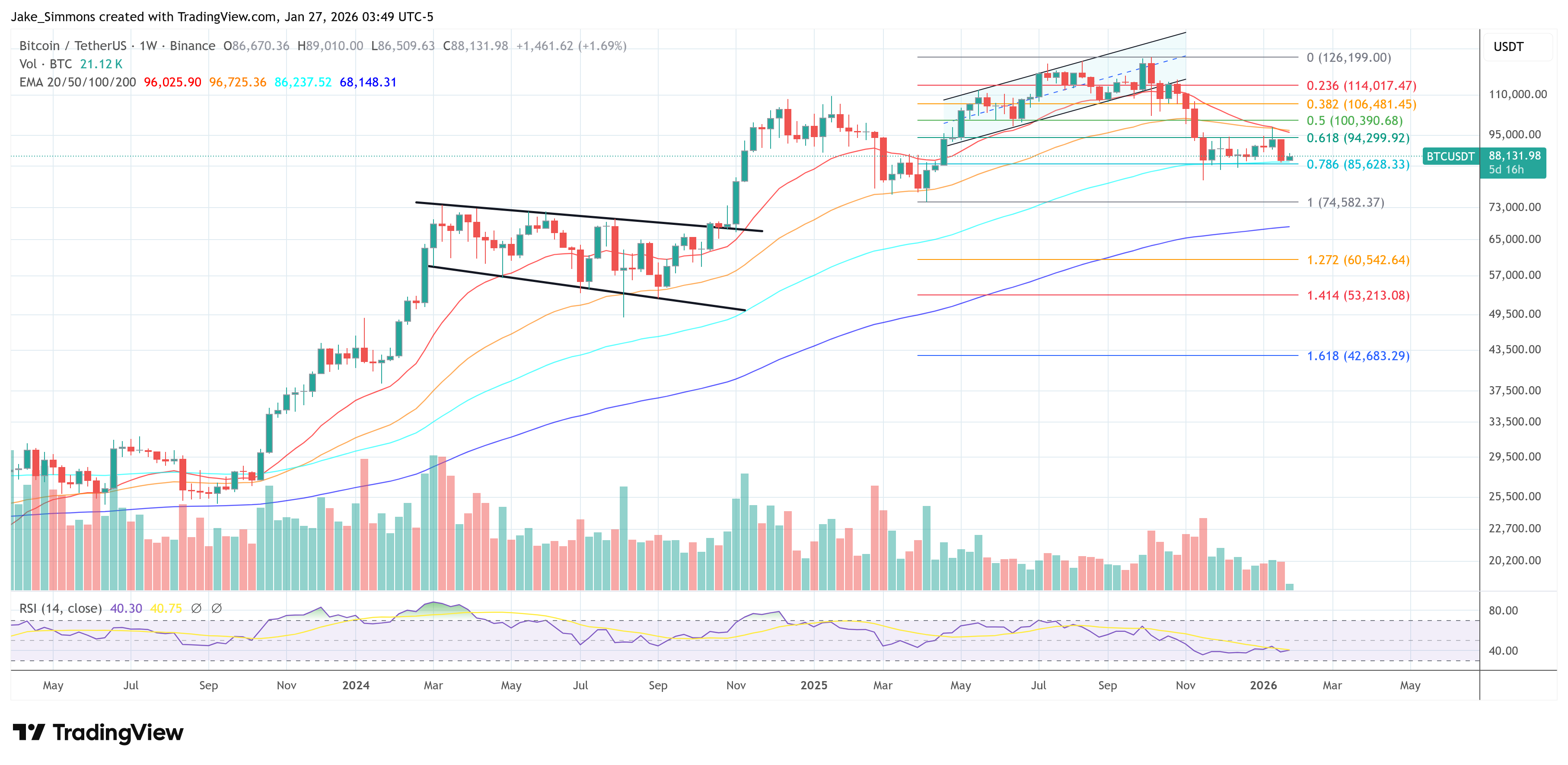

Recent trends show gold and silver reaching record highs, while Bitcoin remains in a tight range of $84,000–$94,000 since mid-November. Anthony Pompliano attributes this to shifting demand drivers and market structures.

- Gold is up 80% due to central bank reserves accumulation and a shift from dollars to gold.

- Silver has increased by 250%, driven by industrial demand in sectors like defense equipment, AI hardware, and self-driving cars.

- Copper and platinum benefit from electrification and supply constraints, respectively.

Bitcoin's Market Dynamics

- Wall Street adoption is altering Bitcoin's holding patterns, with institutional players entering the space.

- Structural changes, such as easier shorting options, have reduced Bitcoin’s volatility from 80 vol to 40 vol.

- The perception of geopolitical stability and disinflation diminishes Bitcoin's appeal as a "chaos hedge."

- Increased competition from AI and other speculative outlets is affecting Bitcoin's market share.

Pompliano suggests that while Bitcoin may seem less dynamic now, its lower volatility and institutional integration might require a longer-term investment perspective.

Current BTC price: $88,131.