1 0

BEARISH 📉 : Bitcoin trading mirrors growth stocks, loses safe-haven status

Bitcoin's Volatility: Bitcoin is increasingly behaving like a high-risk, high-reward asset rather than a stable store of value.

Growth Asset Signals

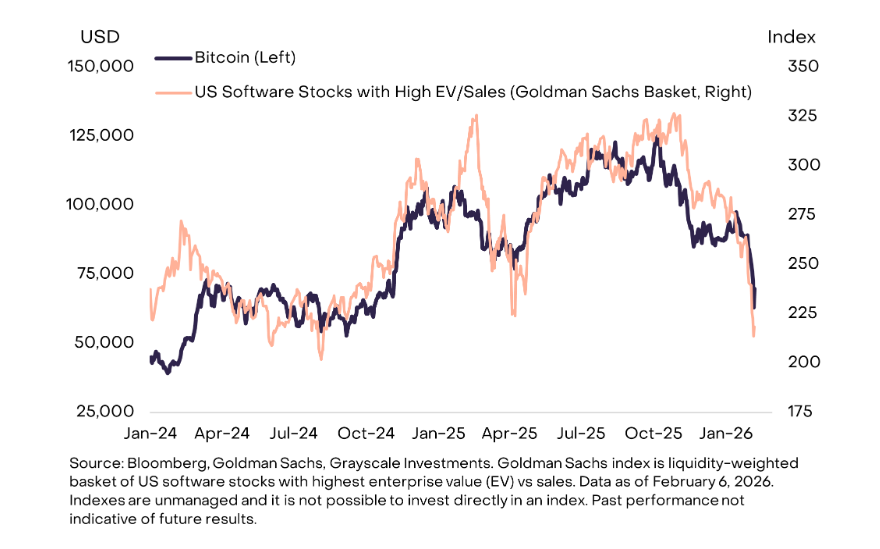

- Grayscale reports that Bitcoin's trading patterns align more with tech stocks than traditional safe havens like gold.

- This trend has been noticeable since early 2024, driven by institutional investments and exchange-traded products.

- Selling pressure from investors focused on AI and tech has impacted Bitcoin prices.

Institutional Influence

- Bitcoin's ties to traditional markets are deepening, with ETF mechanisms and institutional holdings affecting its price movements.

- US-based accounts have actively sold off Bitcoin, creating discounts on some platforms following significant liquidations.

Current Price Levels: Bitcoin is trading around $66,900, with resistance at $69,900 and support below $66,600.

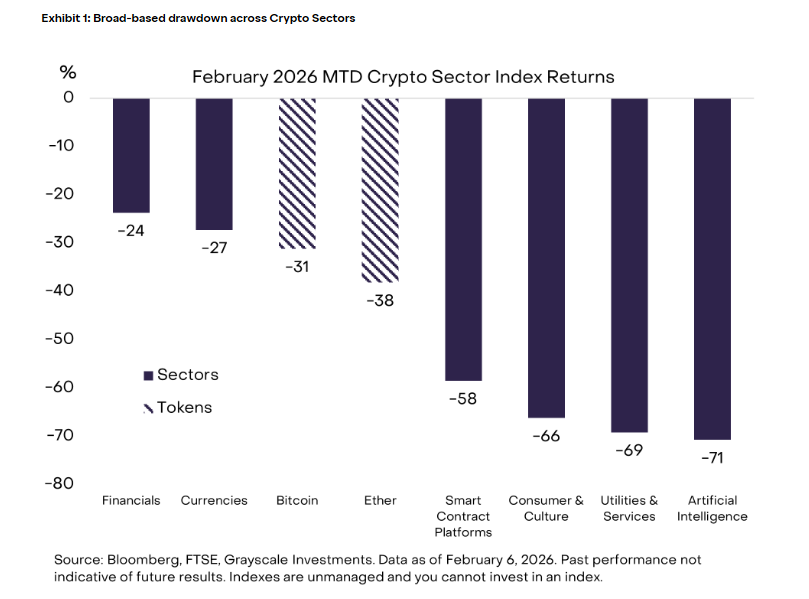

- The market has retraced approximately 50% from its peak over $126,000 in October.

Comparison with Gold

- Gold has reached new highs, diverging from Bitcoin, which hasn't attracted the same safe-haven flows.

- Geopolitical tensions have pushed investments into metals, away from riskier assets like crypto.

Market Sentiment: Bitcoin's behavior reflects an asset influenced by hope and fear rather than a hedge against turmoil.

- Fresh capital, possibly through ETF inflows or retail buying, could stabilize prices.

- Retail focus is currently on AI and growth narratives, sidelining crypto for many individual investors.

Conclusion: While Bitcoin tracks tech stocks in the short term, its long-term potential as a store of value persists. Future performance hinges on capital flows and broader economic conditions.